- United States

- /

- Software

- /

- NasdaqGS:PONY

Will Pony AI (PONY) Partnership with ComfortDelGro Reveal Its True Global Expansion Ambitions?

Reviewed by Sasha Jovanovic

- On September 20, ComfortDelGro announced a partnership with Pony AI to launch autonomous vehicle services in Singapore, beginning with fixed routes in the Punggol area, pending regulatory approval in the coming months.

- This move highlights how Pony AI is cementing its presence in international markets by collaborating with major transport operators and achieving important regulatory milestones.

- We'll explore how Pony AI's entry into Singapore, in partnership with ComfortDelGro, strengthens its investment narrative through global expansion.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Pony AI's Investment Narrative?

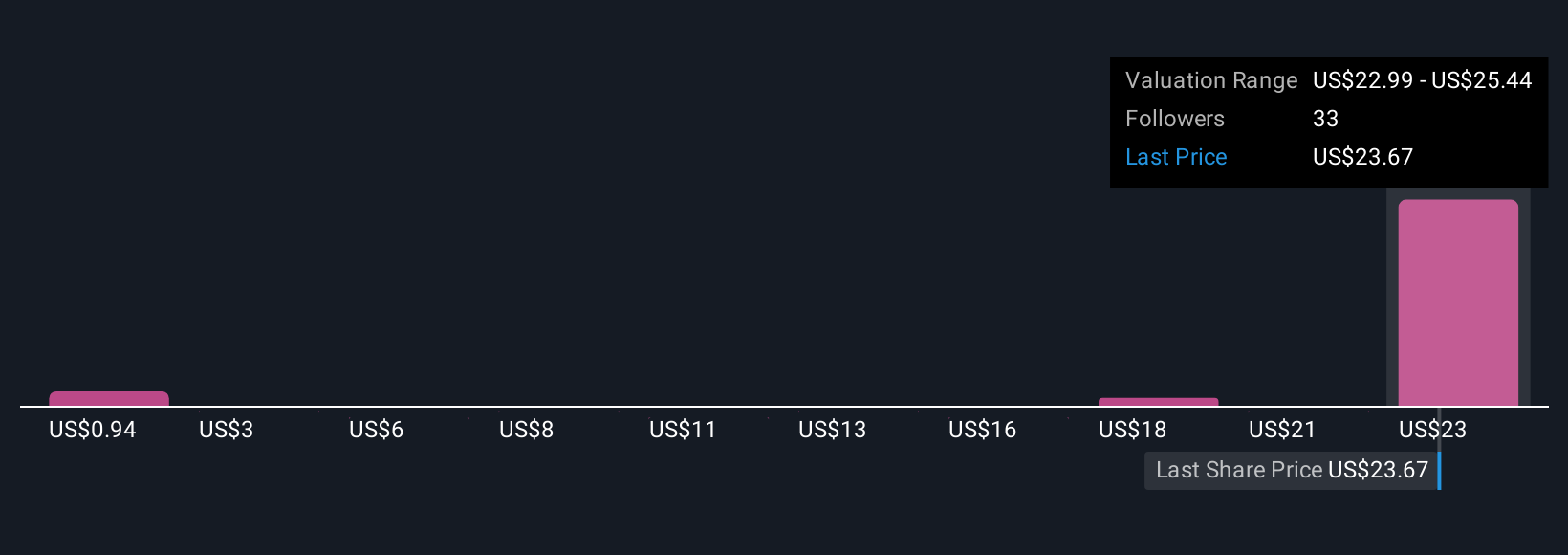

For anyone considering Pony AI stock, it's important to focus on the company's big-picture vision: leading a global rollout of autonomous vehicles and securing a role at the center of the next-generation mobility sector. The recent Singapore partnership could act as a real short-term catalyst because it reinforces Pony AI’s track record of winning regulatory approvals and strong local partnerships. This momentum may reduce near-term execution risks tied to international expansion, previously highlighted by analysts as a key concern. Still, Pony AI's core challenges remain: mounting losses, expensive valuation relative to peers, and a board widely viewed as inexperienced are all important to keep in mind. While the Singapore news adds weight to the global growth story and has supported dramatic stock price moves recently, the company is still not expected to reach profitability within three years, so the risk profile stays elevated for now.

However, questions about management's experience are still lingering for investors to consider.

Exploring Other Perspectives

Explore 13 other fair value estimates on Pony AI - why the stock might be worth less than half the current price!

Build Your Own Pony AI Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pony AI research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pony AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pony AI's overall financial health at a glance.

No Opportunity In Pony AI?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PONY

Pony AI

Through its subsidiaries, engages in the autonomous mobility business in the People’s Republic of China, the United States, and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)