- United States

- /

- Software

- /

- NasdaqCM:PGY

Positive Sentiment Still Eludes Pagaya Technologies Ltd. (NASDAQ:PGY) Following 29% Share Price Slump

The Pagaya Technologies Ltd. (NASDAQ:PGY) share price has softened a substantial 29% over the previous 30 days, handing back much of the gains the stock has made lately. The good news is that in the last year, the stock has shone bright like a diamond, gaining 153%.

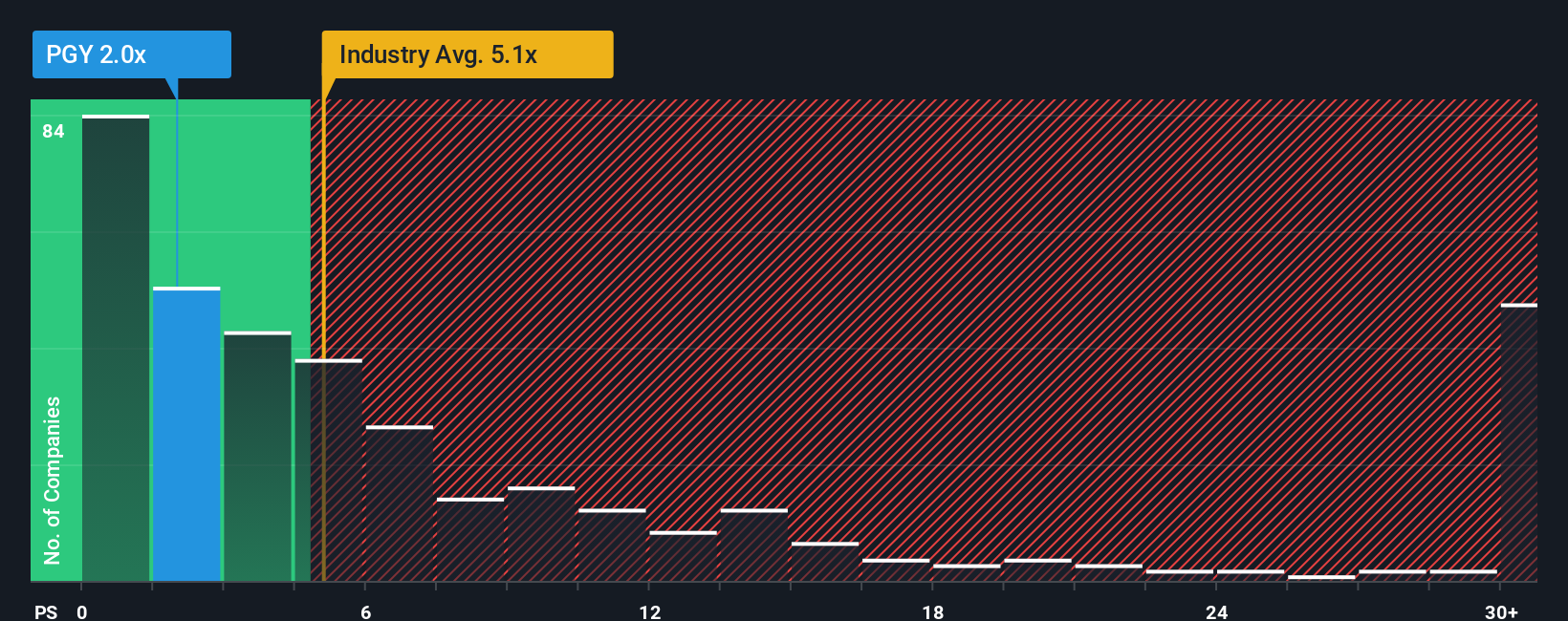

After such a large drop in price, Pagaya Technologies' price-to-sales (or "P/S") ratio of 2x might make it look like a strong buy right now compared to the wider Software industry in the United States, where around half of the companies have P/S ratios above 5.1x and even P/S above 14x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Pagaya Technologies

How Pagaya Technologies Has Been Performing

Pagaya Technologies certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Pagaya Technologies will help you uncover what's on the horizon.How Is Pagaya Technologies' Revenue Growth Trending?

In order to justify its P/S ratio, Pagaya Technologies would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Pleasingly, revenue has also lifted 79% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 22% during the coming year according to the nine analysts following the company. That's shaping up to be similar to the 22% growth forecast for the broader industry.

With this information, we find it odd that Pagaya Technologies is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Pagaya Technologies' P/S Mean For Investors?

Pagaya Technologies' P/S looks about as weak as its stock price lately. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Pagaya Technologies' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Pagaya Technologies that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial services and other service providers, their customers, and asset investors in the United States, Israel, and the Cayman Islands.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.