- United States

- /

- Software

- /

- NasdaqGS:PONY

Pony AI (NasdaqGS:PONY): A Closer Look at Valuation After Recent Share Price Moves

Reviewed by Simply Wall St

Pony AI (NasdaqGS:PONY) has popped up on investors’ radars after its latest shift in share price. With no specific event or announcement sparking the current move, speculation is high regarding whether the price action signals renewed optimism or simply reflects another bout of volatility. Sometimes, it is these quieter moments that offer the clearest windows into what the market expects from a company that operates at the cutting edge of autonomous technology.

Looking at the bigger picture, Pony AI’s stock has experienced its share of ups and downs, with the price climbing around 8% over the past 3 months but still down roughly 7% for the year to date. While the company’s annual revenue growth reached nearly 47% and net losses are shrinking, the share price has not shown sustained upward momentum. In that context, every smaller movement can feel amplified as investors weigh recent developments within the self-driving sector and Pony AI’s capacity to improve its financial outlook.

This raises the question of whether the current price presents an opportunity, or if the market has already factored in all of Pony AI’s future growth.

Price-to-Book of 5.9x: Is it justified?

Pony AI currently trades at a price-to-book (P/B) ratio of 5.9. This figure is a common way to gauge whether the share price fairly represents the company's net assets, especially for firms in capital-intensive or technology-driven sectors such as software and autonomous vehicles.

The price-to-book multiple essentially compares the company's market value to its accounting book value. For Pony AI, this P/B ratio is notably higher than the US Software industry average of 3.9. This indicates that the market places a premium on the company's shares relative to many of its peers. However, being considered "expensive" on this basis suggests investors might be anticipating strong future performance or simply paying up for growth potential in a competitive field.

Result: Fair Value of $14.09 (OVERVALUED)

See our latest analysis for Pony AI.However, ongoing net losses and persistent stock volatility could still challenge the market's optimism and result in shifts in investor sentiment.

Find out about the key risks to this Pony AI narrative.Another View: Our DCF Model Weighs In

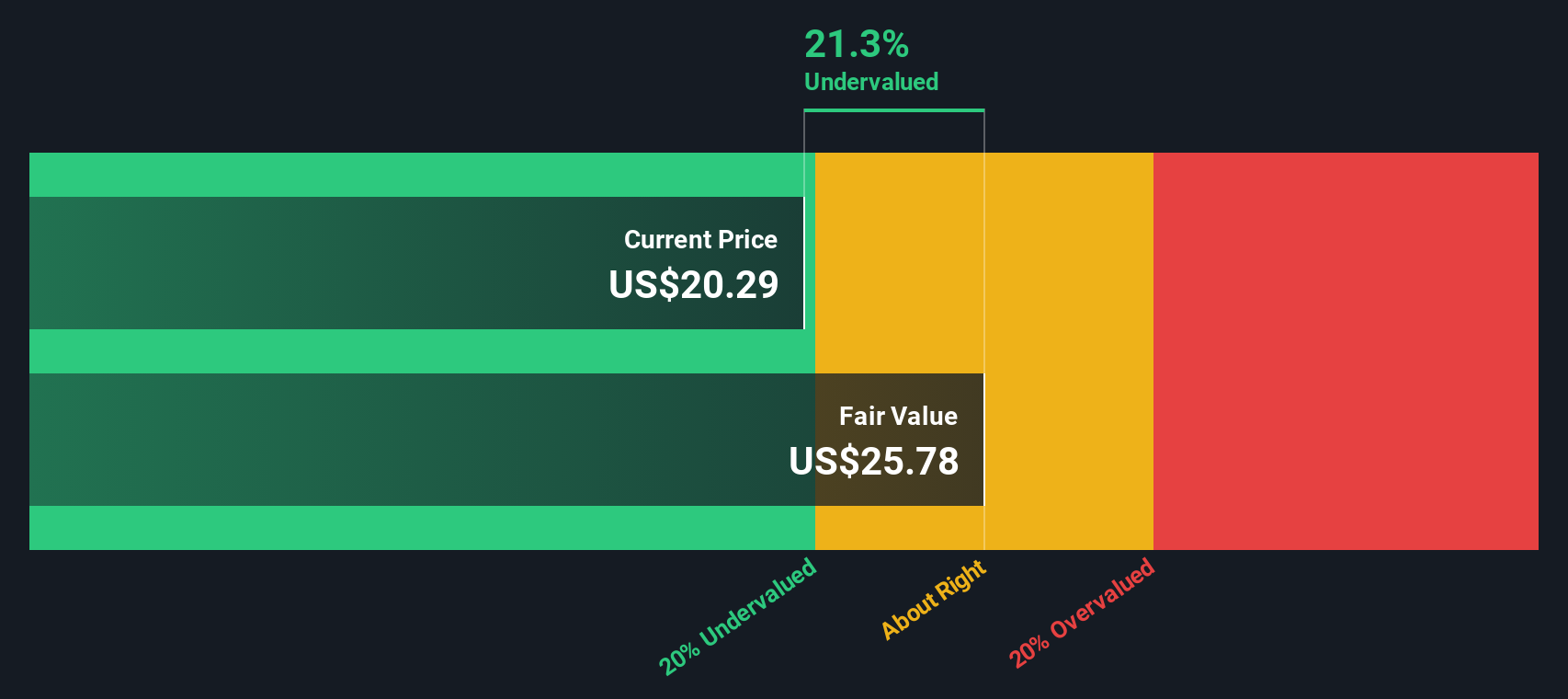

While the earlier metric suggests Pony AI is overvalued compared to net assets, our SWS DCF model presents a different view. It suggests the stock may actually be trading below its fair value. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pony AI Narrative

If you find yourself with a different perspective or are keen to run the numbers your own way, you can easily put together your own narrative in just minutes. Do it your way

A great starting point for your Pony AI research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

There is no reason to limit your strategy to just one opportunity when smart tools can reveal real standouts. If you want an edge, don’t miss out on these powerful market screens:

- Get a head start on the next tech boom by targeting companies at the frontier of AI breakthroughs through AI penny stocks.

- Boost your portfolio’s income potential by selecting industry leaders offering reliable payouts with dividend stocks with yields > 3%.

- Capitalize on value opportunities others overlook by filtering for stocks trading below their true worth using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:PONY

Pony AI

Through its subsidiaries, engages in the autonomous mobility business in the People’s Republic of China, the United States, and internationally.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)