Key Takeaways

- AI-enhanced products, network effects, and diversified asset classes support sustained revenue growth and improved margins amid ongoing digital transformation in the lending sector.

- Regulatory focus on fair lending favors compliant, explainable AI models, strengthening adoption, recurring revenue, and resilience to potential regulatory disruptions.

- Reliance on volatile ABS markets, regulatory scrutiny, client concentration, AI model risks, and rising competition threaten growth, revenue stability, and margin sustainability.

Catalysts

About Pagaya Technologies- A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial services and other service providers, their customers, and asset investors in the United States, Israel, and the Cayman Islands.

- Pagaya's investments in AI-powered prescreen and marketing acquisition products are unlocking significant expansion in lending partner adoption and customer reach, positioning the company to capture a vastly underpenetrated TAM (with current market penetration at just 3% of eligible customers), which underpins strong, sustainable revenue growth as these products scale in the next 12–18 months.

- Ongoing digital transformation in lending and the rise of non-traditional channels (fintechs, neobanks) are increasingly driving demand for Pagaya's frictionless, data-driven underwriting solutions; as more institutions seek to digitize origination and approval, Pagaya's expanding product suite and integration with 31+ partners position it for accelerating fee-based revenue and volume growth.

- Expansion into new asset classes (auto loans, POS lending) and geographies is already broadening and diversifying Pagaya's revenue streams, while auto and POS verticals are now approaching or exceeding personal loan margins; this multi-vertical momentum is likely to drive top-line growth and mitigate concentration risks going forward.

- Strengthening network effects from a growing base of lenders and funding partners are enhancing Pagaya's model performance through richer datasets, increasing underwriting accuracy and lowering acquisition costs, which supports continued margin expansion via operational leverage.

- Increasing regulatory emphasis on fair lending and transparency is prompting more lenders to adopt externally validated, sophisticated AI models-Pagaya's focus on compliance and explainability differentiates its solution, supporting recurring partner revenue and reducing the risk of disruptive regulatory headwinds to earnings.

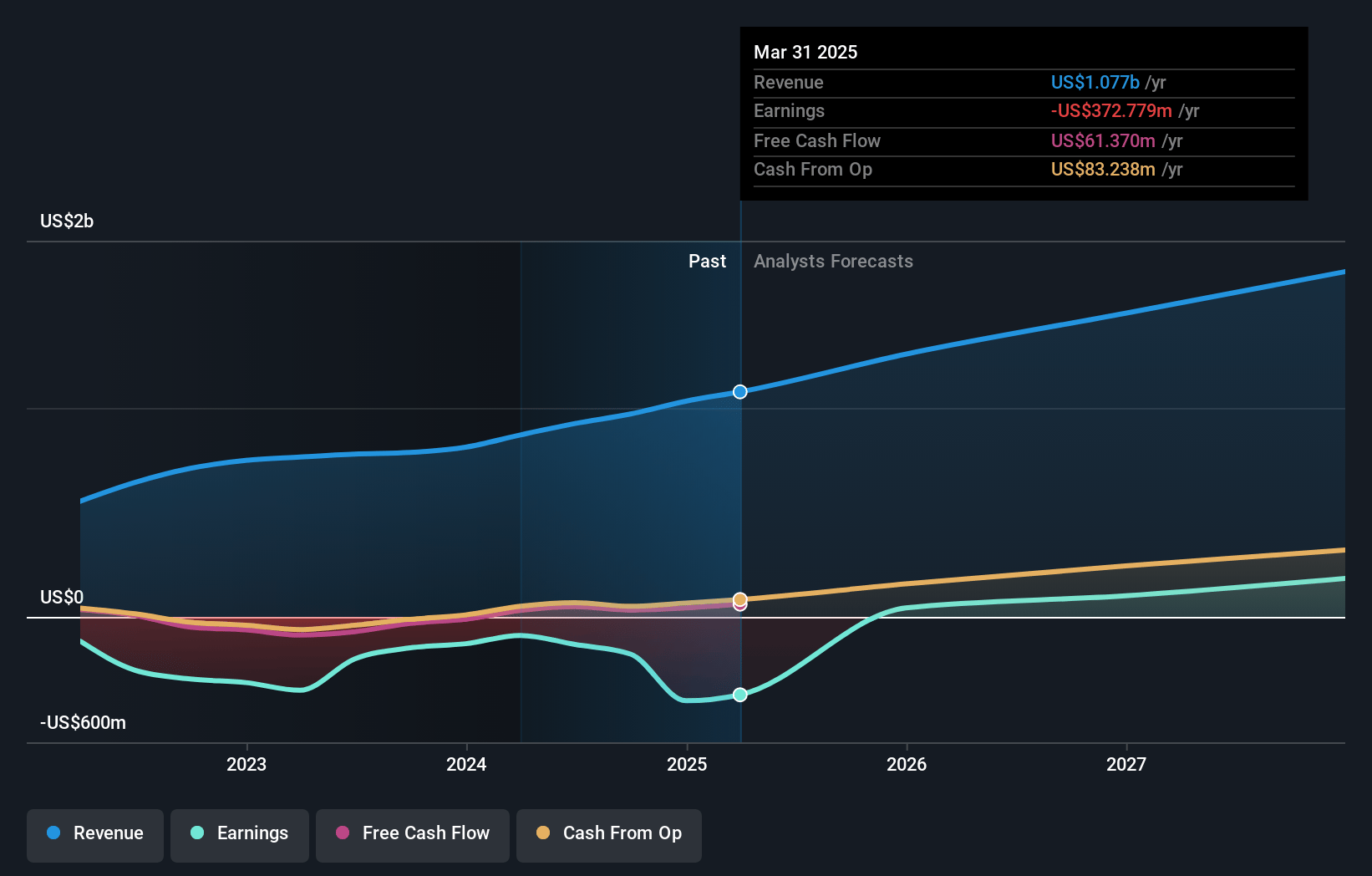

Pagaya Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pagaya Technologies's revenue will grow by 16.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from -34.6% today to 14.2% in 3 years time.

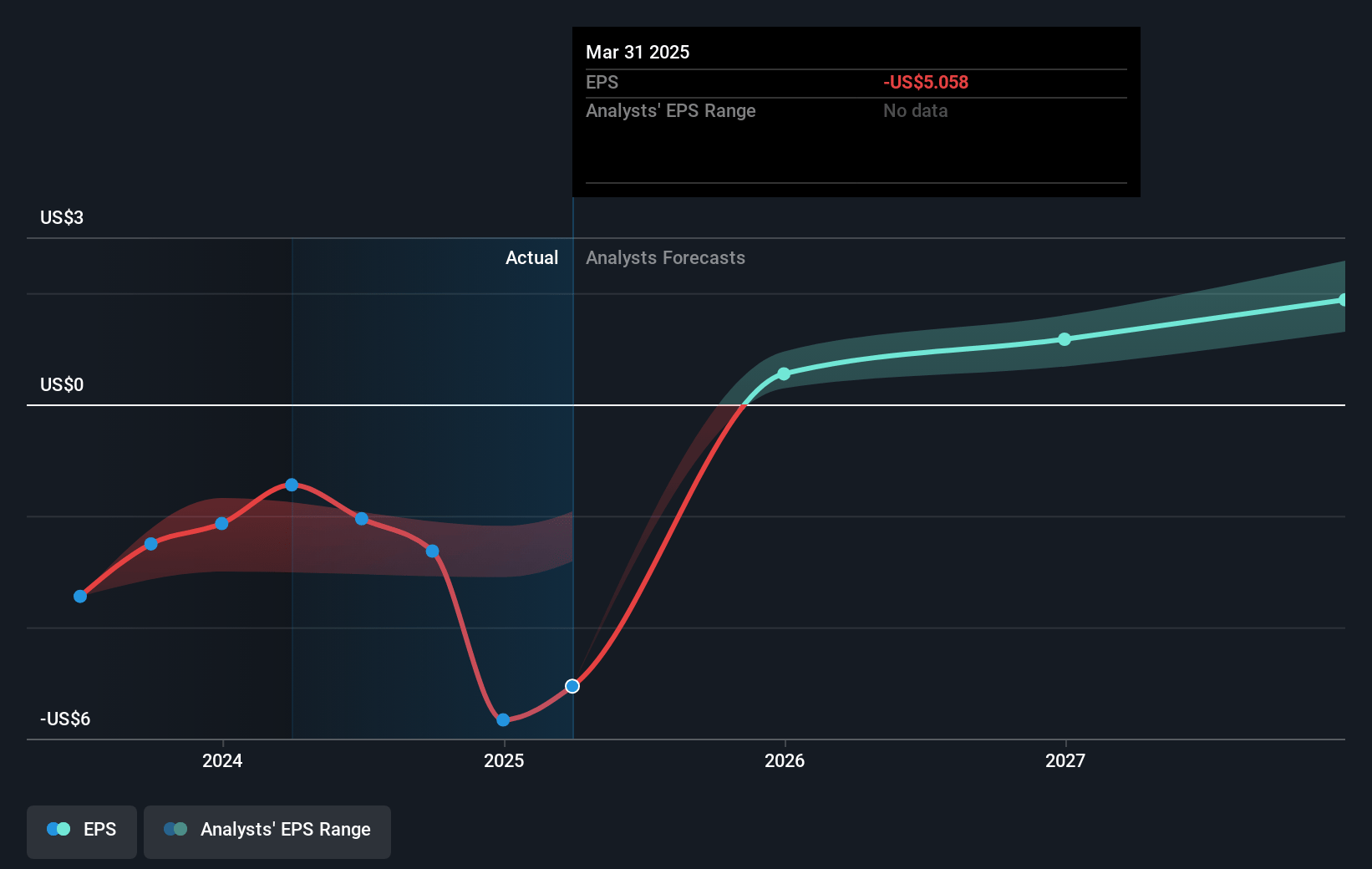

- Analysts expect earnings to reach $240.4 million (and earnings per share of $1.5) by about July 2028, up from $-372.8 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.4x on those 2028 earnings, up from -4.8x today. This future PE is lower than the current PE for the US Software industry at 43.1x.

- Analysts expect the number of shares outstanding to grow by 5.42% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.93%, as per the Simply Wall St company report.

Pagaya Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Dependence on ABS securitization markets and investor appetite-even with improved funding diversification, Pagaya remains reliant on its ability to package and sell loans into volatile asset-backed securities markets; any sustained dislocation or tightening in ABS demand could increase funding costs, restrict growth, and introduce earnings volatility.

- Intensifying regulatory scrutiny over AI-driven lending and data privacy-growing policy emphasis on AI explainability and data transparency could lead to higher compliance costs, forced model changes, or litigation risk, compressing net margins and threatening differentiation.

- Heavy client concentration with key bank and lending partners-although partner count is growing, a significant portion of volume and revenue is concentrated, making Pagaya vulnerable if major partners switch to in-house AI solutions, end partnerships, or seek better terms, leading to sudden revenue loss and earnings pressure.

- AI model degradation and risk of data drift-Pagaya's underwriting and growth depend on the predictive power of its AI credit models; as economic conditions change or data drifts, there is long-term risk that credit losses may spike, damaging reputation, reducing future revenue, and increasing capital needs to cover loan impairments.

- Increasing competition from both fintech and incumbent banks-expanding adoption of in-house or third-party AI underwriting by traditional lenders or aggressive fintech entrants could erode Pagaya's differentiation, push down pricing, and limit the company's ability to grow revenue and maintain FRLPC margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.025 for Pagaya Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $36.0, and the most bearish reporting a price target of just $13.75.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.7 billion, earnings will come to $240.4 million, and it would be trading on a PE ratio of 11.4x, assuming you use a discount rate of 8.9%.

- Given the current share price of $23.49, the analyst price target of $24.02 is 2.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.