- United States

- /

- Software

- /

- NasdaqGS:PLTR

Can Palantir Justify Its Soaring Share Price After Army Communications Flaw Revealed?

Reviewed by Bailey Pemberton

If you have been watching Palantir Technologies’ meteoric stock journey, you are definitely not alone. Whether you already own shares, are debating whether to jump in, or considering taking profits after a jaw-dropping run, it is natural to feel a little dazed by all the action. Palantir’s stock has delivered a whopping 135.7% surge since the start of the year and is up an astonishing 308.3% over the past twelve months. In fact, long-term holders have seen gains as high as 2,131.9% over three years and 1,751.7% across five years. Clearly, something big has been shifting.

Of course, a main driver for Palantir lately has been both its high-profile government contracts and the intense media attention that comes with them. Recent volatility, like last week’s slip of -1.3% and this month’s 3.4% bounce, has often coincided with headlines about security concerns in projects with the Army, balanced by reassurances from management that those issues are resolved. Broader defense and tech sector moves have also played a role as partnerships and competition with Big Tech firms grab investor attention.

Now, with all this price movement, the big question for investors is whether Palantir is still a buy at these levels. If you are looking at the company’s value score, it currently sits at 0 out of 6, meaning it is not considered undervalued by any of the standard valuation checks we apply. But is that the full picture? Next, we will break down the major valuation approaches, and at the end, we will dive into a perspective that might offer even more insight.

Palantir Technologies scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

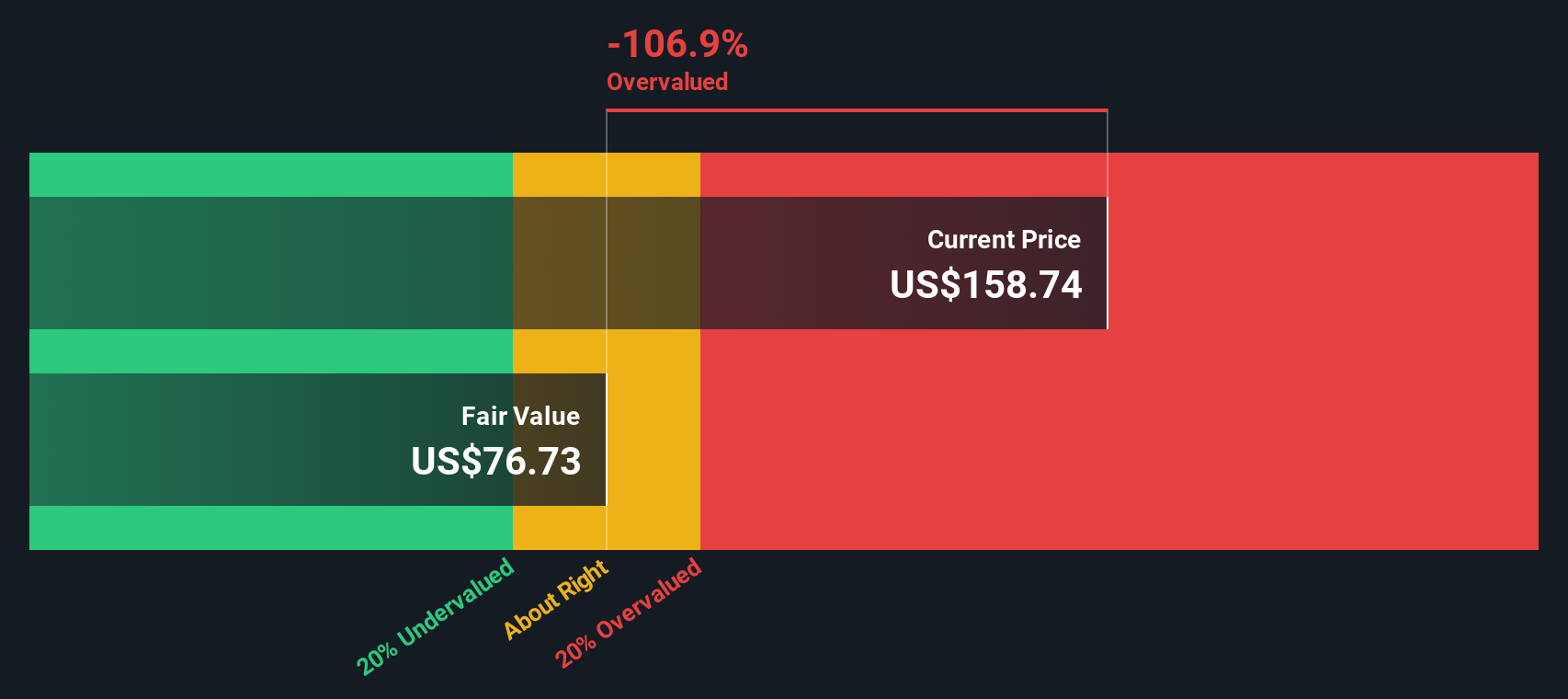

Approach 1: Palantir Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to their present value. This process helps investors judge what the business is truly worth today, based on its ability to generate cash in the years ahead.

For Palantir Technologies, the process starts with last year’s Free Cash Flow (FCF), which reached $1.70 billion. Analyst estimates are available through 2029, projecting FCF to expand to $7.28 billion in that year. Beyond 2029, Simply Wall St applies its own extrapolated growth rates and forecasts figures as high as $14.79 billion by 2035.

After running these projections through a two-stage DCF model, Palantir’s estimated fair value lands at $76.31 per share. However, with the current market price now 132.2% above this intrinsic value, the DCF suggests the stock is significantly overvalued at today’s levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Palantir Technologies may be overvalued by 132.2%. Find undervalued stocks or create your own screener to find better value opportunities.

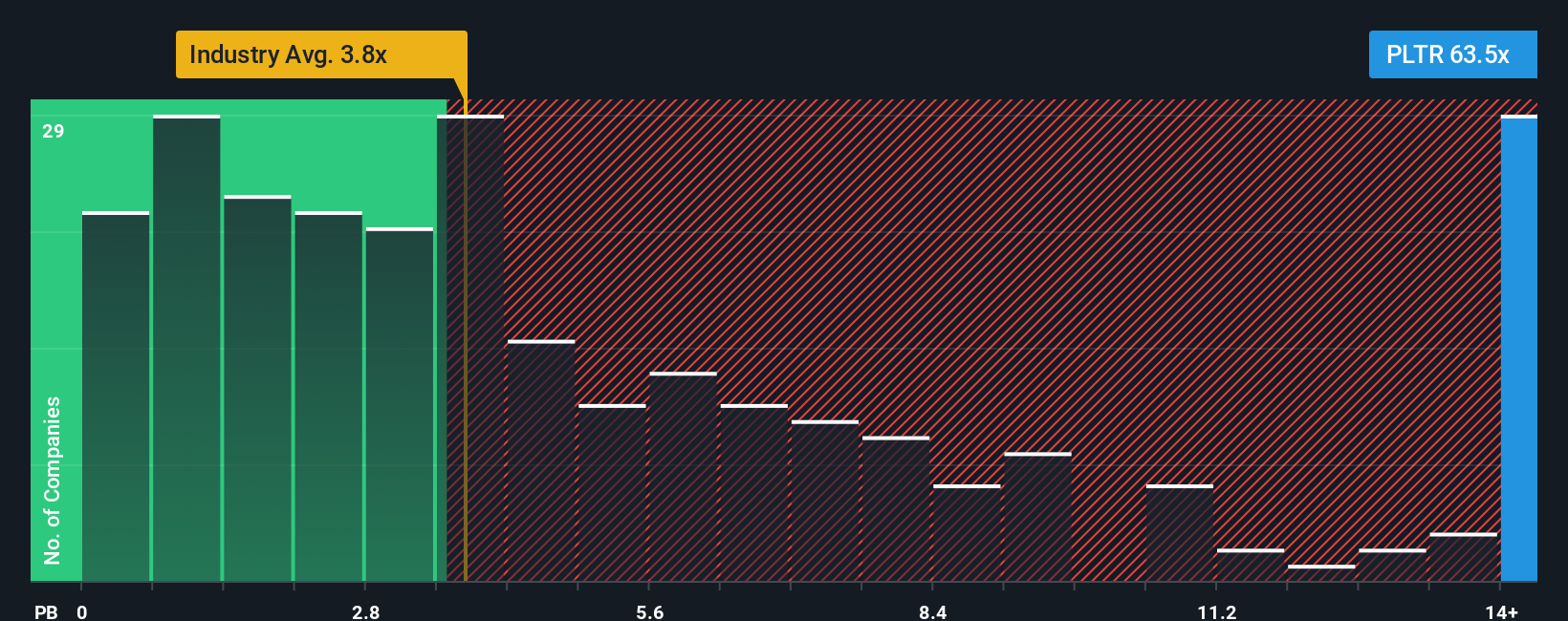

Approach 2: Palantir Technologies Price vs Book (P/B)

The Price-to-Book (P/B) ratio is often used to value companies that are profitable and asset-heavy. It serves as a meaningful gauge for understanding how the market values Palantir’s net assets. While earnings can fluctuate from year to year, the book value tends to provide a more stable metric, especially for software firms that hold substantial intellectual property and operational assets.

What makes a “normal” or “fair” P/B ratio varies with growth expectations and perceived risk. Companies with stronger growth prospects or lower risk profiles tend to warrant a higher P/B because investors are willing to pay more for each dollar of net assets. Conversely, higher risk or lower growth leads to a lower fair multiple.

Currently, Palantir trades at a P/B ratio of 70.9x. This is far above the software industry average of 3.8x and also well above the peer average of 49.1x. For further perspective, Simply Wall St uses a proprietary “Fair Ratio” model. This model refines a fair multiple for Palantir based on its unique earnings growth, profit margins, market cap, and risk factors. It provides a more nuanced benchmark compared to just comparing industry or peers, as it incorporates the company’s specific growth trajectory, associated risks, and sector context.

Comparing Palantir’s current P/B to this Fair Ratio suggests the stock is priced considerably above what might be justified by its financial reality and future expectations.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

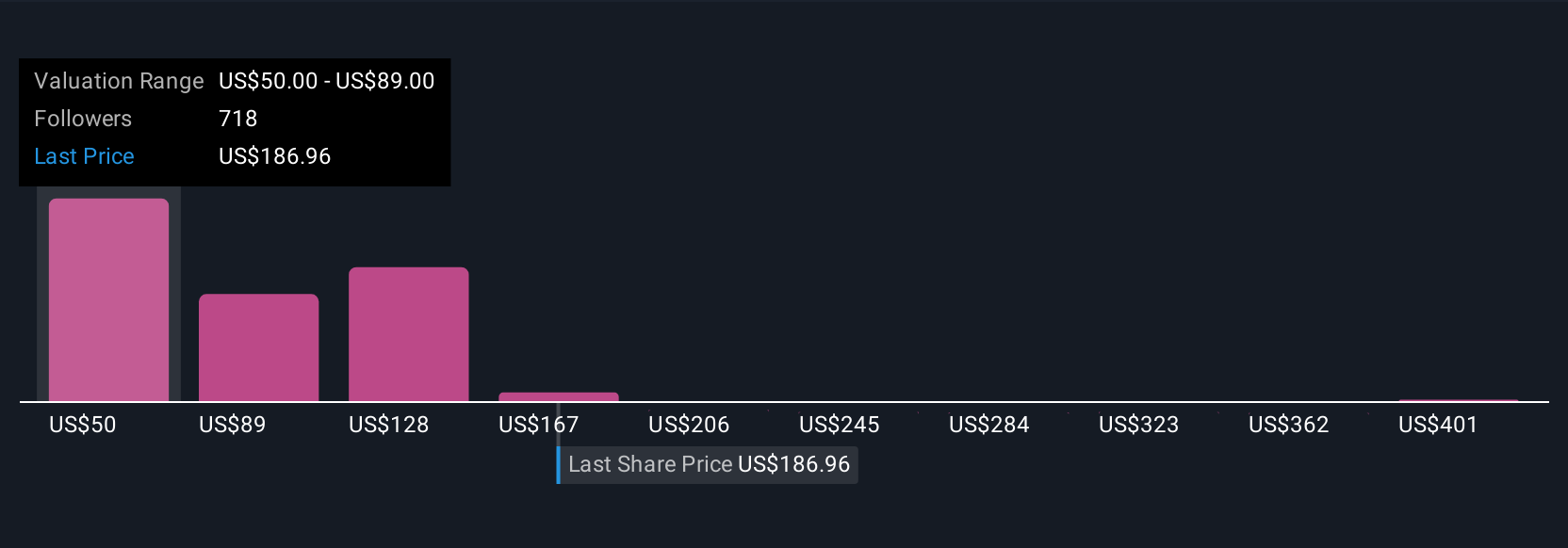

Upgrade Your Decision Making: Choose your Palantir Technologies Narrative

Earlier, we mentioned there is a better way to approach valuation. Let us introduce you to Narratives. A Narrative is your investment story: it is the perspective and reasoning behind your assumptions of a company’s future revenue, profit margins, and fair value, brought to life with your own forecasts and logic rather than just the numbers alone.

Narratives bridge the gap between a company’s story and the financial model. They connect your personal view of what Palantir might achieve, based on trends, product launches, or risks, to an actual fair value estimate. On Simply Wall St’s Community page, Narratives have made advanced analysis accessible to millions, allowing users to quickly create, edit, and update their own perspectives when new information, such as news or earnings, becomes available.

By comparing the Fair Value from your Narrative to the current market price, you can judge at a glance whether Palantir is a buy, hold, or sell according to your conviction, not someone else’s checklist. And because Narratives are dynamically updated as company events unfold, you can always see at a glance if your underlying thesis is still on track or needs a rethink.

- For example, some investors see Palantir’s fair value as high as $112, while others are more conservative, with fair value closer to $66. Your Narrative reflects your strategy.

Do you think there's more to the story for Palantir Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion