- United States

- /

- Software

- /

- NasdaqGS:PANW

Palo Alto Networks (NASDAQ:PANW) Compares Favorably to its Peers

The share price of Palo Alto Networks ( NASDAQ:PANW ) stood out on Friday, rising 9.4% despite weakness in the broader market after the company released its third-quarter results. The share price has also performed well relative to the cybersecurity industry and tech sector over the last few months.

Key Takeaways from this Analysis:

- Margins are improving

- Revenue growth is robust

- Valuation compares favorably to peers

Q3 highlights:

- Revenue of $1.39 bln was 30% higher year-on-year and slightly higher than expected

- Billings rose 40% year-on-year

- GAAP loss per share of $0.74 compared to $1.50 a year ago and 11 cents better than consensus estimates

- Non-GAAP EPS of $1.79 was 29% higher than a year ago and 42 cents better than consensus estimates

Q4 guidance:

- Billings are expected to be between $2.32 and $2.34 bln

- Revenue is expected to be between $1.53 and $1.55 bln

The share price has held up remarkably well compared to technology growth companies and specifically cybersecurity stocks. Part of the reason for this has been the war in Ukraine which has highlighted the threat of cyber-attacks. Palo Alto’s stock was one of the few that rose in late February, and it went on to make a new high of $640 in April — before succumbing to the market-wide selloff.

Palo Alto vs Peers

Cybersecurity stocks are amongst the most expensive in the entire market, as they have continued to deliver strong revenue growth. In addition, cyberattacks of various kinds are expected to continue to be a threat to companies and governments so it’s likely that cybersecurity budgets would be the last to be cut, even during a recession.

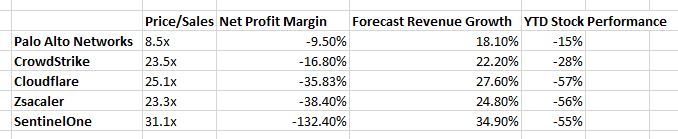

The latest set of results from Palo Alto reinforces the view that the company's revenue growth remains strong while margins are improving - the net loss narrowed to 5.28% of revenue for the quarter. As the table below illustrates, Palo Alto’s net profit margin is negative, but the loss is substantially narrower than its peers. Despite the outperformance, the price-to-sales ratio is also a lot lower than its peers.

How far away is GAAP profitability?

During the earnings call, CEO, Nikesh Arora said the company “intends to target GAAP profitability in the near future.” In the current environment, this will be key." With rising interest rates, the market has become less patient with companies that aren't profitable, so this is indeed key. The company is already cash-flow positive, but cash flows don't account for non-cash items like stock-based compensation.

The chart below reflects the average EPS forecasts from nine analysts. There's a very wide range between the most and least optimistic estimates, which suggest profitability could be anywhere from one to several years away.

These estimates are likely to be revised in the next few weeks. If the lower estimates are raised it could bring the consensus estimates for profitability forward, and the market would likely take notice of that.

What this means for Investors

The cybersecurity industry is seeing strong demand, but most of the companies in the industry with strong growth are still losing money on a GAAP basis. While Palo Alto's growth is lagging slightly, it appears to be closer to profitability and trades on a much lower price to sales ratio.

You can keep track of analyst estimates and other key metrics by referring to our full analysis for Palo Alto Networks which is updated daily.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:PANW

Palo Alto Networks

Provides cybersecurity solutions the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives