- United States

- /

- Software

- /

- NasdaqGS:SAIL

How Investors Are Reacting To SailPoint (SAIL) AI-Driven Application Management Launch and Savvy Asset Acquisition

Reviewed by Simply Wall St

- In August 2025, SailPoint, Inc. introduced SailPoint Accelerated Application Management, an advanced platform designed to transform enterprise application discovery and governance with AI-driven insights and automated workflows, while also announcing plans to acquire key assets from Savvy for enhanced SaaS visibility and identity risk management.

- This launch highlights a move toward rapid, scalable compliance and security coverage, addressing the longstanding challenge of unmanaged enterprise applications at risk.

- We'll explore how this focus on automated, intelligent governance could reshape SailPoint's investment narrative and competitive positioning.

Find companies with promising cash flow potential yet trading below their fair value.

What Is SailPoint's Investment Narrative?

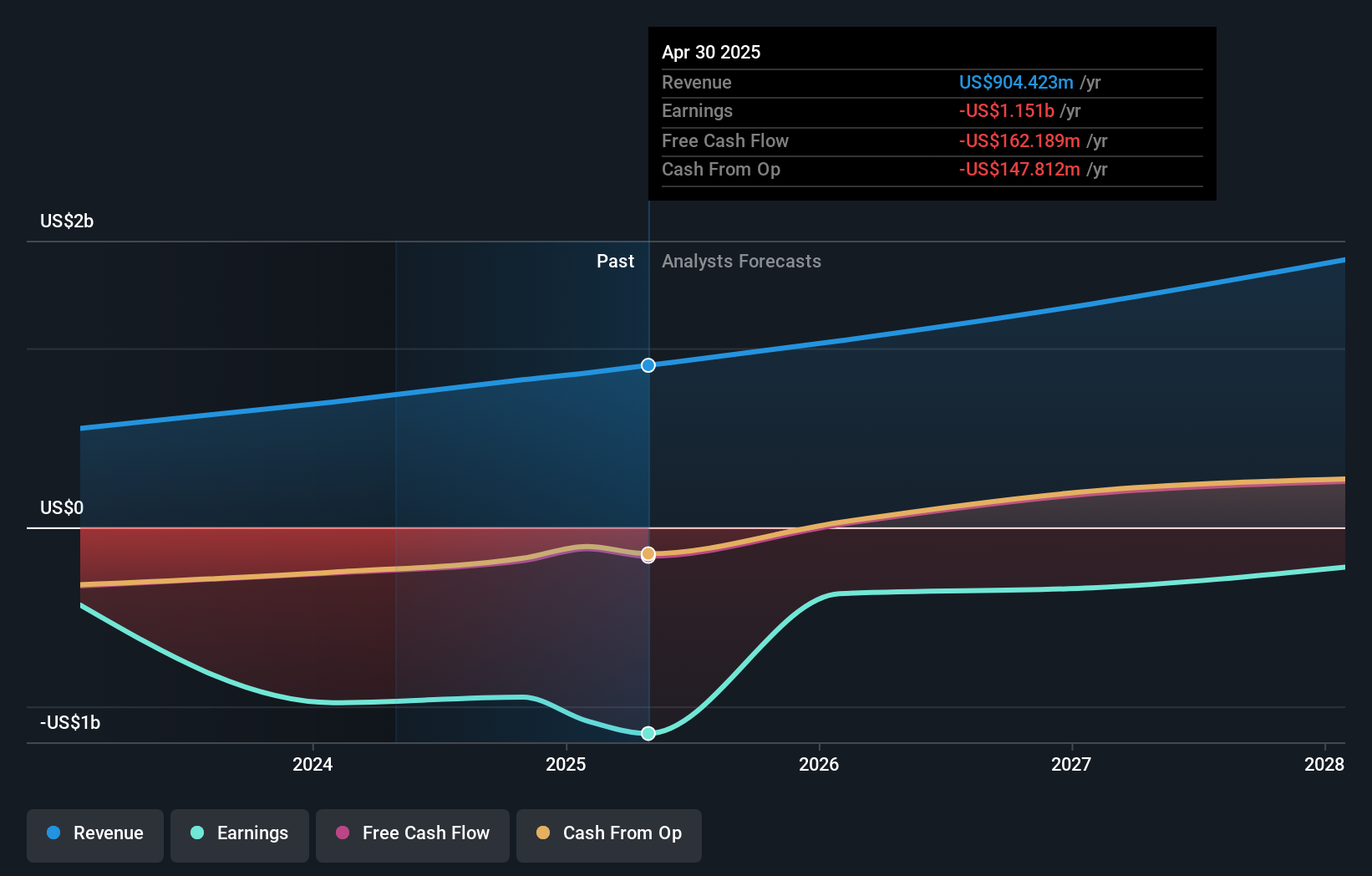

To be convinced by SailPoint’s story today, investors need to see tangible progress from new products quickly lifting both relevance and adoption, while helping address its long-term challenge: narrowing large losses and justifying a premium valuation. The August rollout of SailPoint Accelerated Application Management, with real AI-driven automation, comes at a critical time, its revenue growth is forecast ahead of the broader market, but the company remains deeply unprofitable and trades at a steep price-to-sales multiple. This launch, bundled with the pending acquisition for enhanced SaaS visibility, could sharpen key short-term catalysts by attracting fresh demand and accelerating deployment cycles, potentially reducing time to value for customers. However, concerns around sustained negative earnings, low return on equity, and execution risk on integrating new assets still weigh heavily for shareholders.

But competitive pressures and costly expansion add important context every potential investor should keep in mind.

Exploring Other Perspectives

Explore 2 other fair value estimates on SailPoint - why the stock might be worth just $26.03!

Build Your Own SailPoint Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SailPoint research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SailPoint research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SailPoint's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SAIL

SailPoint

SailPoint, Inc. delivers solutions to enable identity security for the enterprise in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Excellent balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives