- United States

- /

- Software

- /

- NasdaqGS:PLTR

What the Latest Price Rally Means for Palantir After Strong Q1 Growth

Reviewed by Simply Wall St

If you are eyeing Palantir Technologies stock and wondering whether to hold, buy more, or maybe even cash out, you are not alone. This is a stock that has captured headlines, fan enthusiasm, and a fair dose of debate over its true worth. Over just the past three months, Palantir has delivered a 27.6% gain. At the one-year mark, that return increases to a notable 379%. Those numbers have many investors wondering if there is still more room to run or if the good news is already priced in.

Interestingly, the excitement has not always matched the numbers from analysts or traditional value models. Palantir’s latest closing price is about 3% above the average analyst price target and 103.5% above what certain discounted cash flow models suggest. This discrepancy hints at either untapped upside or increased risk appetite among investors. Based on our value score system, Palantir comes in at 0 out of 6 for undervaluation checks, meaning that none of the six key measures currently flag the stock as undervalued.

With growth in both revenue and net income pushing above 25% and 31% annually, it is easy to see why optimism surrounds the company. But does growth alone justify this kind of run-up, or is the market getting ahead of itself?

Let’s unpack the most common valuation methods used to measure a stock like Palantir. Stay tuned, because at the end of this article, I will share a smarter, more nuanced way to think about its real value.

Palantir Technologies delivered 379.4% returns over the last year. See how this stacks up to the rest of the Software industry.Approach 1: Palantir Technologies Cash Flows

A Discounted Cash Flow (DCF) model estimates what a business is worth by projecting its future cash flows and then discounting them back to today’s value, taking into account the time value of money and risk factors.

For Palantir Technologies, the latest trailing twelve-month Free Cash Flow stands at $1.7 billion. Analysts and estimates anticipate strong growth, projecting annual free cash flows reaching $14.8 billion by 2035. These long-term forecasts are informed by both analyst consensus and growth estimates, considering multi-year increases in revenue and operational efficiency.

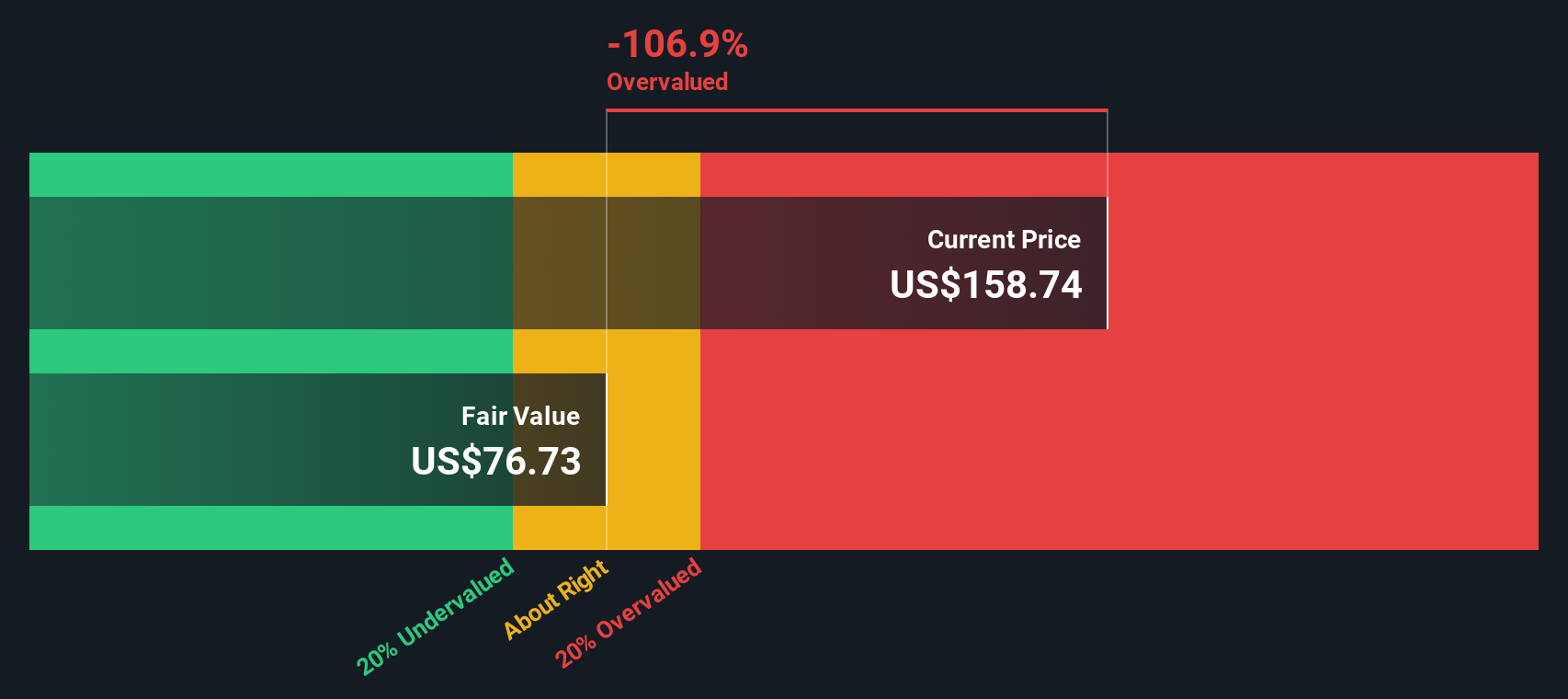

Based on these projections and a standard two-stage free cash flow to equity model, Palantir's estimated intrinsic value is calculated at $76.67 per share. When compared to its current market price, the DCF suggests the stock is 103.5% overvalued. In other words, Palantir is trading significantly above what its cash flows alone might justify.

Result: OVERVALUED

Approach 2: Palantir Technologies Price vs Book

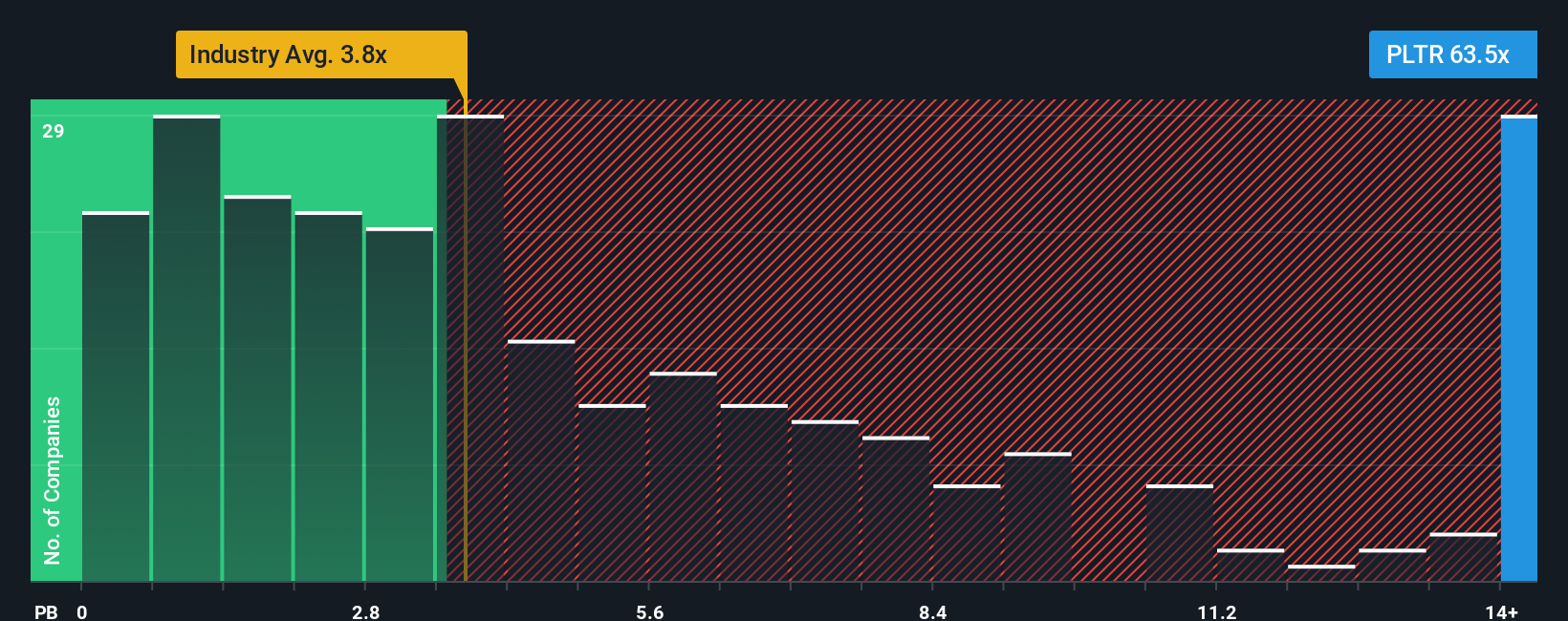

The price-to-book (P/B) ratio is a preferred valuation metric for profitable technology companies, as it offers a straightforward comparison of a company’s market value to its net assets. For mature and consistently profitable firms like Palantir, the P/B ratio can help investors gauge whether the stock price is justified by the underlying balance sheet strength.

Growth expectations and perceived risk play a significant role in what is considered a “normal” or “fair” P/B ratio. Companies with higher growth or lower perceived risk can command higher multiples compared to slower-growing, riskier peers. However, if the ratio climbs too high relative to fundamentals or industry averages, it may signal overvaluation.

Palantir’s current P/B stands at 62.42x. This is dramatically higher than the software industry average of 3.61x and its peer group average of 36.54x. Simply Wall St’s proprietary Fair Ratio incorporates factors such as Palantir’s earnings growth, profit margins, market cap, and sector dynamics to help assess whether this premium is reasonable. In Palantir’s case, its Fair Ratio is significantly below the actual P/B, which indicates that the stock is currently priced much higher than what these underlying fundamentals would justify.

Result: OVERVALUED

Upgrade Your Decision Making: Choose your Palantir Technologies Narrative

A Narrative is more than just a number or chart. It is the story you believe about a company’s future, shaped by your assumptions about factors such as revenue growth, margins, and valuation, and it is expressed through a personalized financial forecast and an estimated fair value.

Rather than relying only on static models or general analyst ratings, Narratives connect your unique perspective with concrete data, making investment decisions more transparent and empowering. Narratives are accessible and easy to create within the Simply Wall St platform, where millions of investors actively share and compare their views on fair value and future growth.

With Narratives, you can quickly see how your outlook compares to market sentiment by matching your fair value to the current share price, helping you decide if it is time to buy, hold, or sell. Narratives are updated automatically whenever new reports or important news emerge, ensuring your investment thesis always reflects the latest information.

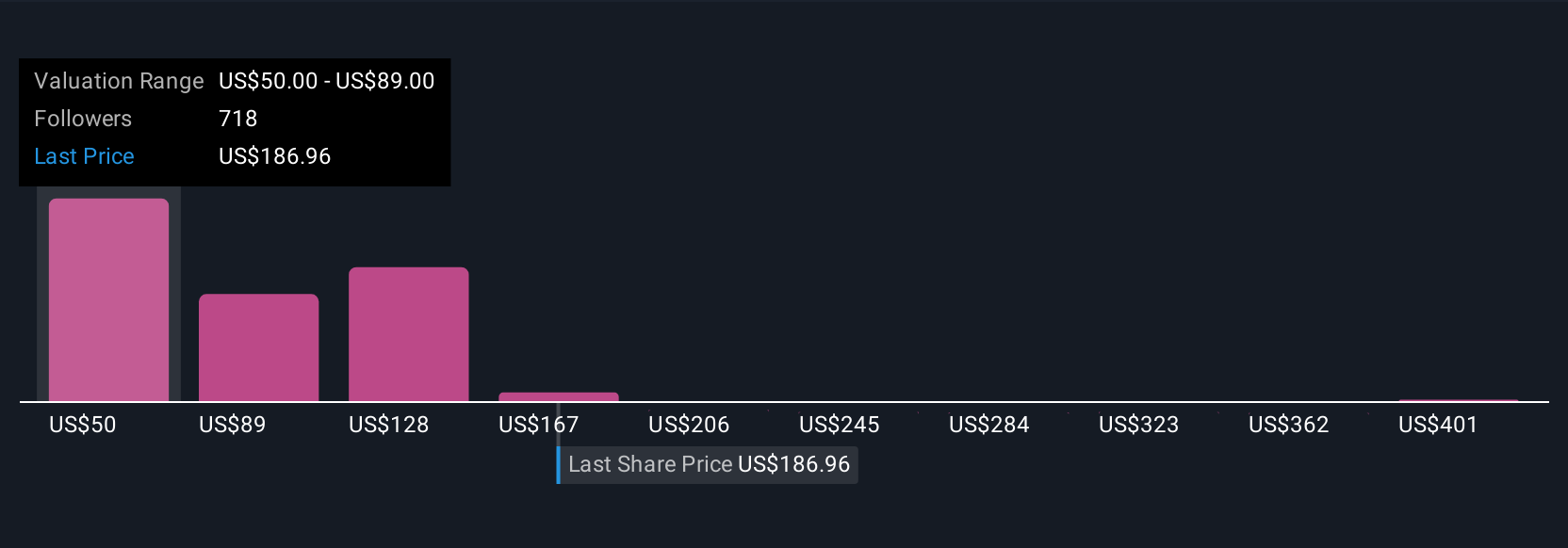

For example, some investors see Palantir’s fair value as low as $66, while others believe it could be worth up to $112. Your Narrative helps you make sense of these wide-ranging views and confidently chart your own path.

Do you think there's more to the story for Palantir Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives