- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (NasdaqGS:PLTR) Rises 33% As Q4 Sales Jump 36%

Reviewed by Simply Wall St

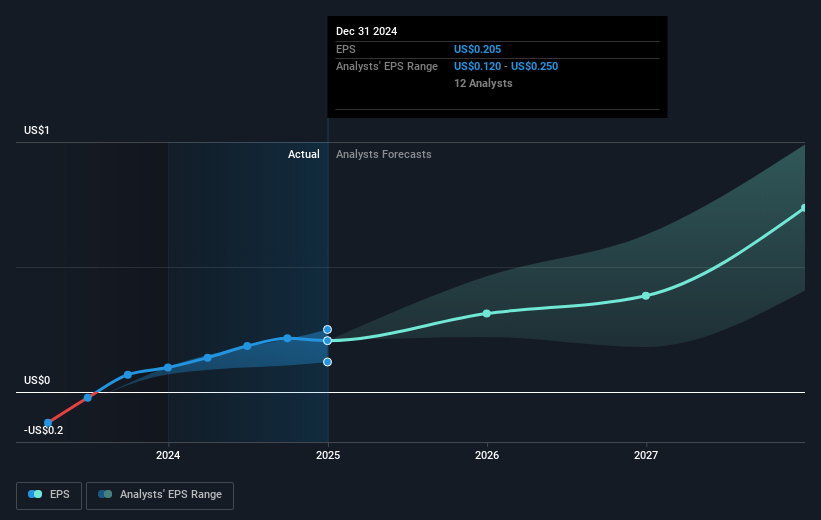

Palantir Technologies (NasdaqGS:PLTR) recently announced a strategic partnership with SAUR Group aimed at enhancing contract management, utilizing its Foundry AI capabilities to streamline compliance tracking. This collaboration is part of broader initiatives that may have influenced a 33% rise in the company’s stock during the last quarter. While Palantir's Q4 earnings showed substantial year-over-year sales growth by nearly 36%, net income declined, which might have tempered investor enthusiasm. Additionally, the company’s ongoing share buyback program, with 342,775 shares repurchased by December 2024, likely bolstered shareholder confidence. Within the tech sector, Palantir withstood market volatility alongside other tech stocks, even as the Nasdaq Composite registered a decline amid mixed economic signals and recent tariff announcements. Investors continue to focus on Palantir’s positioning within the defense and AI sectors, as indicated by its partnerships and recent NASDAQ-100 Index inclusion.

See the full analysis report here for a deeper understanding of Palantir Technologies.

Over the three-year period, Palantir Technologies' total shareholder return was an impressive and very large 687.57%. This exceptional growth far outpaced the broader market and the tech sector, underscoring the company's successful trajectory. Contributing to this performance were significant developments such as the multi-year partnership with the U.S. Army announced in February 2025, a US$400 million deal that focuses on enhancing operational capabilities. Additionally, Palantir's inclusion in the NASDAQ-100 Index in December 2024 greatly enhanced market visibility, which often plays a role in boosting investor confidence.

Furthermore, Palantir secured strategic alliances like the partnership with Tree Energy Solutions in July 2024 to support global decarbonization efforts. The firm's Q4 2024 earnings report also demonstrated substantial revenue increases, despite a slight 15.38% decline in net income from the previous year. These developments, coupled with an active share buyback program culminating in the repurchase of 342,775 shares by February 2025, positioned Palantir robustly within the industry.

- Learn how Palantir Technologies' intrinsic value compares to its market price with our detailed valuation report.

- Assess the potential risks impacting Palantir Technologies' growth trajectory—explore our risk evaluation report.

- Is Palantir Technologies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives