- United States

- /

- Software

- /

- NasdaqGM:RPD

Can Rapid7’s (RPD) Enterprise Shift and Upbeat Outlook Reshape Its Long-Term Growth Narrative?

Reviewed by Simply Wall St

- Rapid7 recently reported its second quarter 2025 results, posting revenue of US$214.19 million and net income of US$8.34 million, while at the same time announcing the upcoming retirement of Chief Financial Officer Tim Adams and confirming participation in Canaccord Genuity’s 45th Annual Growth Conference.

- The company also raised its full-year earnings guidance and emphasized a shift toward focusing on larger, more strategic enterprise customers amid cautious technology spending.

- We'll explore how Rapid7's raised earnings outlook and enterprise customer focus may impact its investment narrative and long-term potential.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Rapid7 Investment Narrative Recap

To be a Rapid7 shareholder, you need confidence in its ability to win larger enterprise deals and successfully convert this pipeline into steady growth, despite persistent caution in technology spending. The Q2 results and earnings guidance raise helped support the most important near-term catalyst, sustained enterprise customer momentum and margin expansion. However, the CFO’s pending retirement has not caused a material impact, while the biggest risk remains uncertainty in deal timing and conversion for these larger contracts. The most relevant recent announcement is Rapid7’s updated full-year earnings guidance, which marked an increase and reflects management’s view that larger customer focus may drive improved profitability and efficiency, even as the business contends with elongated sales cycles and competitive pressures. Yet, investors should be aware that despite these positive signals, extended deal cycles and unpredictable revenue timing could still ...

Read the full narrative on Rapid7 (it's free!)

Rapid7's outlook anticipates $941.1 million in revenue and $65.7 million in earnings by 2028. This is based on a 3.2% annual revenue growth rate and a $37.7 million increase in earnings from the current $28.0 million.

Uncover how Rapid7's forecasts yield a $25.19 fair value, a 18% upside to its current price.

Exploring Other Perspectives

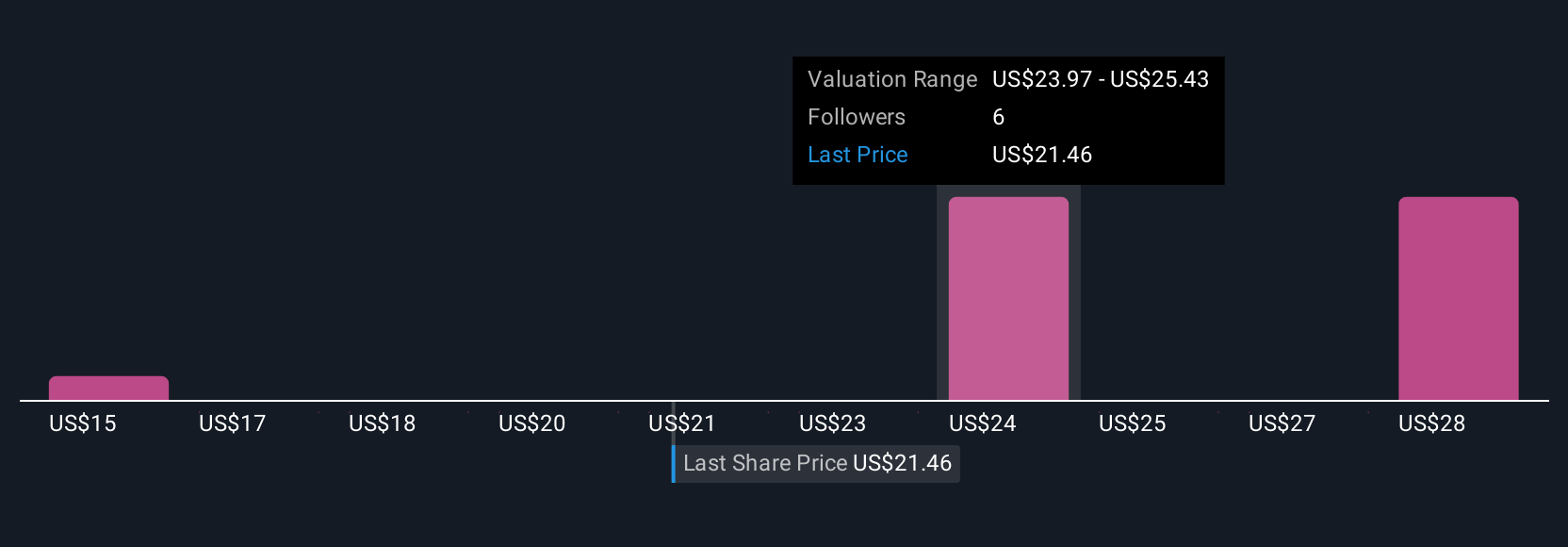

Simply Wall St Community members estimate Rapid7’s fair value between US$15.25 and US$29.79 across three analyses. While opinions differ, ongoing uncertainty in revenue predictability is an important consideration for future performance.

Explore 3 other fair value estimates on Rapid7 - why the stock might be worth as much as 40% more than the current price!

Build Your Own Rapid7 Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rapid7 research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Rapid7 research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rapid7's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:RPD

Rapid7

Provides cybersecurity software and services under the Rapid7, Nexpose, and Metasploit brand names.

Reasonable growth potential with acceptable track record.

Similar Companies

Market Insights

Community Narratives