- United States

- /

- Software

- /

- NasdaqCM:QUBT

Quantum Computing (NasdaqCM:QUBT) Navigates Legal Turmoil Amid Securities Fraud Lawsuit

Reviewed by Simply Wall St

Quantum Computing (NasdaqCM:QUBT) found itself embroiled in significant legal and financial developments this past quarter, coinciding with a modest price increase of 1.48%. The filing of a securities fraud lawsuit against the company and its executives for overstating its technological capabilities and contracts, notably with NASA, is critical. Additionally, a Shelf Registration that concluded with raising $84 million highlighted the company's financial maneuvers. While these events suggest potential challenges, they may have fueled cautious investor optimism. The market atmosphere further influenced Quantum Computing's performance, as major indexes like the Nasdaq Composite experienced a volatile environment, exacerbated by mixed responses to earnings and global policy concerns. In this context, Quantum Computing's price move contrasts with the broader Nasdaq slump, reflecting investor sentiment in the face of regulatory and fiscal uncertainties affecting the tech sector. As the markets continue to absorb various risks, assessing Quantum Computing's legal and economic positioning remains crucial for stakeholders.

Unlock comprehensive insights into our analysis of Quantum Computing stock here.

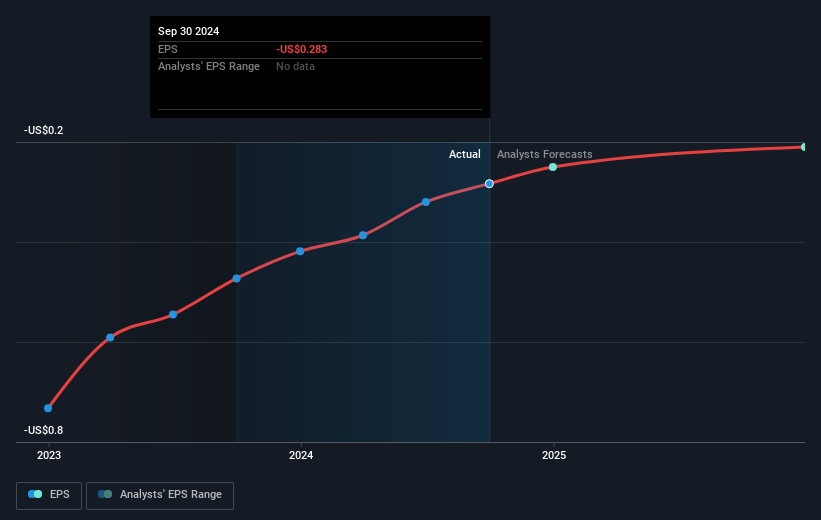

Over the expansive period of last year, Quantum Computing's total shareholder returns skyrocketed, reflecting a remarkable annual return of over 700%. This achievement significantly surpassed both the US market and the software industry, which showed moderate returns. The company's venture into new collaborations, notably a partnership with the Sanders Tri-Institutional Therapeutics Discovery Institute announced in January 2025, may have fortified investor confidence. Additionally, multiple customer orders for TFLN chips in late 2024 suggest burgeoning demand for its advanced technology.

Despite experiencing challenges such as a Nasdaq delisting notice in August 2024 and auditor concerns over its viability in September 2024, the company has cemented critical footholds with entities like NASA. The capital infusion from a shelf registration by early February 2025, raising a substantial US$84.47 million, likely provided necessary liquidity. This combination of technological advances and financial maneuvers might have played key roles in bolstering its stock's stunning performance over the past year.

- Discover whether Quantum Computing is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Uncover the uncertainties that could impact Quantum Computing's future growth—read our risk evaluation here.

- Invested in Quantum Computing? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quantum Computing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:QUBT

Quantum Computing

An integrated photonics company, offers accessible and affordable quantum machines.

Excellent balance sheet slight.

Market Insights

Community Narratives