- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks (NasdaqGS:PANW) Partners With Binary Defense For Flexible XSIAM Deployment

Reviewed by Simply Wall St

Palo Alto Networks (NasdaqGS:PANW) recently announced a strategic partnership with Binary Defense to enhance its Cortex XSIAM platform's security operations, aligning with an uptick in focus on AI-driven cybersecurity solutions. The company's share price rose 9% over the last quarter, reflecting investor interest that coincided with positive market trends, including a 1% gain in major indices as encouraging inflation data provided a benign backdrop. Additionally, collaboration initiatives such as those with Glean and Cribl likely bolstered confidence in Palo Alto Networks' capabilities to innovate and align with broader tech sector growth, as evidenced by steady gains in the Nasdaq Composite.

You should learn about the 1 risk we've spotted with Palo Alto Networks.

The recent partnership with Binary Defense accentuates Palo Alto Networks' emphasis on AI-driven enhancements, potentially accelerating both revenue and earnings by improving the Cortex XSIAM platform's capabilities. As these AI initiatives grow, they may lead to larger deal sizes and cost efficiencies, aligning with forecasts of revenue climbing 15.5% annually and profit margins expanding to 17.2% in three years.

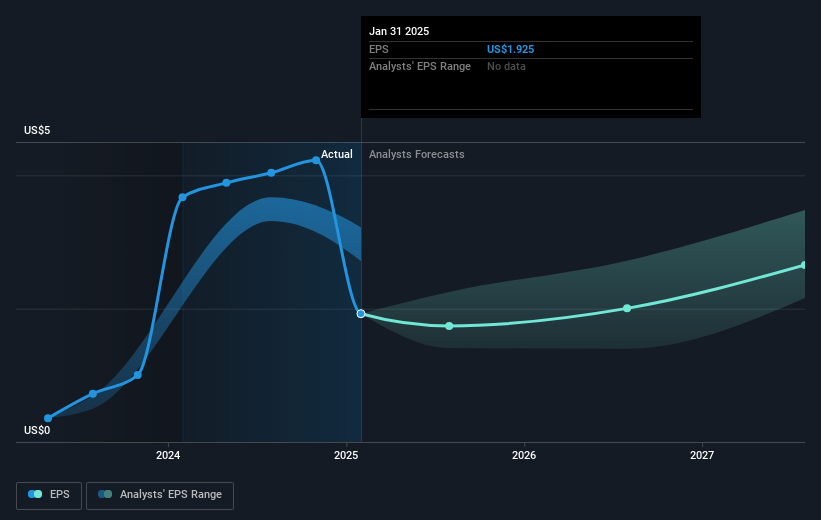

Over the past five years, the company's total return including share price appreciation stood at a very large 414.08%, reflecting robust long-term growth. This impressive performance contrasts with its recent year-over-year earnings decline of 49.4%, against the broader Software industry growth average of 20.5%.

While shares climbed 9% in the past quarter, the current price of US$188.69 still trails the consensus price target of US$211.20, suggesting potential upside. Analysts, however, foresee mixed outcomes, with targets ranging between US$123.00 and US$235.00, dependent on whether projected growth materializes. This disparity underscores the speculative nature of estimates, especially in relation to the anticipated earnings per share of US$3.54 by 2028. The success of international and AI-driven expansion will be crucial in attaining these targets and justifying the high multiples posited for Palo Alto Networks' future valuation.

Evaluate Palo Alto Networks' prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions in the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)