- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (NasdaqGS:PLTR) Partners With Societe Generale To Enhance Financial Crime Prevention

Reviewed by Simply Wall St

Palantir Technologies (NasdaqGS:PLTR) recently announced the deployment of its specialized technological solutions within Société Générale, focusing on anti-financial crime technologies for enhanced security in international retail banking. This significant collaboration likely influenced Palantir's share price increase of 21% over the last quarter. In addition to this partnership, Palantir's multi-year agreement with the SAUR Group and the extension of its contract with the U.S. Army may have bolstered investor confidence. Meanwhile, market trends showed fluctuations as major stock indexes wavered amid tariff concerns. Despite these challenges, Palantir's strong financial results, including increased quarterly sales and strategic buybacks, stood out in a market that experienced a 3% drop in recent days but gained 13% over the prior year. This combination of client successes, financial performance, and a volatile market environment may have contributed to the company's stock performance.

Navigate through the intricacies of Palantir Technologies with our comprehensive report here.

Over the past three years, Palantir Technologies has achieved a very large total return of 664.49% for its shareholders. This performance could be attributed to several key developments. Notably, Palantir's inclusion in the NASDAQ-100 Index in December 2024 helped elevate its profile among investors. Ongoing integration of AI across sectors, highlighted in early 2025, further underscores the company's commitment to innovation, potentially driving investor interest.

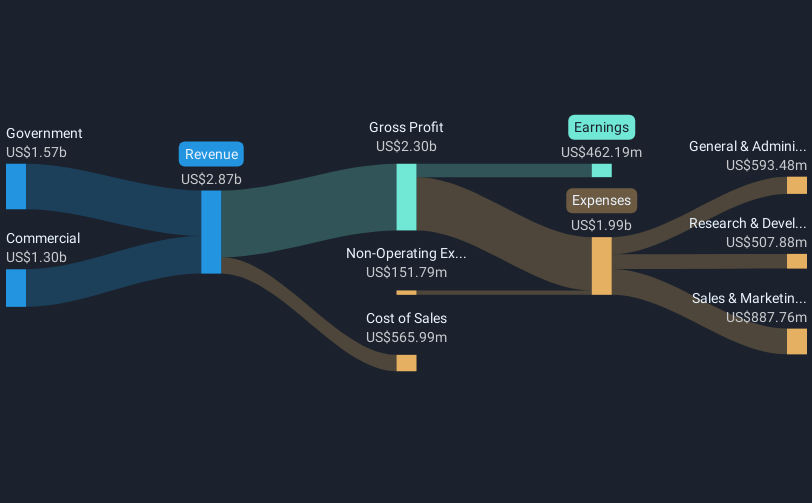

Additionally, strategic partnerships have been pivotal, with the company securing a multi-year contract with SAUR Group in February 2025, enhancing their client base and revenue streams. Financially, Palantir reported full-year sales for 2024 at $2.87 billion, up from $2.23 billion in 2023, reflecting robust growth. A substantial share buyback totaling 2.12 million shares for US$64.2 million since August 2023 suggests confidence in long-term value. These developments may have contributed significantly to Palantir's impressive shareholder returns over the period.

- See how Palantir Technologies measures up with our analysis of its intrinsic value versus market price.

- Understand the uncertainties surrounding Palantir Technologies' market positioning with our detailed risk analysis report.

- Is Palantir Technologies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.