- United States

- /

- Software

- /

- NasdaqCM:PGY

Assessing Pagaya After 200% Surge and Latest Fintech Partnership News

Reviewed by Bailey Pemberton

If you’re looking at Pagaya Technologies and thinking, "Did I miss the boat, or is there more to come?" you’re not alone. The stock has definitely kept investors guessing, especially with such a wild ride over the past year. Despite taking a breather recently, with shares down 6.6% this week and off about 20.4% over the past month, Pagaya is still up an astonishing 207.9% year-to-date and 191.5% across the last twelve months. Even zooming out further, the three-year climb stands at 68.1%, pointing to some serious long-term momentum.

Some of these big moves have lined up with broader trends in fintech: investor optimism around expanding partnerships, positive sentiment toward AI-powered financial networks, and a general re-rating of growth stocks as market risk appetite has shifted. It’s clear the market is recalibrating how it values Pagaya, sometimes in a hurry.

So, is the current dip a risk to avoid, or an opportunity hiding in plain sight? That’s where valuation steps in. When we put Pagaya through our standard set of valuation checks, it scored a strong 5 out of 6, suggesting the stock is undervalued by most traditional metrics. Before you make up your mind, let’s dig into how these valuation methods apply to Pagaya specifically. And for those wanting the full picture, stick around until the end as we highlight an even more insightful way to judge where value really lies.

Approach 1: Pagaya Technologies Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by estimating a company’s future cash flows and then discounting them back to today’s value. This offers a way to understand what those future profits are really worth in current dollars. Essentially, it is an effort to put a fair value on a business based on its ability to generate cash going forward.

For Pagaya Technologies, the most recent Free Cash Flow (FCF) stands at $104.6 Million. Looking ahead, projections show robust growth. Analysts and extrapolations forecast FCF rising to around $632.8 Million by 2035. While only the earliest years are based on analyst expectations, later forecasts still suggest a steady upward trend. Over the next decade, FCF expansion is estimated to run at double-digit rates most years, indicating confidence in ongoing business momentum.

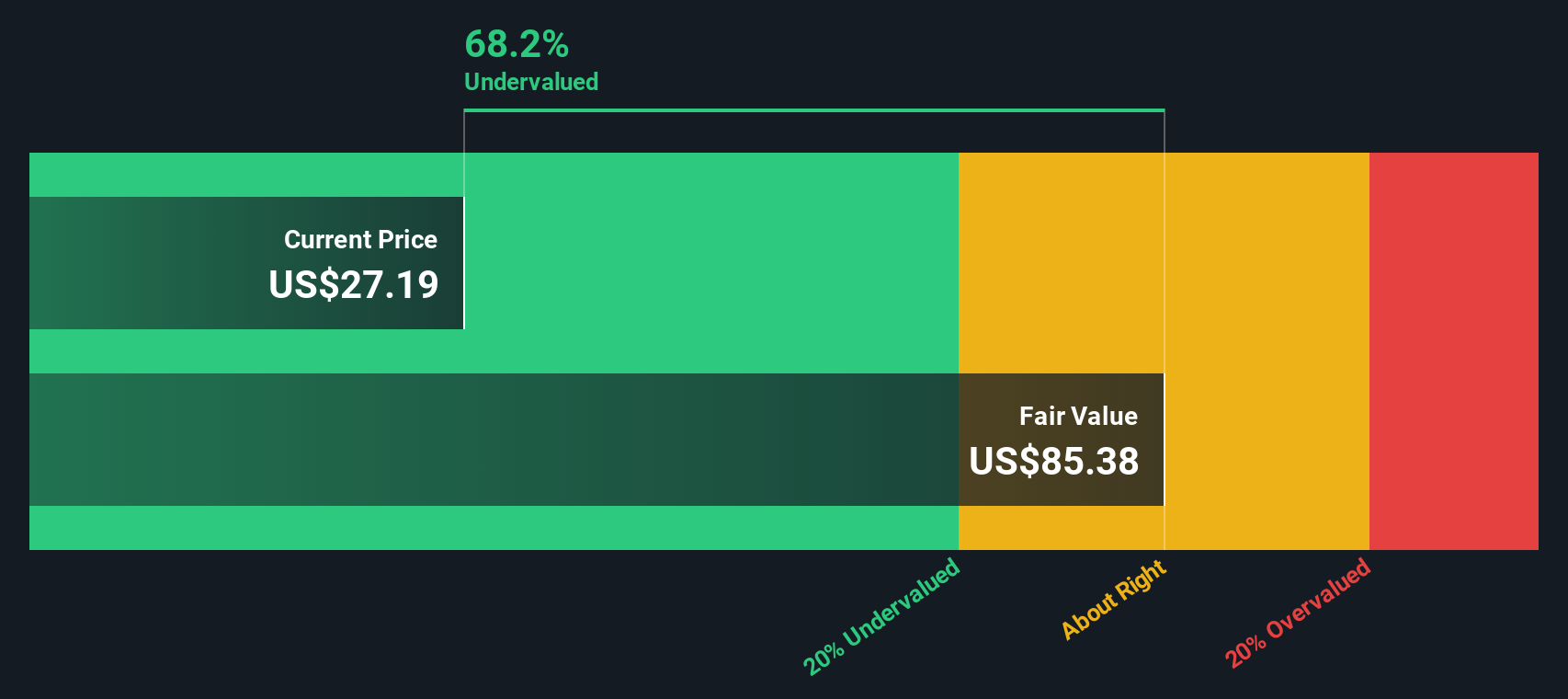

Based on these future FCFs, Simply Wall St’s DCF analysis arrives at an intrinsic value of $86.22 per share. Compared to Pagaya’s current market price, this valuation implies the stock is trading at around a 65.6% discount. This suggests a significant undervaluation by traditional fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pagaya Technologies is undervalued by 65.6%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Pagaya Technologies Price vs Sales

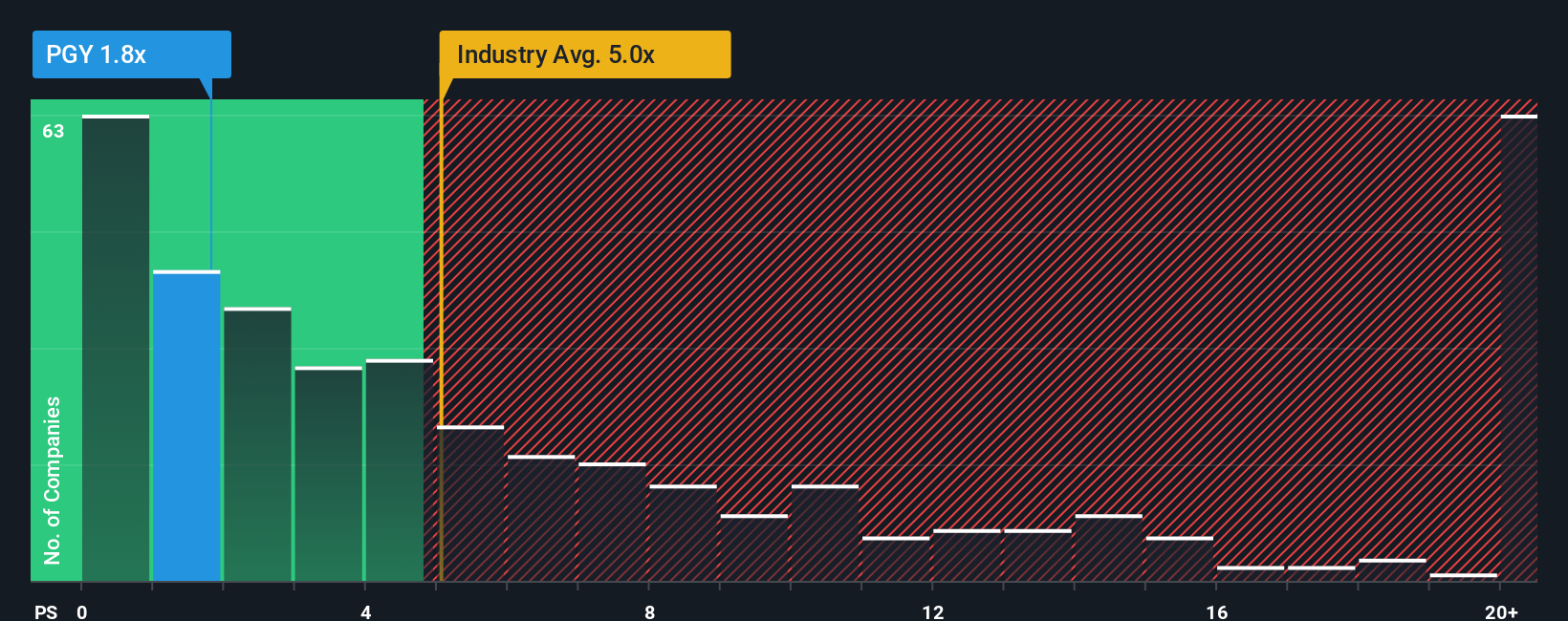

The Price-to-Sales (P/S) ratio is a go-to valuation tool for companies like Pagaya Technologies, especially when profitability is volatile or earnings are negative. Because revenue tends to be less prone to accounting differences and short-term swings than earnings, the P/S multiple offers a cleaner look at how the market is valuing every dollar of Pagaya’s sales.

Typically, a higher P/S ratio is justified for companies with strong growth prospects and low risk, while slower growers or businesses facing big headwinds tend to command lower multiples. The “right” multiple depends on how investors view the company’s future potential and the risks involved, both relative to its peers and the broader software industry.

Right now, Pagaya trades at a P/S ratio of 1.97x. To put this in context, the average for its peers is 7.07x, while the software industry overall sits at 5.28x. However, Simply Wall St introduces the idea of a “Fair Ratio,” in Pagaya’s case calculated at 3.69x. Unlike simple comparisons, the Fair Ratio is built uniquely from Pagaya’s growth outlook, profit margin, size, and risk profile, giving a more nuanced sense of what would be reasonable for the company right now.

While Pagaya’s current P/S is well below both peer and industry benchmarks, it is also noticeably lower than the company’s Fair Ratio of 3.69x, suggesting that the stock is undervalued by this measure as well.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pagaya Technologies Narrative

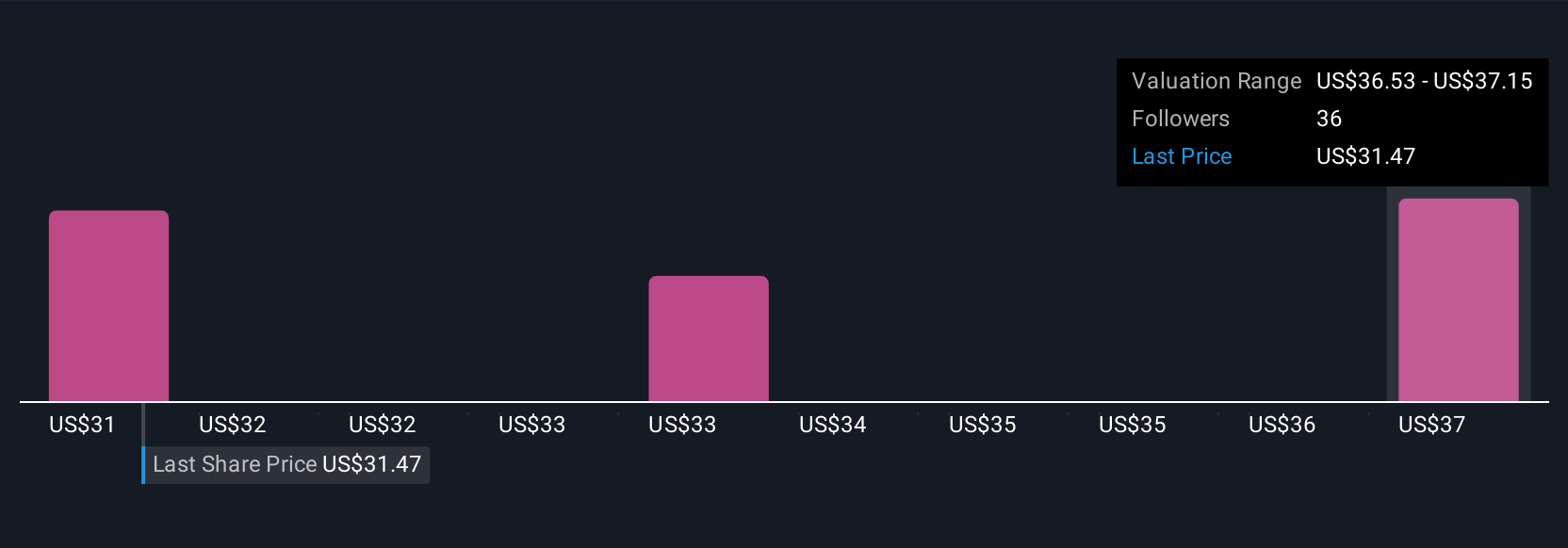

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique perspective on a company, where you connect your story—your outlook on its future growth, products, and risks—to the numbers, including assumptions about future revenue, earnings, margins, and ultimately, fair value.

Rather than just crunching numbers, Narratives tie together the company's real-world story with a financial forecast, so you can see exactly how your beliefs and expectations translate into a share price target. With Simply Wall St, Narratives are easy to create and update right on the Community page, making this tool accessible to millions of investors worldwide.

By comparing the Fair Value from your Narrative to Pagaya Technologies’ current price, you can make smarter decisions about when to buy, hold, or sell. Even better, Narratives update dynamically as new news and results come in, keeping your investment thesis always up to date.

For Pagaya Technologies, for example, some investors are very bullish and see a fair value of $54.00 based on fast-growing AI finance adoption, while others are more cautious, setting their fair value at $27.00 to account for competition and regulatory risks. This shows how Narratives let you personalize your investment approach.

Do you think there's more to the story for Pagaya Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial services and other service providers, their customers, and asset investors in the United States, Israel, and the Cayman Islands.

Undervalued with high growth potential.

Market Insights

Community Narratives