- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms (RIOT): Reassessing Valuation After Softer Bitcoin Output and a Strategic Shift to HPC Data Centers

Reviewed by Simply Wall St

Riot Platforms (RIOT) is back in focus after reporting softer November bitcoin production and sales, just as investors weigh its shift toward high performance computing data centers and the potential impact of an expected first lease in early 2026.

See our latest analysis for Riot Platforms.

Despite the softer November mining update, the share price is still up strongly with a year to date share price return of 48.28 percent and a hefty three year total shareholder return of 273.73 percent. This suggests momentum is cooling in the short term, but the longer term thesis around the HPC transition remains very much intact.

If you like the Riot story but want a broader tech and infrastructure angle, this could be a good moment to explore high growth tech and AI stocks for other high potential names.

With the stock still trading well below consensus targets despite hefty past gains, the key question now is whether investors are overlooking Riot’s next leg of HPC driven growth, or if the market has already priced it in.

Most Popular Narrative: 43.6% Undervalued

With Riot Platforms last closing at $15.51 versus a most popular narrative fair value of $27.50, the spread reflects a bold long term earnings vision.

Riot's aggressive build out of a scalable data center business leverages its extensive, readily available power capacity in high demand regions, well positioning the company to benefit from surging demand for AI and cloud computing infrastructure, this is likely to drive higher revenue growth and improved valuation multiples over time.

Want to see how this power heavy strategy turns into upside potential? The narrative leans on ambitious growth, richer margins, and a future multiple usually reserved for elite software names. Curious which forward looking numbers are doing the heavy lifting behind that fair value?

Result: Fair Value of $27.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside depends on Riot actually landing large scale data center leases and on Bitcoin prices staying supportive amid rising competition and network difficulty.

Find out about the key risks to this Riot Platforms narrative.

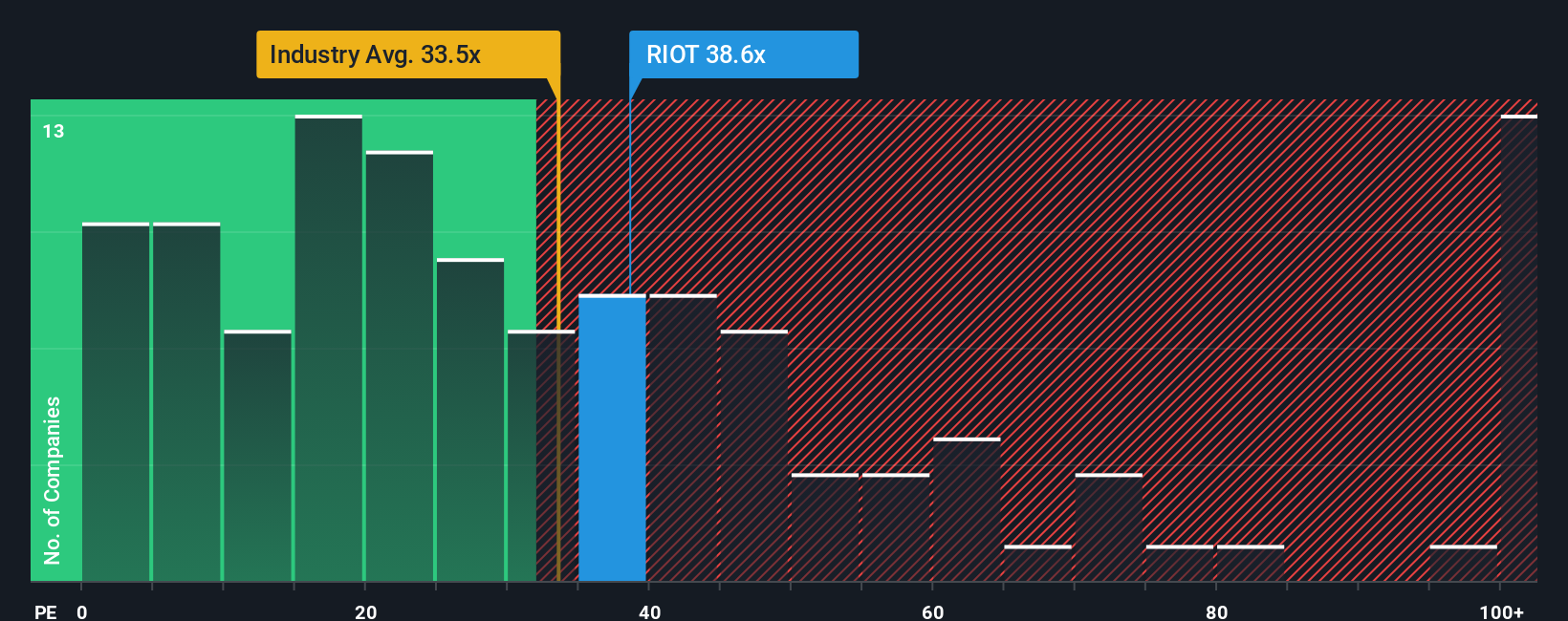

Another View: Market Ratios Flash a Caution Signal

While the narrative fair value suggests upside, the current price to earnings ratio near 35 times looks steep against both US software peers at about 32 times and a fair ratio closer to 7.6 times. That big gap hints at valuation risk if expectations slip, rather than hidden value.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Riot Platforms Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Riot Platforms research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next potential opportunity with targeted screeners that can surface strong risk reward setups that might otherwise be overlooked.

- Review these 900 undervalued stocks based on cash flows to explore companies that pair solid fundamentals with attractive valuations before they gain broader market attention.

- Explore these 30 healthcare AI stocks to focus on businesses that combine medical innovation with intelligent software to help reshape patient outcomes and operational efficiency.

- Evaluate these 15 dividend stocks with yields > 3% to identify companies offering cash distributions that can support portfolio income through different market environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026