- United States

- /

- Software

- /

- NasdaqGS:SCWX

Amidst increasing losses, Investors bid up SecureWorks (NASDAQ:SCWX) 9.2% this past week

It is a pleasure to report that the SecureWorks Corp. (NASDAQ:SCWX) is up 49% in the last quarter. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 40% in one year, under-performing the market.

The recent uptick of 9.2% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for SecureWorks

SecureWorks isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In just one year SecureWorks saw its revenue fall by 13%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 40% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

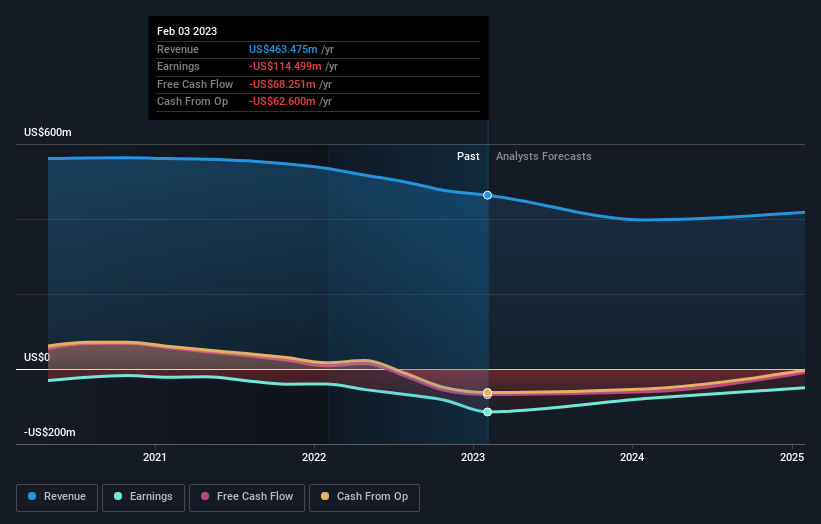

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. You can see what analysts are predicting for SecureWorks in this interactive graph of future profit estimates.

A Different Perspective

We regret to report that SecureWorks shareholders are down 40% for the year. Unfortunately, that's worse than the broader market decline of 13%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 0.4% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with SecureWorks , and understanding them should be part of your investment process.

SecureWorks is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

If you're looking to trade SecureWorks, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SCWX

SecureWorks

Through its subsidiaries, provides technology-driven information security solutions for protecting its customers in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives