- United States

- /

- Software

- /

- NasdaqGM:RPD

Will UAE Expansion and DESC Certification Transform Rapid7's (RPD) Access to Regulated Enterprise Contracts?

Reviewed by Sasha Jovanovic

- Rapid7, Inc. recently established a local entity, launched a locally-hosted platform instance, and opened a Dubai office, marking a significant investment and increased regional presence in the United Arab Emirates.

- By achieving DESC cybersecurity certification and aligning with data sovereignty mandates, Rapid7 is now positioned to access regulated government and enterprise contracts in a UAE cybersecurity market projected to reach US$4.51 billion by the end of 2025.

- We’ll consider how DESC certification and local UAE operations can influence Rapid7’s investment narrative and potential access to major enterprise contracts.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Rapid7 Investment Narrative Recap

To own Rapid7, I believe you need to have conviction in its ability to win larger, more strategic cybersecurity contracts by supporting highly regulated industries undergoing digital transformation, especially as enterprises consolidate security vendors. The recent UAE expansion and DESC certification may help Rapid7 access new regulated government and enterprise deals, but does not materially change the near-term reliance on successfully operationalizing its upsell and expansion engine, the central catalyst, or lessen exposure to extended deal cycles and unpredictable revenues, which remain the biggest risk right now.

Among Rapid7's recent updates, the Q3 2025 earnings announcement scheduled for November 4, 2025, stands out. This is most relevant to the UAE news, as quarterly results will help gauge whether investments like the Dubai office and regional compliance moves are beginning to contribute to top-line momentum or simply add near-term costs without yet moving the revenue needle.

However, investors also need to be aware that while the UAE expansion offers potential, the unpredictability caused by elongated deal cycles and shifts to bigger, but slower, contracts could...

Read the full narrative on Rapid7 (it's free!)

Rapid7's narrative projects $941.1 million revenue and $65.7 million earnings by 2028. This requires 3.2% yearly revenue growth and a $37.7 million earnings increase from $28.0 million today.

Uncover how Rapid7's forecasts yield a $24.66 fair value, a 32% upside to its current price.

Exploring Other Perspectives

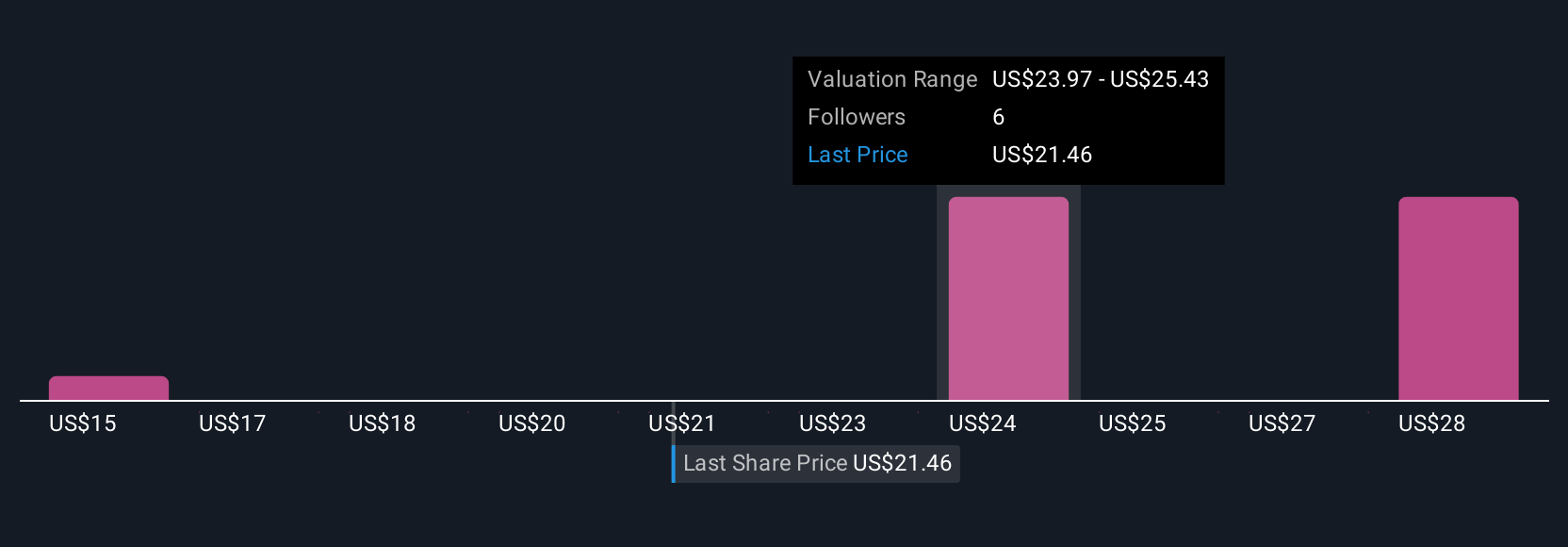

Three fair value estimates from the Simply Wall St Community span from US$15.25 to US$28.23, showing wide disagreement about Rapid7’s intrinsic worth. While some see strong expansion potential in regulated markets, others may weigh sales unpredictability more heavily in their outlook, reminding you to consider a range of opinions.

Explore 3 other fair value estimates on Rapid7 - why the stock might be worth as much as 52% more than the current price!

Build Your Own Rapid7 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rapid7 research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Rapid7 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rapid7's overall financial health at a glance.

No Opportunity In Rapid7?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Ferrari's Intrinsic and Historical Valuation

Recently Updated Narratives

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

Looking to be second time lucky with a game-changing new product

Adobe - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).