- United States

- /

- Software

- /

- NasdaqGS:PANW

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

The United States market has shown robust performance, rising 1.5% over the last week and up 22% over the past year, with earnings projected to grow by 15% annually in the coming years. In this environment, a good tech stock typically exhibits strong growth potential and innovation that aligns well with these positive market dynamics.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 29.07% | 27.57% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 29.97% | 53.77% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

| Ascendis Pharma | 33.05% | 58.72% | ★★★★★★ |

Click here to see the full list of 230 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Arcutis Biotherapeutics (NasdaqGS:ARQT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Arcutis Biotherapeutics, Inc. is a biopharmaceutical company dedicated to developing and commercializing treatments for dermatological diseases, with a market cap of $1.50 billion.

Operations: Arcutis Biotherapeutics focuses on the pharmaceutical segment, generating $138.71 million in revenue from its dermatological treatments.

Arcutis Biotherapeutics, despite its unprofitability, is navigating a transformative phase with significant strides in dermatological treatments. The company's revenue is projected to grow by 29.5% annually, outpacing the US market average of 8.9%, indicative of robust market acceptance and expansion potential. Recent developments include a promising submission to the FDA for ZORYVE cream for young children with atopic dermatitis, supported by compelling phase 3 trial results showing notable efficacy as early as week one. This innovation not only diversifies Arcutis’s portfolio but also solidifies its foothold in pediatric dermatology—a move likely to enhance long-term growth amidst a volatile share price landscape.

Palo Alto Networks (NasdaqGS:PANW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palo Alto Networks, Inc. offers cybersecurity solutions globally and has a market cap of approximately $132.44 billion.

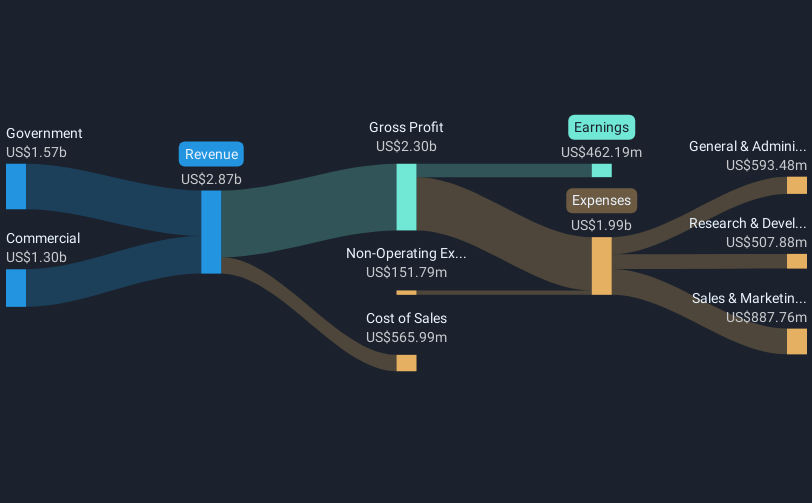

Operations: The company generates revenue primarily from its Security Software & Services segment, amounting to $8.57 billion. Gross profit margin trends are noteworthy, reflecting the company's operational efficiency in delivering cybersecurity solutions worldwide.

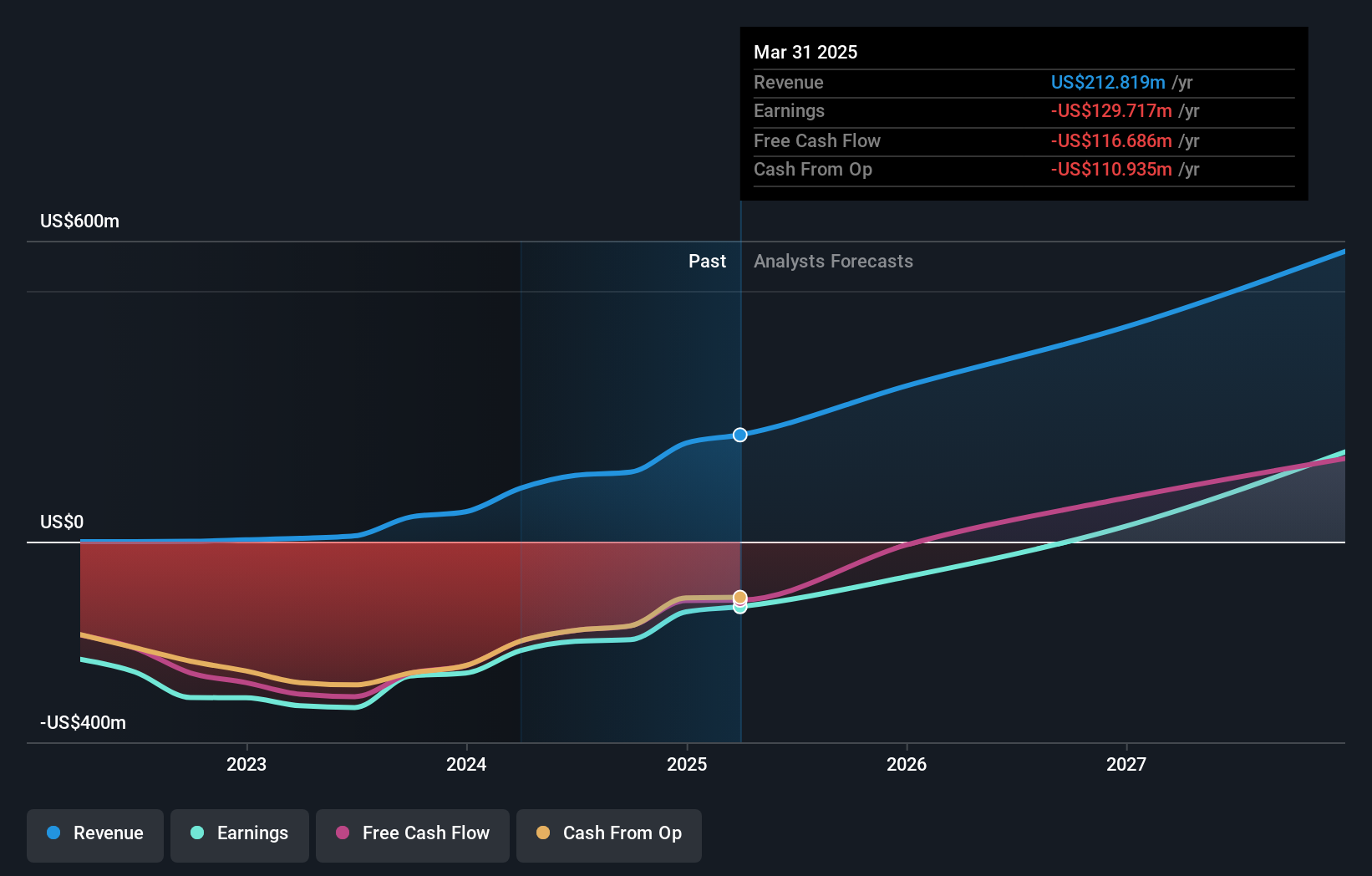

Palo Alto Networks is at the forefront of cybersecurity innovation, evidenced by its recent launch of Cortex® Cloud, enhancing cloud security with AI-driven capabilities. Despite a challenging fiscal year with net income dropping to $618 million from $1,941.1 million, the firm's revenue growth projection remains robust at 14% annually. The company's commitment to R&D is underscored by significant investments in developing cutting-edge solutions that address evolving security threats in real-time environments. With new board members like Helle Thorning-Schmidt and Ralph Hamers adding diverse expertise, Palo Alto Networks is strategically poised to navigate the complex cybersecurity landscape effectively.

Palantir Technologies (NasdaqGS:PLTR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Palantir Technologies Inc. develops software platforms for intelligence and counterterrorism operations across the United States, the United Kingdom, and internationally, with a market cap of $271.45 billion.

Operations: Palantir Technologies specializes in creating software platforms that support intelligence and counterterrorism efforts globally. The company generates revenue by providing these advanced analytical tools to government and commercial clients, aiding in data integration and analysis. With a significant market presence, Palantir's focus on enhancing decision-making capabilities through its technology is central to its business model.

Palantir Technologies continues to redefine its role in high-tech growth sectors, particularly through significant contracts and strategic alliances. Recently, the company forecasted robust revenue growth with expectations between $3.74 to $3.76 billion for 2025, highlighting a consistent upward trajectory in financial performance. Its R&D commitment is evident from its ongoing enhancements in AI capabilities across defense and security systems, notably with the U.S. Army's Vantage program which now supports over 100,000 users with advanced data integration tools. This focus on developing cutting-edge solutions ensures Palantir remains integral to national security innovations while fostering substantial market expansion.

Make It Happen

- Access the full spectrum of 230 US High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives