- United States

- /

- Software

- /

- NasdaqGS:PANW

What's the Real Value of Palo Alto Networks After Its Latest AI Security Push?

Reviewed by Bailey Pemberton

Thinking about Palo Alto Networks as your next move? You’re not alone. This stock has been on many radars, and for good reason. With cybersecurity spending in focus and a broader market that’s been anything but quiet, Palo Alto Networks has delivered both consistency and surprise. Over the last week, the stock was up 0.7%, and it has gained 6.2% in the past month alone. While the pace isn’t always breakneck, the year-to-date return stands at a solid 15.4%. If you zoom out further, the story gets even more impressive: 407.9% higher over the last five years.

Recent price momentum has been tied, in part, to growing global attention on cybersecurity needs, as high-profile breaches and geopolitical tensions keep security solutions in the spotlight. Investors seem to be recalibrating what “risk” really means in this sector, giving Palo Alto Networks some lift as a perceived safe harbor in tech. But not everything points straight up. The valuation picture is trickier to decode. On a commonly used value scoring system, Palo Alto Networks only notches a 1 out of 6 for being undervalued. That means it clears just one major hurdle for bargain hunters, suggesting there’s more work to do before calling this a “cheap” buy.

So what’s really going on under the hood? Next, we’ll dive into the different ways experts try to measure value for Palo Alto Networks, and stick around, because there’s an even better perspective on valuation worth considering at the end.

Palo Alto Networks scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Palo Alto Networks Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and then discounting those amounts back to their value in today's dollars. It is a favored tool for long-term investors because it attempts to capture the real earning power of the business.

For Palo Alto Networks, the current Free Cash Flow stands at approximately $3.5 billion. Analysts expect this figure to grow meaningfully each year, with free cash flow projected to reach $8.3 billion by 2030. It is important to note that while analysts directly estimate up to five years ahead, projections beyond that are extrapolated based on realistic assumptions.

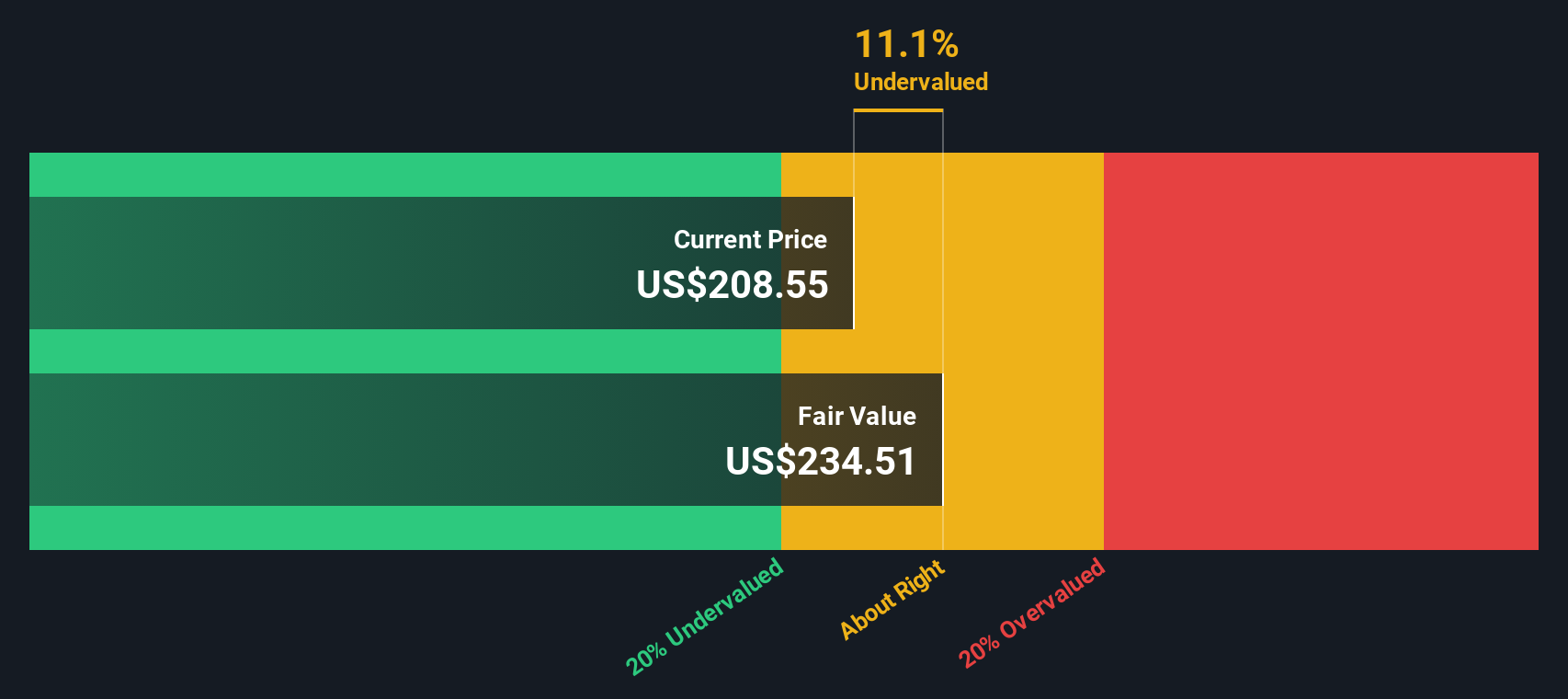

Using this forward-looking approach, the DCF model calculates an estimated intrinsic value of $235.28 per share. With the stock currently trading at about an 11.4% discount according to this model, Palo Alto Networks appears to be undervalued relative to its future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Palo Alto Networks is undervalued by 11.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Palo Alto Networks Price vs Earnings

For profitable tech companies like Palo Alto Networks, the price-to-earnings (PE) ratio is a widely used method of valuation. The PE ratio gives investors a quick way to measure how much they are paying for each dollar of earnings. This makes it especially relevant for companies with positive and consistent profits.

Growth expectations and perceived risk play a big role in what counts as a “normal” or “fair” PE. If investors expect higher future growth, they are often willing to pay up and accept a higher PE. On the other hand, significant risks or slower growth trends usually call for a lower multiple.

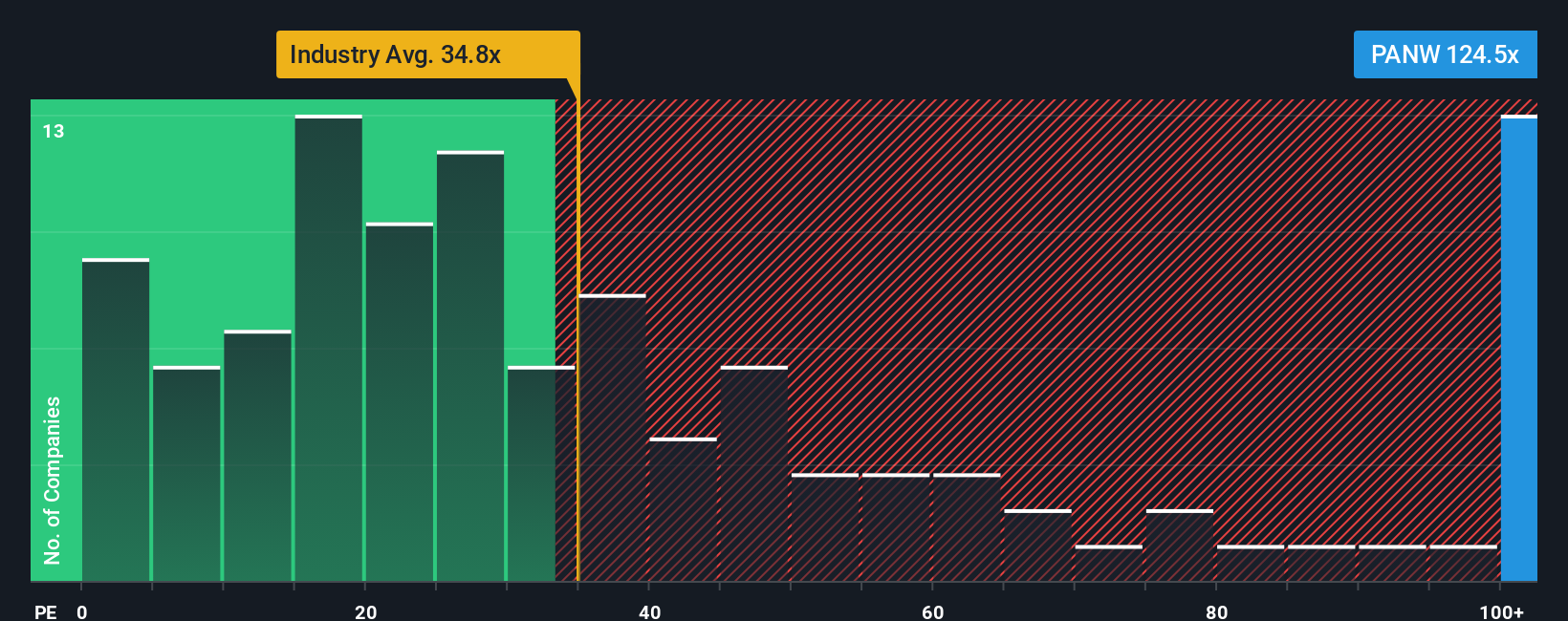

Right now, Palo Alto Networks trades at a PE of 124.5x. That is much higher than the software industry average of 34.8x, and also above the average PE of its closest peers at 58.9x. However, instead of just comparing to peers, the “Fair Ratio” from Simply Wall St helps put this in better perspective. This proprietary fair PE of 45.0x accounts for Palo Alto Networks’ earnings growth, its large market cap, profit margin, and sector-specific risks. This gives a richer view than a straight industry average.

Comparing the Fair Ratio to the company’s actual PE, the stock appears to be trading at a premium well above what these fundamentals would justify. This suggests the stock may be overvalued based on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Palo Alto Networks Narrative

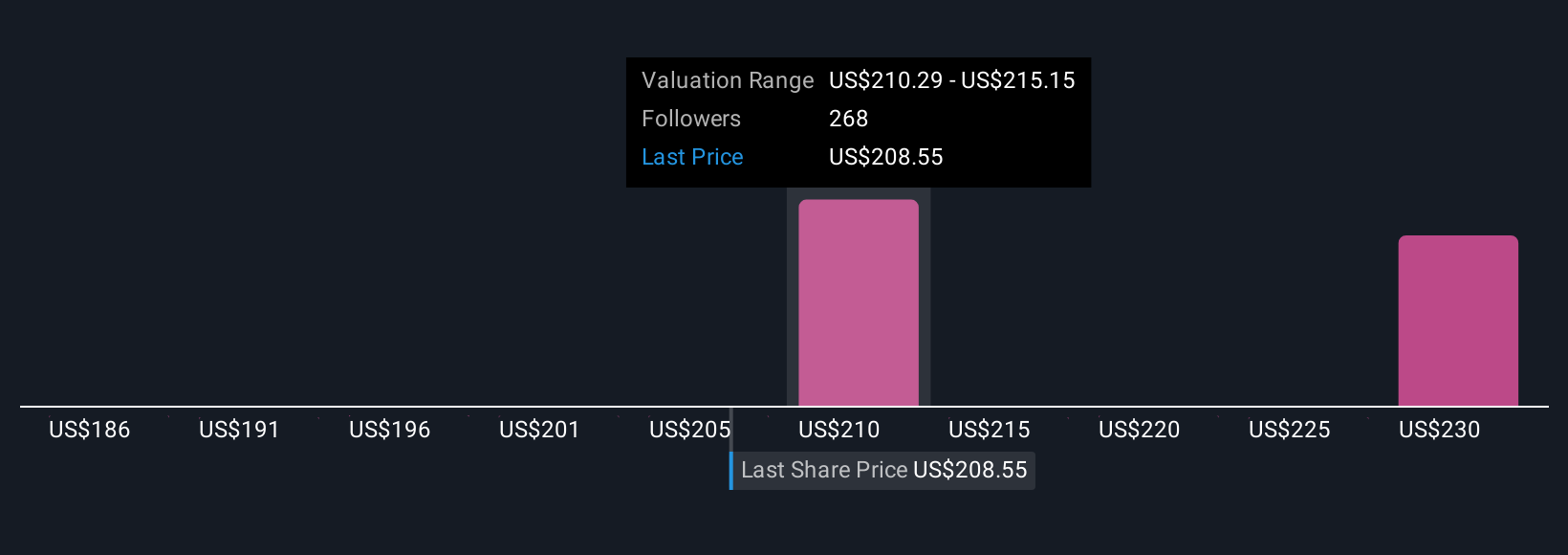

Earlier, we mentioned there’s an even better way to understand valuation, so let’s introduce you to Narratives. In simple terms, a Narrative is your personalized investment story. It is where you connect your view of Palo Alto Networks’ future with the numbers behind its revenue, profit margins, and fair value.

Narratives bring together three things: what you believe about the company’s direction, how that translates into a financial forecast, and how these elements inform your estimate of fair value. This approach turns a company’s story into actionable insights, rather than just relying on ratios or stock charts, by matching your expectations with what you think the business is worth.

Best of all, crafting and tracking Narratives is now easy and accessible on Simply Wall St’s Community page, where millions of investors share, compare, and update their perspectives as new news or earnings releases emerge. Narratives help you decide when to buy or sell by showing how your fair value compares to today’s price, updating automatically if catalysts, risks, or industry trends change.

For example, some investors see AI and platform leadership fueling rapid recurring revenue, setting a Narrative with a bullish fair value near $240, while others take a cautious view on profitability and integration risks, supporting a more conservative Narrative close to $131.

Do you think there's more to the story for Palo Alto Networks? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives