- United States

- /

- Software

- /

- NasdaqGM:RPD

Rapid7 (RPD): Exploring Valuation Perspectives After Recent Share Price Weakness

Reviewed by Simply Wall St

See our latest analysis for Rapid7.

Rapid7’s year-to-date share price return sits sharply lower at -53.68%, capping off a tough stretch for shareholders. The past 12 months haven’t offered much relief either, with total shareholder return down 54.87% as recent macro headwinds and sector pressures appear to have weighed on sentiment. Momentum still seems to be fading for now, despite the company's ongoing efforts to drive growth.

If you're exploring what else the tech sector is offering, now is a good opportunity to see the full lineup using our curated list of high-growth and AI-driven stocks: See the full list for free.

With shares trading well below analyst price targets and recent declines weighing on sentiment, investors now face a critical question: is Rapid7 undervalued at these levels, or is the market already pricing in all future growth potential?

Most Popular Narrative: 26% Undervalued

Rapid7's most widely followed valuation narrative places fair value at $24.66, nearly 35% higher than the latest close of $18.24. This suggests the stock is trading well below its projected potential. In this context, the narrative’s underlying logic spotlights a specific business transformation as the core justification for its higher price target.

Rapid7's unified Command platform and MDR-led solutions are increasingly winning larger, strategic consolidation deals as enterprises seek to reduce fragmentation and simplify compliance in complex, highly regulated environments. This points to an expanding addressable market, higher average revenue per customer, and sustained revenue growth opportunity.

Curious what bold financial assumptions justify this valuation? The story hinges on a combination of future revenue growth, fatter profit margins, and a big shift in how cash flows are valued. There may be a twist in the forecast that only a deep dive will uncover.

Result: Fair Value of $24.66 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, extended deal cycles or stalled growth in legacy vulnerability management could jeopardize the bullish outlook and disrupt near-term revenue momentum.

Find out about the key risks to this Rapid7 narrative.

Another View: Multiple-Based Valuation Suggests Caution

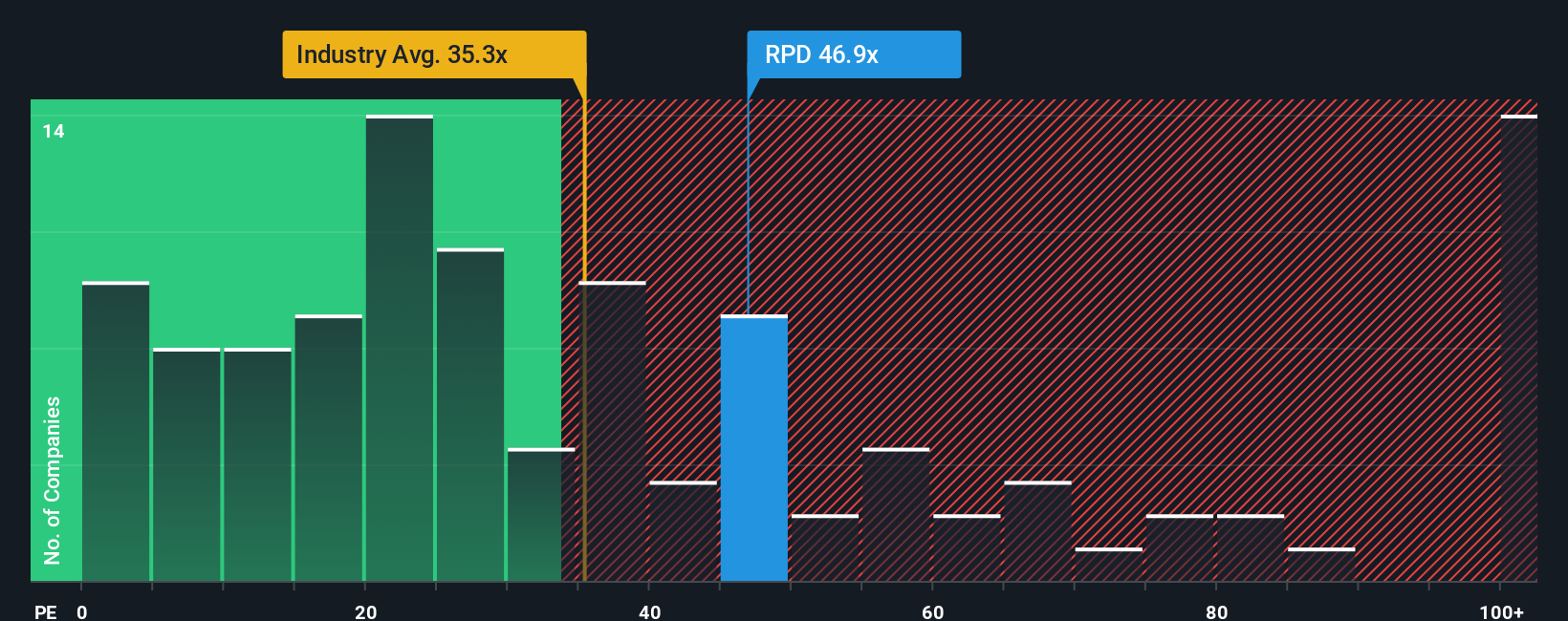

Looking at Rapid7 through the lens of its price-to-earnings ratio, things look much less optimistic. The company’s ratio stands at 42.1x, which is significantly higher than both the US Software industry average of 34.8x and the fair ratio of 35.2x that the market might eventually enforce. This premium signals that investors are paying up for growth that could be harder to achieve, especially if trends slow or competition grows more intense. Is the market expecting too much, too soon?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Rapid7 Narrative

If you have a different perspective or prefer to run the numbers yourself, it takes less than three minutes to build your own view, your way: Do it your way

A great starting point for your Rapid7 research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Stretch your potential returns by seeking out unique ideas alongside Rapid7. Don’t watch from the sidelines while others gain an edge using tailored screeners.

- Capture growth with emerging tech by tapping into the latest trends through these 26 AI penny stocks in artificial intelligence innovation.

- Maximize future returns and income by targeting steady cash flow from leading companies found with these 24 dividend stocks with yields > 3%.

- Ride the volatility and outsized potential of overlooked gems with these 3582 penny stocks with strong financials making waves in the market’s under-the-radar corners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

Intuit Stock: When Financial Software Becomes the Operating System for Small Business

Meta’s Bold Bet on AI Pays Off

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

The "Sleeping Giant" Stumbles, Then Wakes Up