- United States

- /

- Software

- /

- NasdaqCM:PGY

Why Pagaya Technologies (PGY) Is Up 35.2% After Upbeat Q2 2025 Revenue and Profit Guidance And What's Next

Reviewed by Simply Wall St

- Pagaya Technologies recently released its financial guidance for the second quarter ended June 30, 2025, projecting total revenue between US$290 million and US$310 million with GAAP net income expected to range from US$0 to US$10 million.

- This update offers early insight into management’s expectations for both top-line growth and a potential swing to profitability over the reported period.

- We'll explore how management's preliminary revenue and net income guidance could influence Pagaya Technologies' investment outlook and strategic direction.

Find companies with promising cash flow potential yet trading below their fair value.

Pagaya Technologies Investment Narrative Recap

To be a shareholder in Pagaya Technologies, you need to believe in the company's ability to consistently scale its AI-driven lending platform, capture untapped partner growth, and navigate funding volatility in the asset-backed securities market. The recent Q2 guidance, which suggests management is expecting steady revenue and a potential swing to profitability, does not materially change the most important short-term catalyst: expanding network volume from new and existing partners. The core risk remains exposure to fluctuations in ABS investor demand, which can directly impact funding costs and growth plans.

One recent announcement most relevant to the Q2 outlook is the May launch of POSH, Pagaya’s new asset-backed revolving securitization platform targeting the point-of-sale financing segment. This move broadens revenue opportunities and could contribute to more diversified, stable funding as the company continues seeking alternative capital sources to support partner growth, a direct response to the key catalyst of platform expansion and a partial hedge against concentration risk.

Yet, while guidance signals optimism, investors should not overlook the risk that even with product expansion, Pagaya remains vulnerable if ABS market conditions suddenly shift and...

Read the full narrative on Pagaya Technologies (it's free!)

Pagaya Technologies' outlook anticipates $1.7 billion in revenue and $240.4 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 16.3% and a $613.2 million increase in earnings from the current level of -$372.8 million.

Exploring Other Perspectives

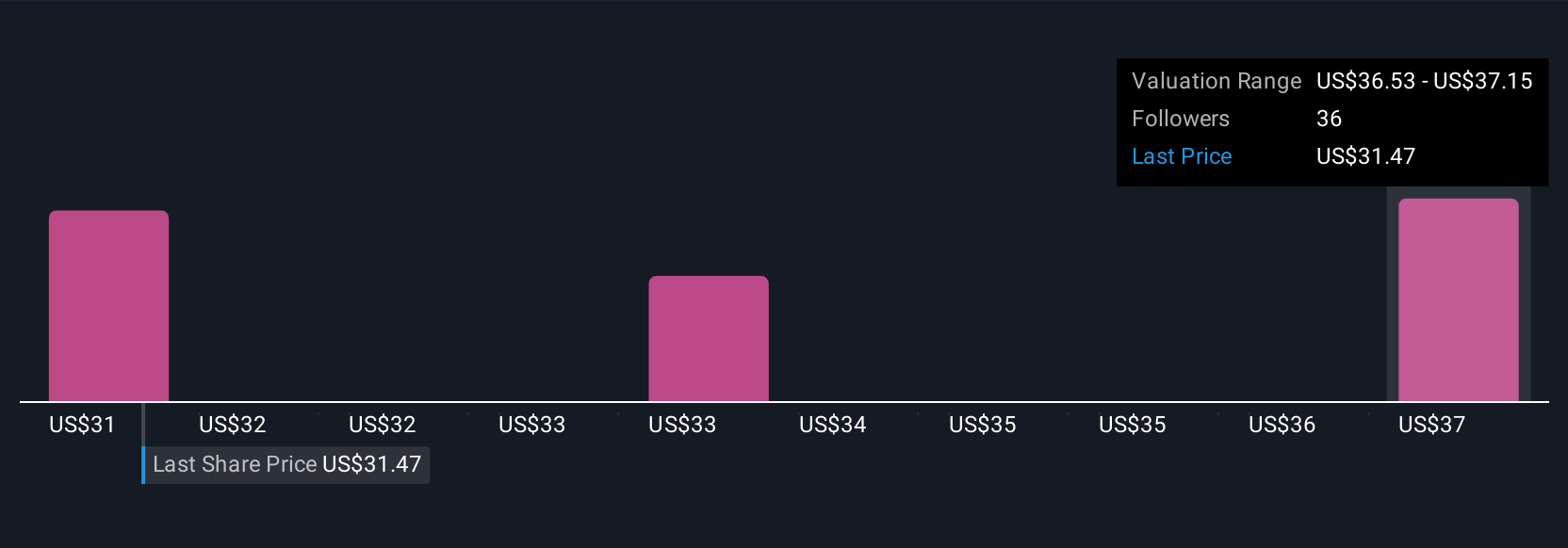

Fair value estimates from the Simply Wall St Community span US$24.03 to US$36.55 based on three separate analyses. Against this diversity of opinion, remember that Pagaya’s reliance on ABS securitization means sudden market shifts could reshape both growth and risk profiles, explore these viewpoints to challenge your own assumptions.

Build Your Own Pagaya Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pagaya Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pagaya Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pagaya Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial services and other service providers, their customers, and asset investors in the United States, Israel, and the Cayman Islands.

High growth potential and good value.

Market Insights

Community Narratives