- United States

- /

- Software

- /

- NasdaqGS:SNPS

Is Synopsys a Bargain After Recent Semiconductor Design Acquisition and 15% Year-to-Date Drop?

Reviewed by Bailey Pemberton

- Wondering if Synopsys is a hidden gem or priced to perfection? You are not alone. Inquisitive investors have been eyeing this stock for signs of value.

- The share price has been a wild ride lately, climbing 5.5% in the last week, but still down 10.0% over the last month and a notable 15.1% year-to-date.

- Much of this volatility comes on the heels of renewed sector interest and big headlines around Synopsys' recent acquisition of semiconductor design assets. This has fueled speculation about its growth prospects while raising some eyebrows over integration risks.

- Based on our valuation checks, Synopsys earns a 2 out of 6 score, so the numbers leave plenty of room for debate. Let us break down those valuation methods and reveal why the traditional approach might not tell you the whole story.

Synopsys scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Synopsys Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and discounts them back to today’s value. This approach aims to estimate the business’s intrinsic worth. For Synopsys, this involves taking current and projected cash flow data for the next decade and determining what those future earnings are worth today in dollar terms.

Currently, Synopsys generates Free Cash Flow (FCF) of approximately $1.26 billion. Analyst estimates suggest FCF will grow significantly, reaching $5.26 billion by 2030. Projections for these years include both direct analyst estimates for the next five years and extrapolated values for the subsequent period. All of these numbers are presented in US dollars to provide a consistent basis of comparison.

Based on this two-stage cash flow projection, Synopsys’ intrinsic value is estimated at $471.38 per share. This represents about 13.1% above the company’s recent share price, suggesting that the market currently values the business below what this model indicates.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Synopsys is undervalued by 13.1%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Synopsys Price vs Earnings

For profitable technology companies like Synopsys, the Price-to-Earnings (PE) ratio is a widely accepted valuation metric. It compares a company’s current share price to its earnings per share, providing a simple and direct way to see how the market values each dollar of profit. Investors often look to PE ratios because they reflect not just today’s performance, but also the market’s collective expectations for growth and perceived risk. Faster-growing and less risky businesses typically justify higher PE ratios.

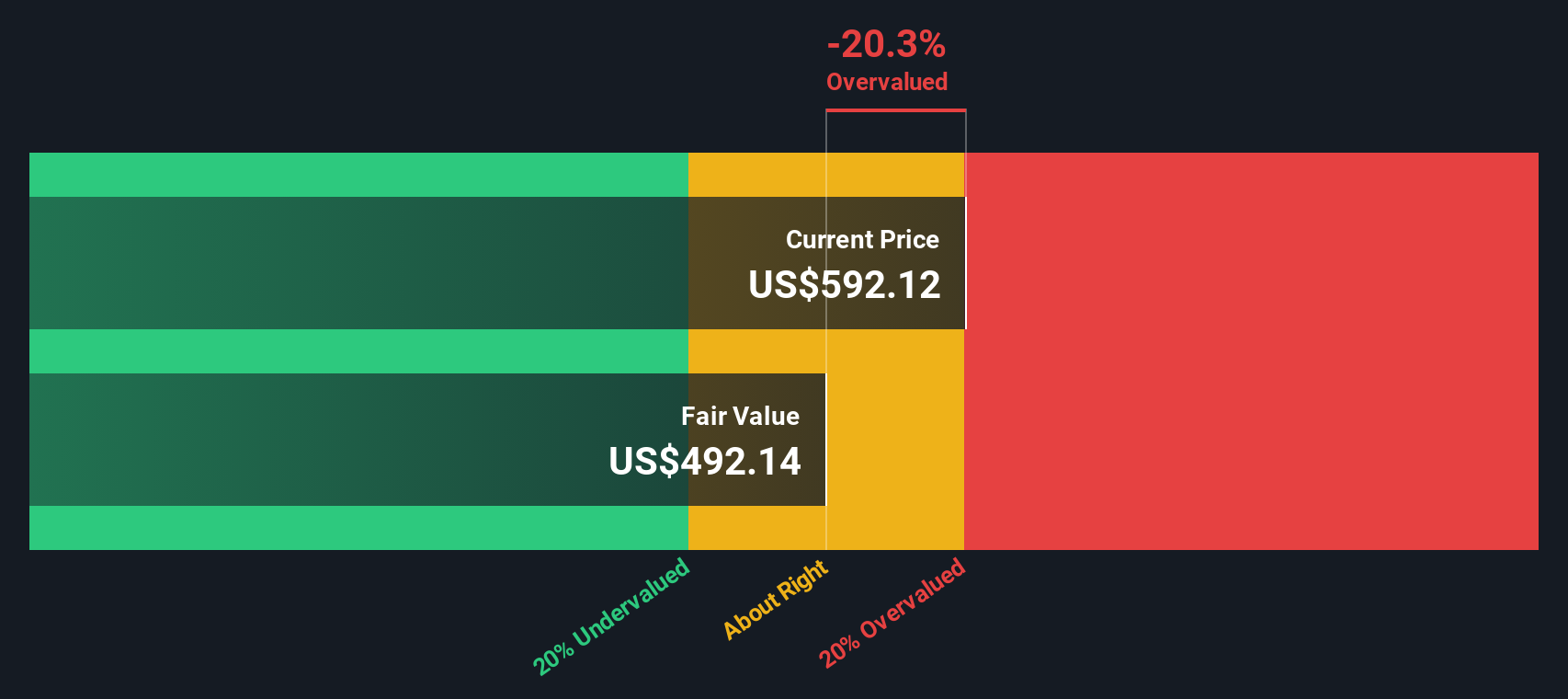

Currently, Synopsys trades at a PE ratio of 65.2x, slightly above its peer average of 64.0x and more than double the software industry average of 30.8x. While this might seem expensive at first glance, it is important to factor in company-specific attributes. Simply Wall St’s proprietary "Fair Ratio" attempts to do exactly this, assigning Synopsys a Fair PE of 45.4x based on factors such as its earnings growth, market cap, profit margin, industry, and risk profile.

Unlike simple peer or industry comparisons, the Fair Ratio is more robust, as it weighs Synopsys’ specific growth potential and risk alongside market trends. This gives a more tailored sense of what’s justified for the stock, rather than relying solely on averages that may not account for Synopsys’ unique strengths and weaknesses.

Given that the current PE ratio of 65.2x is significantly above the Fair Ratio of 45.4x, Synopsys shares appear overvalued by this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Synopsys Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investing story. It connects your unique view of Synopsys to a concrete forecast and fair value. Instead of just plugging numbers into ratios, Narratives let you capture the “why” behind your assumptions, such as your predictions for revenue growth or margins, and see how these play out compared to the market’s price.

Narratives are not complex; they are easy-to-use, interactive tools available to everyone on Simply Wall St’s Community page, where millions of investors share, refine, and update their perspectives in real-time. Narratives equip you to decide whether to buy or sell by comparing your own Fair Value to the latest share price, all while adjusting dynamically as new information like fresh earnings or relevant news emerges.

For example, with Synopsys, some investors build bullish Narratives around accelerating profitability and integration success after the Ansys acquisition, with targets up to $715 per share. Others set more cautious bearish Narratives amid IP headwinds, expecting just $550 per share. Narratives let you make investment decisions with greater clarity, confidence, and context tailored to your personal outlook.

Do you think there's more to the story for Synopsys? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SNPS

Synopsys

Provides design IP solutions in the semiconductor and electronics industries.

Mediocre balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Ferrari's Intrinsic and Historical Valuation

SAP's Intrinsic and Historical Valuation

Nike: A Market Leader with Resilience and Long-Term Growth Potential

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale