- United States

- /

- Software

- /

- NasdaqGM:RZLV

Rezolve AI (RZLV) Is Up 31.6% After US$200M Funding and Higher 2025 Revenue Targets - What’s Changed

Reviewed by Sasha Jovanovic

- Rezolve AI reported first half 2025 earnings, revealing US$6.32 million in sales and sharply higher annual recurring revenue guidance driven by expanding adoption of its Brain Suite and reinforced partnerships with Microsoft and Google.

- The company also secured a US$200 million private placement from leading institutional investors, highlighting strong confidence in its commercial momentum and acquisition strategy even as net losses widened due to accelerated growth investments.

- We’ll now explore how Rezolve AI’s raised revenue targets and expanding enterprise presence inform its ongoing investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Rezolve AI's Investment Narrative?

For Rezolve AI, the big picture is all about whether you believe in high-growth, high-investment AI commerce platforms that are not yet profitable, but are rapidly scaling thanks to bold expansion moves and key partnerships. The recent surge in sales, lifted annual recurring revenue guidance, and strong capital infusion from major institutional investors could further accelerate near-term growth catalysts, such as product launches and enterprise customer gains. This also boosts firepower for acquisitions, reflecting both market confidence and ambition. However, this comes as net losses widened substantially, shareholder dilution increased, and execution risks around integrating new technologies and scaling globally remain front and center. With shares rising steeply after the news and analysts lifting targets, the current narrative is shifting from “can they grow” to “can they manage this pace and turn a profit soon,” especially as ongoing legal issues and negative equity still loom. On the flip side, rapid investment raises questions about how soon profitability will come.

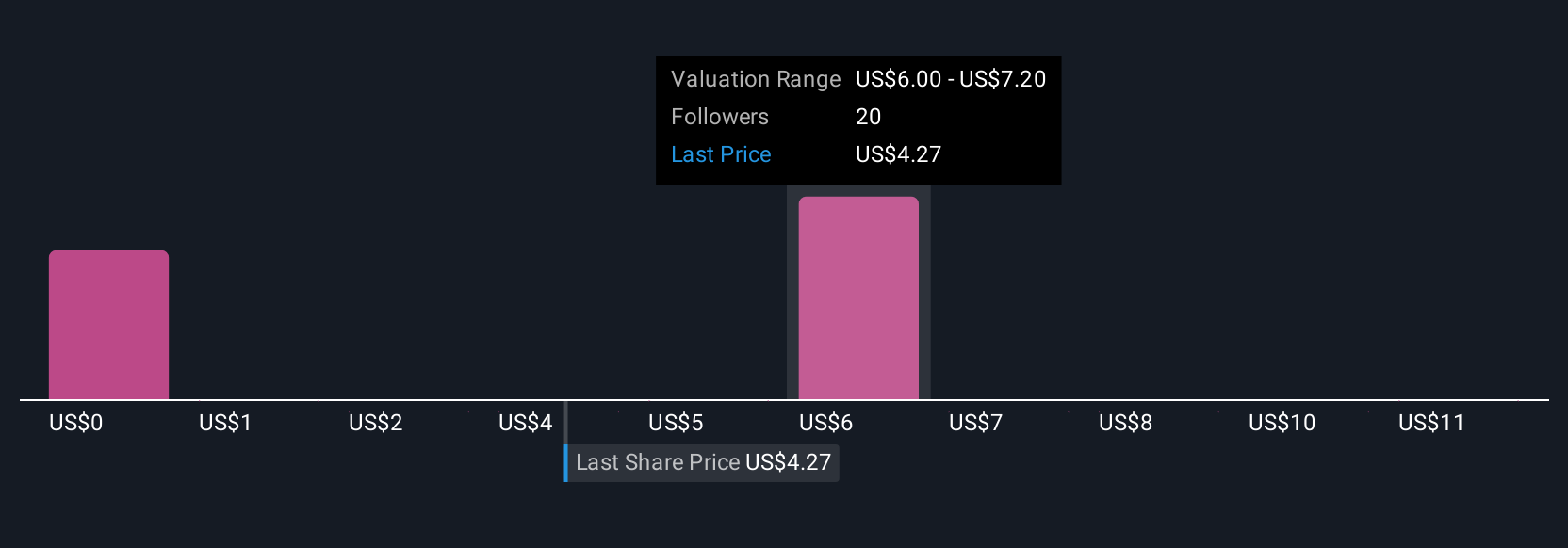

Rezolve AI's shares have been on the rise but are still potentially undervalued by 41%. Find out what it's worth.Exploring Other Perspectives

Explore 11 other fair value estimates on Rezolve AI - why the stock might be worth less than half the current price!

Build Your Own Rezolve AI Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rezolve AI research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Rezolve AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rezolve AI's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RZLV

Rezolve AI

Provides generative AI solutions for the retail and e-commerce sectors.

High growth potential with low risk.

Market Insights

Community Narratives