- United States

- /

- Software

- /

- NasdaqCM:PRCH

Why The Narrative Around Porch Group Is Shifting After Strong Results And Analyst Upgrades

Reviewed by Simply Wall St

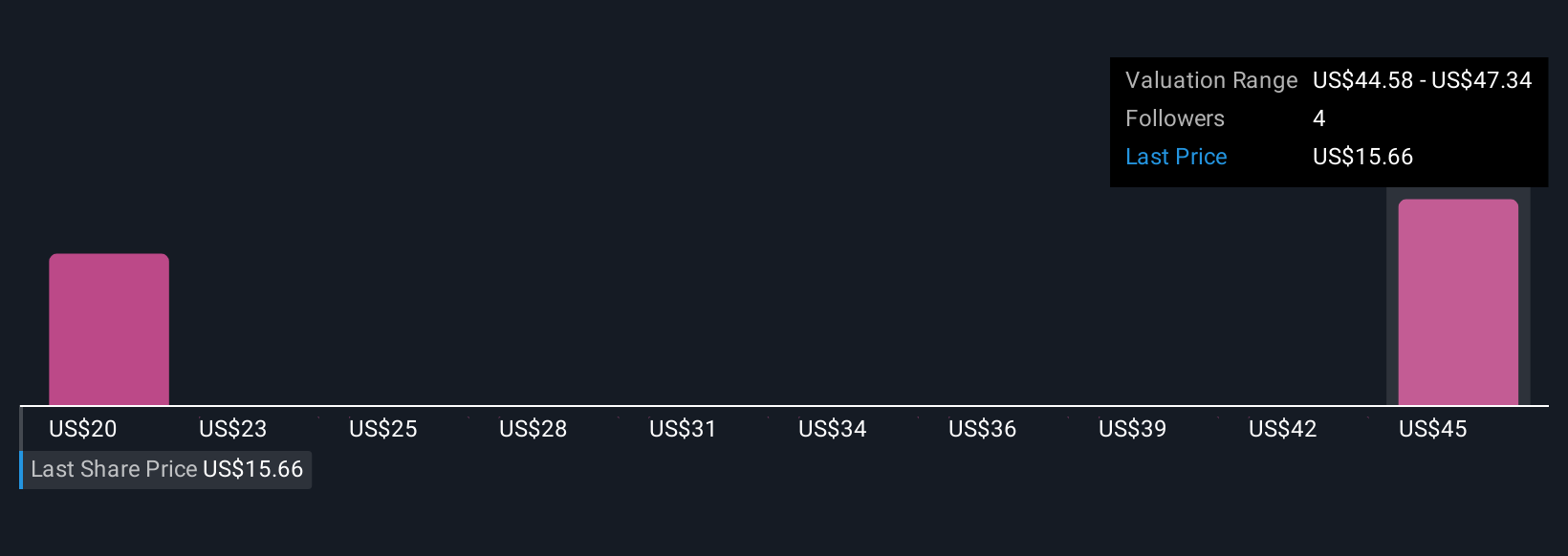

Porch Group’s consensus analyst price target has jumped significantly, rising from $14.00 to $19.75 in the latest update. Much of this optimism is driven by robust revenue growth forecasts, now climbing to 14.4% per annum. As sentiment shifts, it is essential to stay informed to understand where analysts see this evolving narrative heading next.

What Wall Street Has Been Saying

Analyst commentary on Porch Group has intensified following the company’s strong recent performance and updated guidance. The investment community remains divided, but most agree that recent gains have heightened the stakes for upcoming quarters. Below are the key takeaways from both bullish and bearish perspectives:

🐂 Bullish Takeaways

- Analysts with bullish outlooks, such as those from Northland Securities and Benchmark, highlight Porch Group’s ability to scale policy volume and project premiums could grow at an annual rate of 20% to 25%. This represents a significant upgrade from previous expectations.

- Management’s focus on the reciprocal insurance business draws praise for its effective risk management, insulating earnings from weather-related volatility except in exceptional circumstances.

- Street research notes strong execution, particularly within the insurance segment. This is evidenced by an 18% upside surprise in consolidated gross profit and a 24% beat in insurance gross profit for Q2, which has exceeded expectations from multiple coverage analysts.

- Upgrades from several firms also reflect enthusiasm for Porch Group’s shift to a capital-light operating structure, which is expected to support margin expansion. Notably, Stifel raised its price target from $14.00 to $22.00, citing the pathway toward a 30% EBITDA margin by 2027, up from 13% forecasted in 2025.

🐻 Bearish Takeaways

- More cautious analysts, including some at Guggenheim and MoffettNathanson, warn that recent outperformance may already be reflected in the stock price, limiting near-term upside potential.

- Concerns persist regarding the sustainability of accelerating premium growth, especially if macroeconomic conditions shift or weather events surpass moderate levels.

- Continued scrutiny remains on valuation, with a few firms expressing that Porch Group’s current multiples leave little margin for execution missteps.

- MoffettNathanson, for instance, maintained a neutral stance and held its price target at $18.00. The firm cited short-term uncertainty and the need for consistent margin delivery before revising estimates upward.

What's in the News

- Porch Group raised its 2025 revenue guidance to a range of $405 million to $425 million, up from the previous outlook of $400 million to $420 million. This reflects growing confidence in business momentum.

- The company introduced new Home Factors features that help detect interior water intrusion. These enhancements aim to improve risk segmentation and underwriting for insurers, with a goal of reaching over 100 unique property attributes and covering 90% of US homes by the end of the year.

- Porch Group was added to several Russell value indexes, including the Microcap, Small Cap Comp, 2000, 2500, 3000, and 3000E. This is expected to increase the company’s visibility among value-focused and small-cap investors.

How This Changes the Fair Value For Porch Group

- The Consensus Analyst Price Target has significantly risen from $14.00 to $19.75.

- The Consensus Revenue Growth forecasts for Porch Group have significantly risen from 4.1% per annum to 14.4% per annum.

- The Future P/E for Porch Group has significantly risen from 31.30x to 85.31x.

🔔 Never Miss an Update: Follow The Narrative

Narratives offer a smarter, story-driven way to invest. By tying together a company's story, financial forecasts, and fair value, Narratives let you understand the “why” behind the numbers. On Simply Wall St’s Community page, millions of investors use Narratives to compare fair value to price, decide when to buy or sell, and stay up to date as new news or earnings are released.

Read the original Narrative for Porch Group to see how the latest insights shape the outlook and valuation: Fee-Based Model Transition And Data Expansion Will Shape Our Future.

- Discover how Porch Group’s transition to a fee-based model and creation of PIRE could drive higher margins and earnings predictability.

- Stay informed about ambitious growth initiatives in software, data, and expanded geographic reach, with products like Home Factors poised to unlock new revenue streams.

- Learn about key risks, including execution delays and challenges tied to the evolving insurance and data strategy. This information can help you better judge if the current fair value makes sense.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PRCH

Porch Group

Operates a vertical software and insurance platform in the United States.

Reasonable growth potential with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)