- United States

- /

- Software

- /

- NasdaqGM:RPD

Should Rapid7’s HITRUST Compliance Partnership Shift the Risk Calculus for RPD Investors?

Reviewed by Sasha Jovanovic

- In early December 2025, HITRUST and Rapid7 announced a partnership integrating Rapid7’s Surface Command platform with the HITRUST assurance framework to automate continuous compliance and strengthen cyber resilience for customers.

- A particularly important angle is how this integration could shift customers away from manual, point-in-time audits toward ongoing, evidence-based validation that also supports lower cyber insurance costs.

- We’ll now explore how this move toward continuous, automated HITRUST-aligned compliance could influence Rapid7’s longer-term investment narrative and risk profile.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Rapid7 Investment Narrative Recap

To own Rapid7, you really need to believe in its Command platform as a core security and compliance hub for larger, more regulated customers, despite modest revenue growth and margin pressure. The HITRUST integration supports that thesis by reinforcing the consolidation and automation story, but it does not fundamentally change the near term risk around elongated deal cycles and timing uncertainty for larger, more complex contracts.

Among recent announcements, the expanded partnership with Microsoft around MDR for Microsoft looks particularly relevant. Together with HITRUST, it underscores Rapid7’s push to sit on top of existing security stacks and compliance regimes, which could support the long term catalyst of winning bigger consolidation deals even as near term revenue growth remains uneven.

Yet while automation and partnerships may help, investors should also be aware that...

Read the full narrative on Rapid7 (it's free!)

Rapid7's narrative projects $941.1 million revenue and $65.7 million earnings by 2028. This requires 3.2% yearly revenue growth and about a $37.7 million earnings increase from $28.0 million today.

Uncover how Rapid7's forecasts yield a $20.37 fair value, a 28% upside to its current price.

Exploring Other Perspectives

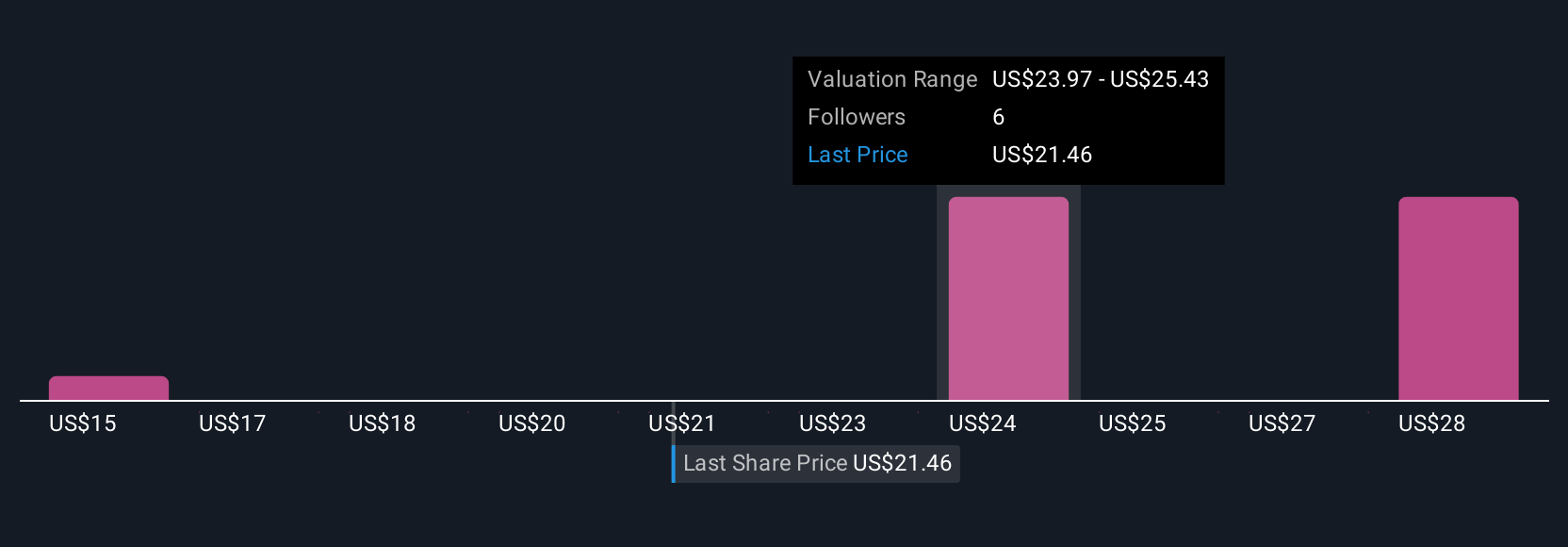

Four Simply Wall St Community members currently see Rapid7’s fair value between US$15.25 and US$26.15, highlighting very different expectations. Against that spread, the risk of extended deal cycles and lumpier revenue timing could meaningfully shape how the company’s performance actually unfolds, so it is worth comparing several viewpoints before forming a view.

Explore 4 other fair value estimates on Rapid7 - why the stock might be worth just $15.25!

Build Your Own Rapid7 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rapid7 research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Rapid7 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rapid7's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026