- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks' (NASDAQ: PANW) Stock Split Makes Sense when you look at the the Current Shareholder Base

Key Takeaways from This Analysis:

- Palo Alto Networks will be conducting a 3-for-1 stock split after the close tomorrow, 13th September.

- Shares are still trading on a substantially lower price-to-sales ratio compared to peers.

- The stock split could make more retail investors aware of the stock and broaden the shareholder base which is heavily skewed to institutions.

Palo Alto Networks ( NASDAQ: PANW ) will be conducting a 3-for-1 stock split after the market closes on Tuesday 13th September. On Wednesday, shareholders will receive two additional shares for each share they hold at the close on Tuesday. With a pre-split share price of ~$570, shares should be trading at ~$190 after the split. The number of shares outstanding will increase from ~99.4 million to ~299 million.

Stock splits don’t actually do anything to increase the value of a company - they merely divide the company into more shares. But they do make shares more affordable to retail investors who may only be able to buy one or two shares of a company. As fractional share ownership becomes more common, the need for stock splits could become less relevant.

Nevertheless, stock splits have become popular amongst retail investors as they have often led to a short-term bump in share prices. While the idea is that more investors will buy the share at a lower price, traders often buy ahead of the split in anticipation of this increased buying. Whether or not the share price holds onto its gains often depends on whether new buyers intend to hold for the long term, or take a quick profit.

See our latest analysis for Palo Alto Networks

PANW Valuation vs Peers

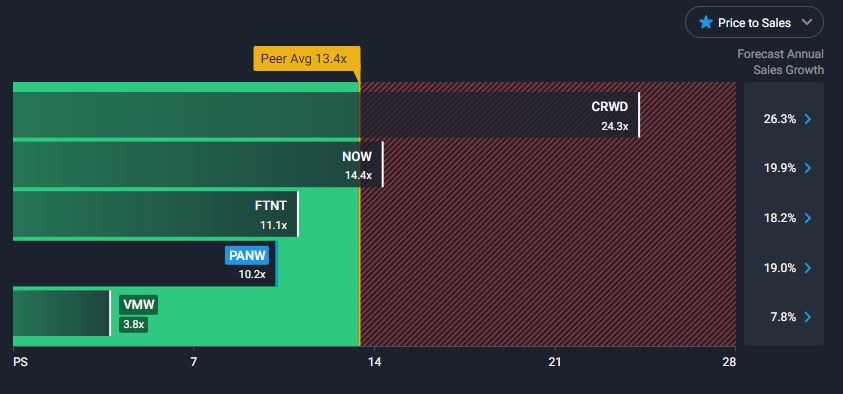

In May we pointed out that Palo Alto compares favorably to its peers when we compare its valuation, margins, and growth outlook. Cybersecurity stocks trade on some of the highest price-to-sales multiples in the market - no doubt due to their strong growth rates and the fact that cybersecurity is an essential expense for businesses.

More well-known rivals like CrowdStrike ( NASDAQ: CRWD ) do have higher revenue growth rates, but they also have wider net loss margins and trade on higher price-to-sales ratios.

Palo Alto’s stock price has outperformed the S&P 500 and the Nasdaq cybersecurity index since our previous report, and while the gap between its price-to-sales ratio and its peers has narrowed slightly it’s still notable. This may be one of the reasons the company is wanting to broaden its investor base.`

The PANW stock split might broaden the investor base

The higher a share price is, the more sense a stock split makes. Typically we see companies splitting their stock when the share price is higher than $1,000, so in Palo Alto’s case, it doesn’t seem necessary at this point. But it does make sense when we look at the company’s current investor base.

Retail investors currently own just 10% of the company, while institutions hold 88% of the stock. It’s possible that this stock split makes more retail investors aware of the company, which could lead to a broadening of this investor base.

What this means for investors

Stock splits do little for the underlying value of a company, but they can serve to bring new investors with smaller investors onto the shareholder register. And, because they have become popular amongst retail investors, they can generate publicity amongst investors.

It will be interesting to see whether Palo Alto’s stock split does broaden the investor base - and whether the valuation gap closes. You can keep track of both on our Palo Alto analysis page which is updated daily.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives