- United States

- /

- Software

- /

- NasdaqGS:RDWR

Radware Ltd. (NASDAQ:RDWR) Released Earnings Last Week And Analysts Lifted Their Price Target To US$21.43

It's been a pretty great week for Radware Ltd. (NASDAQ:RDWR) shareholders, with its shares surging 20% to US$22.26 in the week since its latest quarterly results. Earnings are an important time for investors, as they can track a company's performance, look at what the analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. Readers will be glad to know we've aggregated the latest statutory forecasts to see whether the analysts have changed their mind on Radware after the latest results.

See our latest analysis for Radware

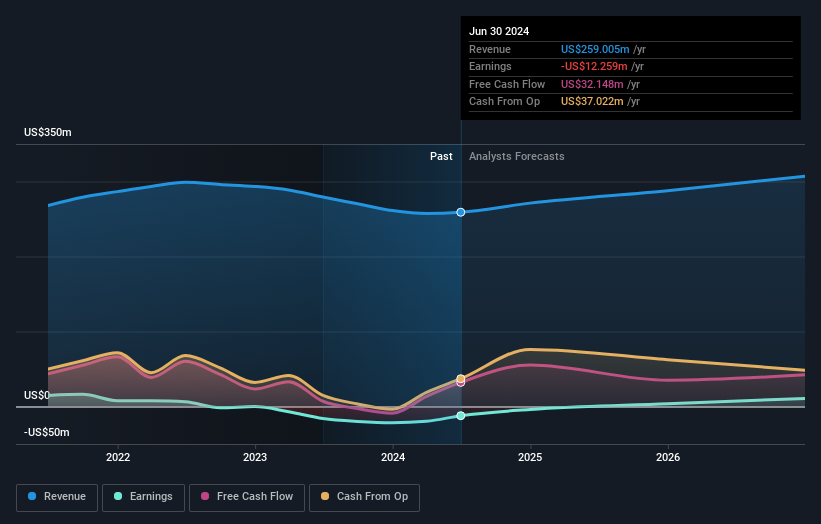

Taking into account the latest results, the most recent consensus for Radware from four analysts is for revenues of US$271.2m in 2024. If met, it would imply a credible 4.7% increase on its revenue over the past 12 months. Per-share statutory losses are expected to explode, reaching US$0.10 per share. In the lead-up to this report, the analysts had been modelling revenues of US$264.4m and earnings per share (EPS) of US$0.02 in 2024. Yet despite a small increase to revenues, the analysts are now forecasting a loss instead of a profit, which looks like a reduction in sentiment after the latest results.

It will come as a surprise to learn that the consensus price target rose 7.7% to US$21.43, with the analysts clearly more interested in growing revenue, even as losses intensify. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. The most optimistic Radware analyst has a price target of US$23.00 per share, while the most pessimistic values it at US$19.29. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or thatthe analysts have a strong view on its prospects.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Radware's past performance and to peers in the same industry. The analysts are definitely expecting Radware's growth to accelerate, with the forecast 9.6% annualised growth to the end of 2024 ranking favourably alongside historical growth of 2.3% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to see revenue growth of 12% annually. So it's clear that despite the acceleration in growth, Radware is expected to grow meaningfully slower than the industry average.

The Bottom Line

The most important thing to take away is that the analysts are expecting Radware to become unprofitable next year. Fortunately, they also upgraded their revenue estimates, although our data indicates it is expected to perform worse than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. At Simply Wall St, we have a full range of analyst estimates for Radware going out to 2026, and you can see them free on our platform here..

You can also see our analysis of Radware's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RDWR

Radware

Develops, manufactures, and markets cyber security and application delivery solutions for cloud, on-premises, and software defined data canters.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Hims & Hers Health - Valuation

TAV Havalimanlari Holding will soar with €2.5 billion investments fueling future growth

Lexaria Bioscience's Breakthrough with DehydraTECH to Revolutionize Drug Delivery

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.

NVDA+AEVA Agreement is a game changer for the AEVA stock even though it is just a partnership and does not have a roll out until 2028 (which means receivables as early as 2027, I would imagine) This agreement effectively moves the goal posts of profitability for AEVA much closer since this is in addition to the recent Forterra agreement, as well as the (just announced) European carmaker agreement (which is believed to be Mercedes-Benz). Underneath all of this, AEVA has a pre-existing agreement with Daimler truck. So business seems to be booming, especially with really big name brands…which tends to bring in more brand nanes (and more agreements/contracts/announcements, etc). This often creates more coverage from analysts (often with upside stock upgrades) that I believe will be occurring over the next 3 to 6 months (as professional traders/analysts often research for 2 to 3 months before initiating coverage of a new issue). Anyway, just my opinion , so please do your own due diligence. Disclaimer: I DO trade in this stock from time to time and I may have a position currently