- United States

- /

- Software

- /

- NasdaqGM:RPD

How Rapid7’s (RPD) Launch of Vector Command Advanced Has Changed Its Investment Story

Reviewed by Simply Wall St

- On August 19, 2025, Rapid7 announced the launch of Vector Command Advanced, an enhanced service expanding its continuous red teaming and exposure validation to help organizations meet compliance requirements with internal network testing and audit-ready reporting.

- This offering leverages continuous, expert-led validation and advanced attack path visualization to streamline both compliance processes and real-world risk remediation.

- We'll consider how the integration of advanced compliance testing and attack simulation with Vector Command Advanced could alter Rapid7’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Rapid7 Investment Narrative Recap

To be a shareholder in Rapid7, you need to believe in the company's ability to grow by providing unified cybersecurity platforms that help enterprises address both compliance and real-world risk in increasingly regulated, hybrid environments. The launch of Vector Command Advanced expands Rapid7’s compliance-focused capabilities, potentially strengthening the appeal for larger deals, though it may not materially reduce the near-term uncertainty stemming from extended deal cycles, the central catalyst and key risk at play.

Of the company’s recent announcements, the introduction of Incident Command is especially relevant. As a next-generation SIEM with SOC expert–trained AI workflows, it is designed to address enterprise needs for automated security operations and efficient compliance reporting, directly complementing the compliance and adversarial testing capabilities highlighted with Vector Command Advanced.

However, investors should be aware that, despite new offerings, persistent revenue timing uncertainty driven by longer deal cycles remains a crucial consideration for...

Read the full narrative on Rapid7 (it's free!)

Rapid7's narrative projects $941.1 million revenue and $65.7 million earnings by 2028. This requires 3.2% yearly revenue growth and a $37.7 million earnings increase from $28.0 million today.

Uncover how Rapid7's forecasts yield a $25.19 fair value, a 21% upside to its current price.

Exploring Other Perspectives

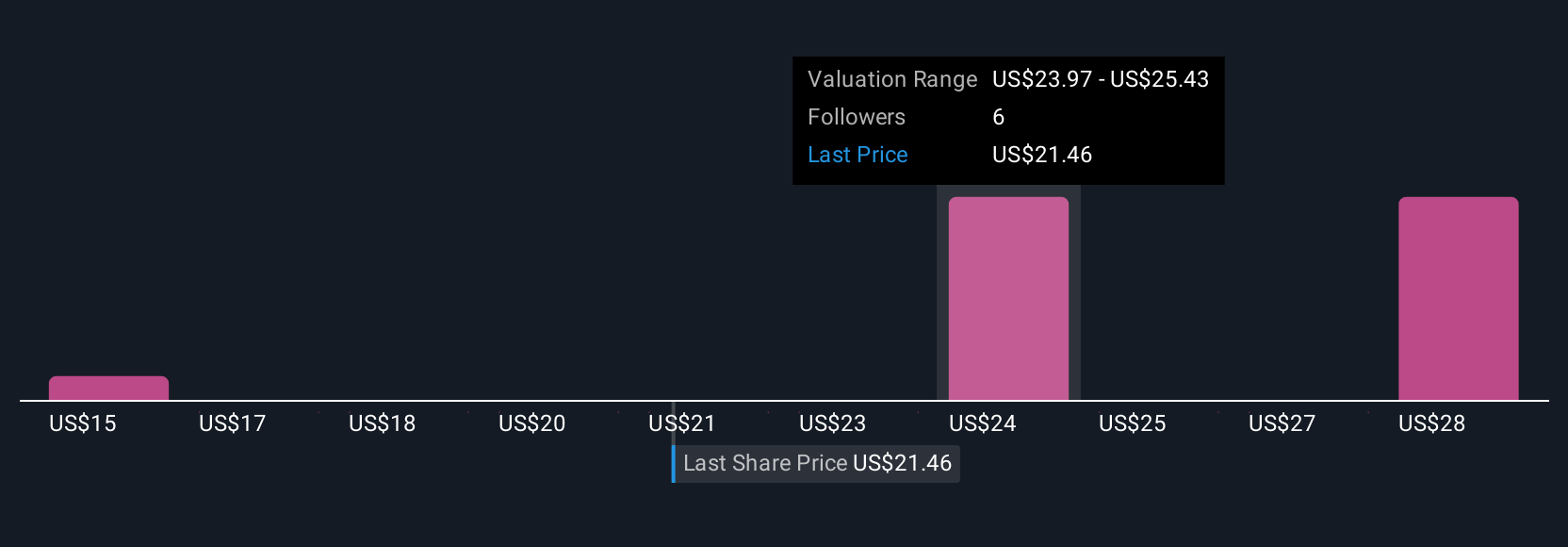

Simply Wall St Community members set fair value estimates ranging from US$15.25 to US$29.76, spanning three unique outlooks. While many see upside, lingering concerns about unpredictable revenue cycles could weigh on the company’s ability to fully capitalize on new product launches, explore these varied views for a fuller picture.

Explore 3 other fair value estimates on Rapid7 - why the stock might be worth as much as 43% more than the current price!

Build Your Own Rapid7 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rapid7 research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Rapid7 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rapid7's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives