- United States

- /

- Software

- /

- NasdaqGS:SAIL

SailPoint (SAIL): Valuation in Focus After Identity University Expansion and HCLTech AI Security Partnership

Reviewed by Simply Wall St

With all the buzz around SailPoint (SAIL) this week, investors might be wondering if these headline-grabbing moves signal something bigger for the company. The major expansion of Identity University caught many eyes, especially with the addition of practice-driven labs and broader certification opportunities for cybersecurity pros hungry for new skills. In addition, the fresh partnership with HCLTech should give SailPoint even greater reach in the emerging world of AI-powered identity security. It is clear the company is making bold moves to solve the talent shortage and enhance real-world protection for enterprises.

While these announcements are impressive, what matters most for shareholders is how they tie into the bigger story. Over the past month, SailPoint’s share price has jumped 17%, with momentum building over the past week as well. The stock has seen only modest gains so far this year, even as SailPoint has posted double-digit revenue growth and a sharper turn in net income. These simultaneous product and partnership launches suggest SailPoint is leaning into growth, but markets have so far been measured in their response.

So, is now the time to buy in before the crowd, or has the market already priced in SailPoint’s next stage of growth?

Price-to-Sales of 13.8x: Is it justified?

Currently, SailPoint is trading at a price-to-sales (P/S) ratio of 13.8x, which is notably higher than both its peer average and the broader US Software industry average. This premium suggests that investors are assigning a significant value to the company’s potential for future growth, regardless of current profitability.

The price-to-sales ratio is an important metric for technology firms, especially those in the growth phase and not yet profitable, because it reflects how much investors are willing to pay for each dollar of revenue. For software companies with high revenue growth but weak earnings, the P/S ratio is often seen as a key valuation tool.

SAIL’s current multiple sits well above those of similar companies in its field. This suggests the market has strong expectations for future expansion and profitability. However, it also raises concerns that the stock may be overvalued if these expectations are not met. Investors should consider whether the premium is justified by SailPoint’s growth story or if caution is warranted given its ongoing lack of profitability.

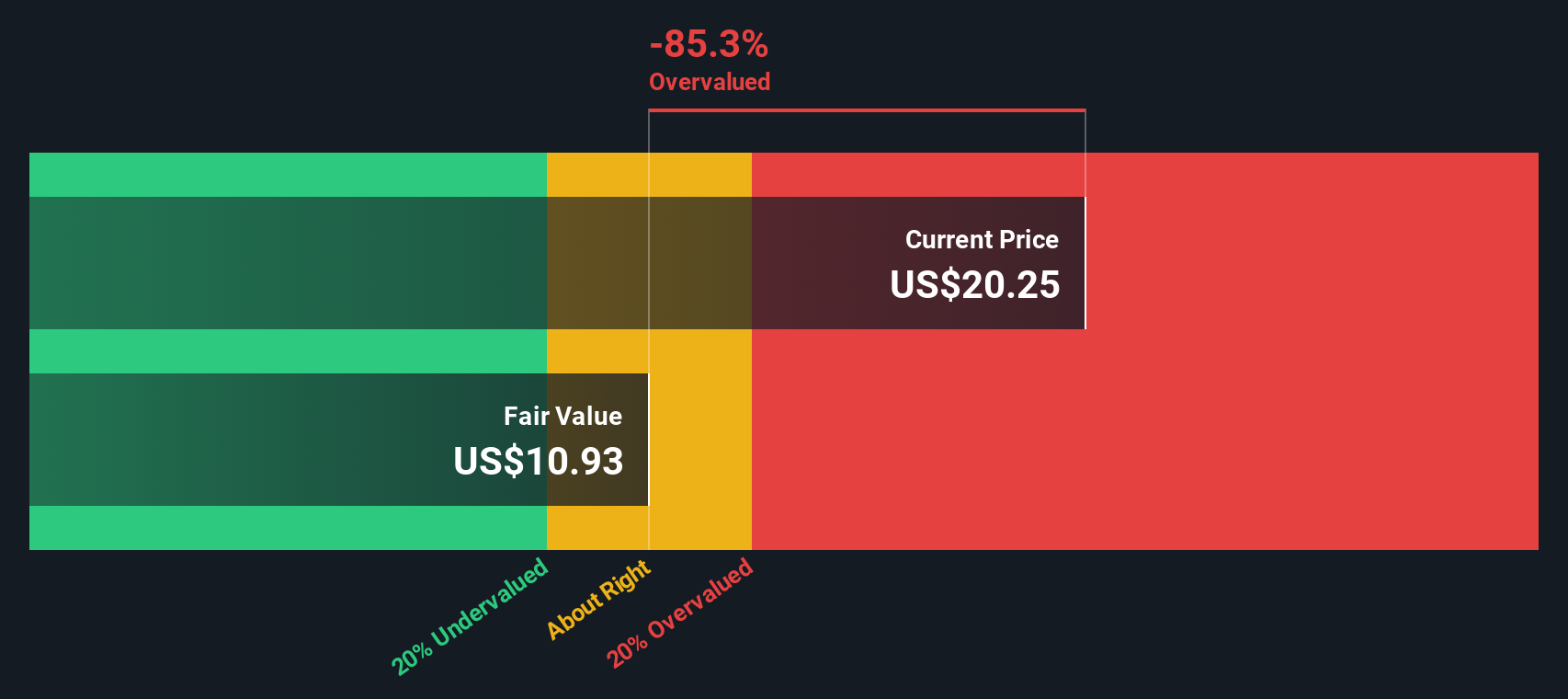

Result: Fair Value of $11.76 (OVERVALUED)

See our latest analysis for SailPoint.However, SailPoint’s lack of profitability and reliance on strong growth projections remain key risks. These factors could quickly change investor sentiment if results disappoint.

Find out about the key risks to this SailPoint narrative.Another View: What Does the DCF Model Say?

Taking a different angle, our DCF model also points to SailPoint being overvalued. This echoes some of the same caution as the market multiples approach. Does this reinforce the case, or is there still room for surprise down the line?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding SailPoint to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own SailPoint Narrative

If you see the story differently or want your own perspective, you can dive into the numbers and shape your personal take in just minutes. Do it your way

A great starting point for your SailPoint research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Expand your portfolio with opportunities you might be overlooking. The right stock at the right time could make a real difference in your financial future.

- Supercharge your returns with market leaders offering dividend stocks with yields > 3% and compounding growth that can boost your passive income.

- Tap into tomorrow’s technologies and ride the momentum of AI penny stocks as artificial intelligence continues to transform every industry.

- Spot hidden gems trading below their true worth by checking out undervalued stocks based on cash flows which smart investors are scooping up now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:SAIL

SailPoint

SailPoint, Inc. delivers solutions to enable identity security for the enterprise in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion