- United States

- /

- Software

- /

- NasdaqGS:PRGS

Is Progress Software’s Share Price Slide Now Signalling a Long Term Value Opportunity

Reviewed by Bailey Pemberton

- Wondering if Progress Software is quietly becoming a value opportunity, or a trap that just looks cheap on the surface? This breakdown is designed to give you a clear, no nonsense view of what you are really buying at today’s price.

- The stock has bounced about 4.1% over the last week and 4.7% over the last month, but it is still down roughly 30.3% year to date and 35.2% over the past year. That tells us sentiment has been weak even as short term buyers start to nibble again.

- Those moves sit against a backdrop of Progress steadily repositioning itself as a recurring revenue, infrastructure software platform, using a mix of tuck in acquisitions and ongoing product investment to keep its toolkit relevant for enterprise developers. While the headlines have not been dramatic, this slow and steady strategy helps explain why some investors are revisiting the story even after a rough year for the share price.

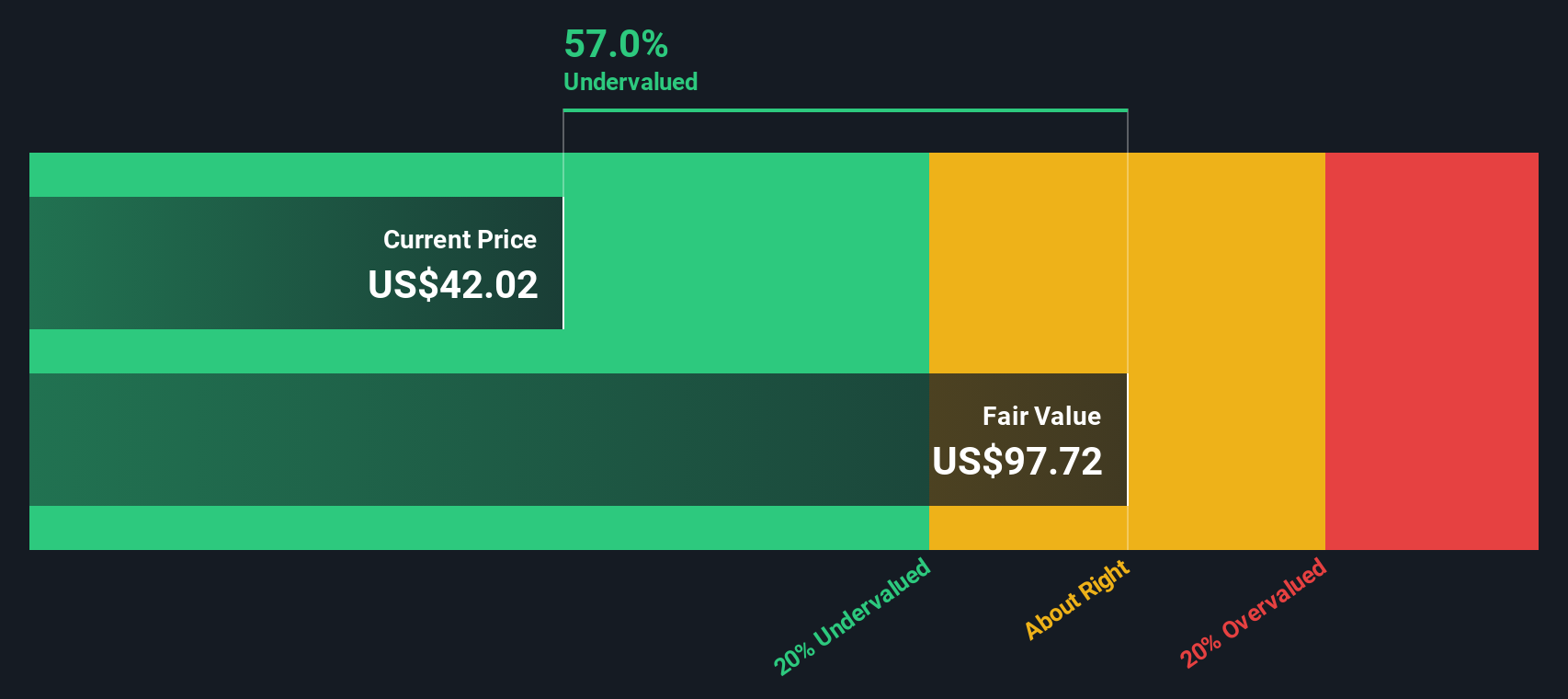

- On our numbers, Progress Software scores a 3/6 valuation check. This implies that roughly half of the metrics we track suggest the shares are undervalued, and the other half look more fully priced. Next we will walk through those different valuation approaches in detail, and then finish with a more intuitive way to decide what the stock is really worth to you as an investor.

Find out why Progress Software's -35.2% return over the last year is lagging behind its peers.

Approach 1: Progress Software Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what a business is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms.

For Progress Software, the latest twelve month free cash flow sits at about $185.3 million. Analysts and extrapolations foresee this climbing steadily, with projections reaching around $342.6 million by 2030 as the company expands its recurring infrastructure software base.

Using a 2 Stage Free Cash Flow to Equity model, these annual free cash flows are forecast over the next decade, then discounted to today and combined with a terminal value. That process produces an estimated intrinsic value of roughly $94.59 per share.

Compared with the current market price, this implies the shares are trading at about a 52.3% discount to the DCF estimate, suggesting investors are paying far less than the modeled long term cash generation would justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Progress Software is undervalued by 52.3%. Track this in your watchlist or portfolio, or discover 904 more undervalued stocks based on cash flows.

Approach 2: Progress Software Price vs Earnings

For profitable software businesses like Progress Software, the price to earnings ratio is a useful way to judge value because it connects what investors are paying today directly to the company’s current earnings power. In general, faster growth and lower perceived risk justify a higher PE multiple, while slower or more volatile earnings usually deserve a lower one.

Progress currently trades on a PE of about 39.9x, which is higher than both the broader Software industry average of roughly 32.7x and the peer group average of about 29.8x. At face value, that premium might make the stock look a bit expensive. However, Simply Wall St’s Fair Ratio framework estimates that, given Progress’s specific mix of earnings growth, profit margins, industry position, market cap and risk profile, a more appropriate PE would be closer to 46.8x. Because this Fair Ratio adjusts for company specific fundamentals rather than relying on broad comparisons, it can give a more tailored view of what investors should be willing to pay.

Set against that 46.8x Fair Ratio, the current 39.9x PE suggests the market is applying a discount rather than a premium.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1447 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Progress Software Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Progress Software’s story to clear financial estimates and a fair value that you can actually act on.

A Narrative lets you spell out why you think the company will win or struggle, then ties that story to your assumptions for future revenue, earnings and margins, producing a forecast and a fair value that all line up with your own logic.

On Simply Wall St’s Community page, Narratives are easy to build and compare. They update dynamically as new information, such as earnings or M&A news, becomes available. This helps your signals, based on Fair Value versus today’s Price, stay aligned with current information.

For example, one Progress Software Narrative might see AI and SaaS acquisitions supporting earnings to justify a fair value near $83 per share, while a more cautious Narrative focused on integration and macro risks could land closer to $57. Where you sit between those views may influence whether the current price appears more like an opportunity or a warning sign.

Do you think there's more to the story for Progress Software? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRGS

Progress Software

Develops, deploys, and manages artificial intelligence (AI) powered applications and digital experiences in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026