- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (NasdaqGS:PLTR) Helps Anthropic Enter Government Sector With FedStart Integration

Reviewed by Simply Wall St

Palantir Technologies (NasdaqGS:PLTR) has recently announced a collaboration with Anthropic, aiming to enhance AI solutions' availability to the government sector, adhering to stringent security standards. This initiative coincides with the company's notable share price increase of 31% in the last quarter. Supporting this growth, Palantir's participation in multiple client partnerships and its inclusion in the S&P 100 index may have bolstered investor confidence. Despite a flat market performance over the past week, Palantir's active engagement in strategic projects and announcements seems to have positively influenced its stock performance more broadly during a period of market growth.

Over the past three years, Palantir Technologies has significantly outperformed, achieving a very large total shareholder return of 660.58%. In contrast, over the past year, the company's return exceeded both the US Software industry, which had a 0.1% decline, and the broader US market, which returned 5.7%. This impressive longer-term performance highlights Palantir's strong market appeal and successful initiatives.

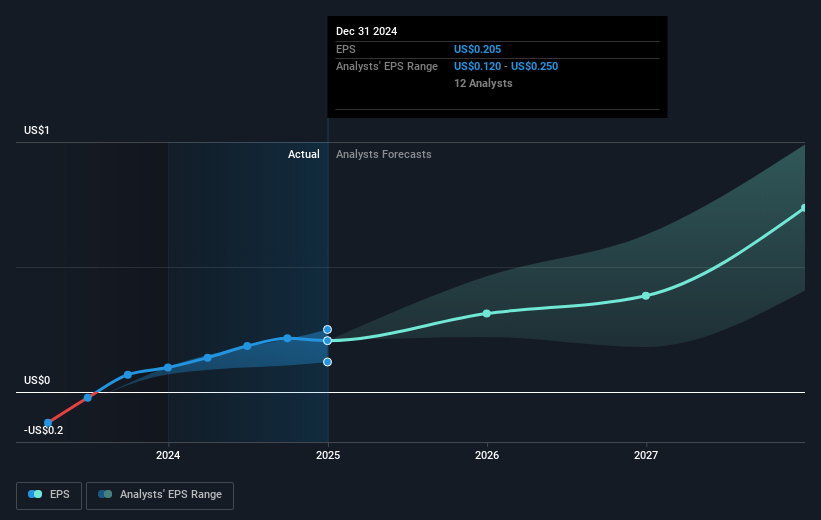

The recent share price increase of 31% within the last quarter may reflect enhanced investor confidence stemming from Palantir's active collaborations and strategic initiatives, such as its partnership with Anthropic. Analysts' consensus price target of US$87.05 indicates a potential valuation discrepancy, given the current share trading levels. In light of Palantir's revenue of US$2.87 billion and net earnings, ongoing strategic partnerships and entry into the S&P 100 index could further bolster revenue and earnings projections. These developments suggest robust mechanisms to support future financial growth, possibly driving the realization of forecasted financial performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives