- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks (PANW): Reassessing Valuation After New GSA OneGov Deal and Shareholder Backing

Reviewed by Simply Wall St

Palo Alto Networks (PANW) just landed a multiyear U.S. General Services Administration OneGov deal, giving federal agencies discounted access to its AI security and cloud platforms while shareholders backed fresh incentives and board continuity.

See our latest analysis for Palo Alto Networks.

Even with the GSA OneGov win and a steady drumbeat of AI security headlines, Palo Alto Networks’ 30 day share price return of minus 6.61 percent and modest year to date share price gain of 6.06 percent show near term momentum cooling. However, a five year total shareholder return of 223.50 percent points to a still powerful long term compounding story.

If this federal deal has you thinking more broadly about cybersecurity and AI, it could be a good time to explore other high growth tech and AI names via high growth tech and AI stocks.

With the stock now trading about 15 to 17 percent below consensus targets despite double digit revenue and nearly 20 percent net income growth, investors face a key question: is this a genuine dip to buy, or is the market already discounting Palo Alto Networks’ next leg of AI driven growth?

Most Popular Narrative: 14.6% Undervalued

With Palo Alto Networks last closing at $191.69 against a narrative fair value near $224.53, the valuation story leans positive while hinging on ambitious growth math.

Strategic investments in AI-driven security, automation, and differentiated product innovation (e.g., AI firewalls, SASE, secure browser, Cortex Cloud, XSIAM) are driving rapid ARR growth in high-value segments (>32% NGS ARR growth and over 2.5x AI ARR YoY), supporting a move towards higher-margin, recurring revenue streams, and improved long-term net margins.

Want to see what kind of revenue curve and margin lift could justify this premium platform bet, and how earnings power is projected to scale from here? Dive into the full narrative to unpack the assumptions behind that fair value.

Result: Fair Value of $224.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing acquisition integration challenges and intensifying competition in AI driven security could pressure margins and growth, potentially undermining the long term premium narrative.

Find out about the key risks to this Palo Alto Networks narrative.

Another Lens on Valuation

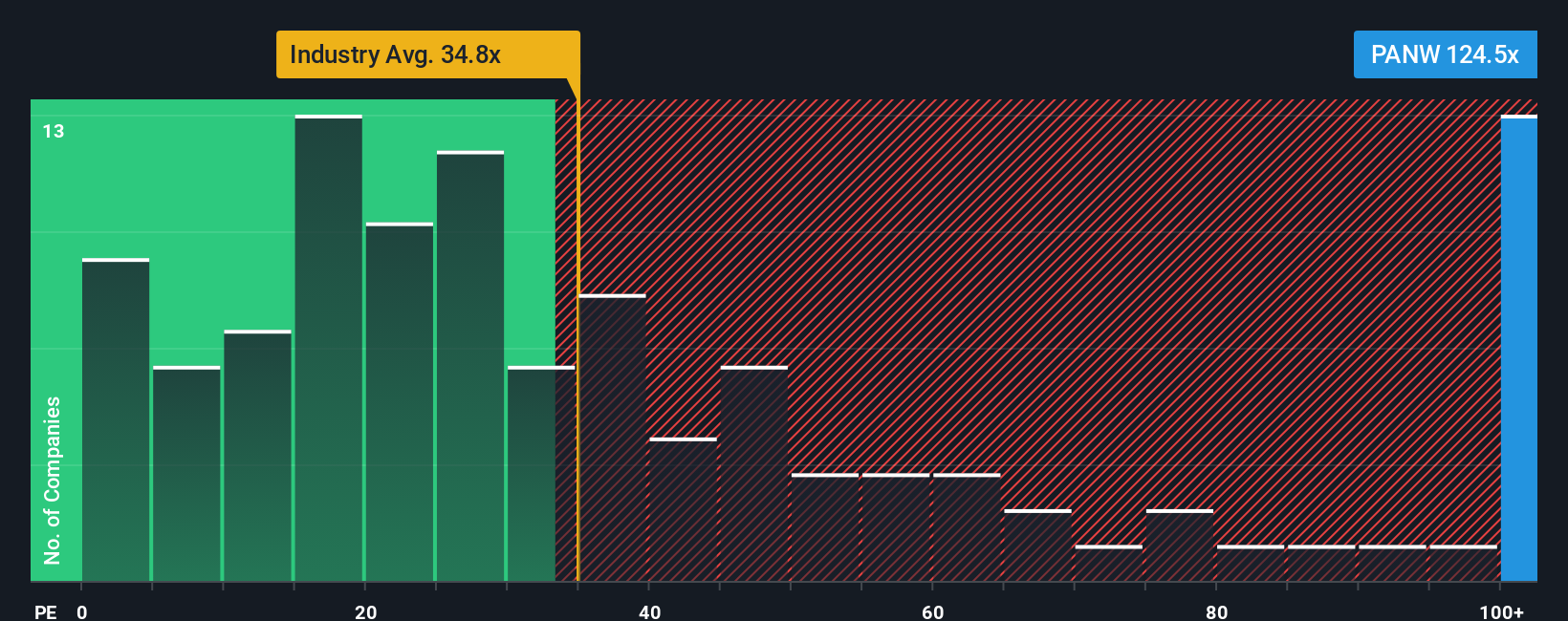

While the narrative fair value suggests upside, the earnings multiple paints a tougher picture. PANW trades on a price to earnings ratio of 119.6 times versus 48 times for peers and a 43.4 times fair ratio. This implies the market already bakes in a lot of success and leaves less room for missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Palo Alto Networks Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your Palo Alto Networks research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the crowd by using the Simply Wall Street Screener to pinpoint fresh opportunities before the market wakes up to their potential.

- Explore these 13 dividend stocks with yields > 3% that may help strengthen your portfolio’s cash flow.

- Research these 26 AI penny stocks that are involved in AI powered innovation.

- Review these 908 undervalued stocks based on cash flows that may appear mispriced relative to their cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)