- United States

- /

- Software

- /

- NasdaqGS:PANW

Exploring 3 High Growth Tech Stocks In The US Market

Reviewed by Simply Wall St

The United States market has shown robust performance recently, rising 8.4% in the last week with all sectors gaining ground, and achieving a 5.9% increase over the past year, while earnings are projected to grow by 13% annually. In this context of strong market momentum, identifying high growth tech stocks involves looking for companies that demonstrate innovative capabilities and have the potential to capitalize on expanding technological trends within this favorable economic environment.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.44% | 29.79% | ★★★★★★ |

| TG Therapeutics | 26.03% | 37.60% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 65.75% | ★★★★★★ |

| Arcutis Biotherapeutics | 25.76% | 58.17% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.72% | 58.76% | ★★★★★★ |

| TKO Group Holdings | 22.48% | 25.17% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.61% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.36% | 59.79% | ★★★★★★ |

Click here to see the full list of 234 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Palo Alto Networks (NasdaqGS:PANW)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Palo Alto Networks, Inc. is a global provider of cybersecurity solutions with a market capitalization of $112.54 billion.

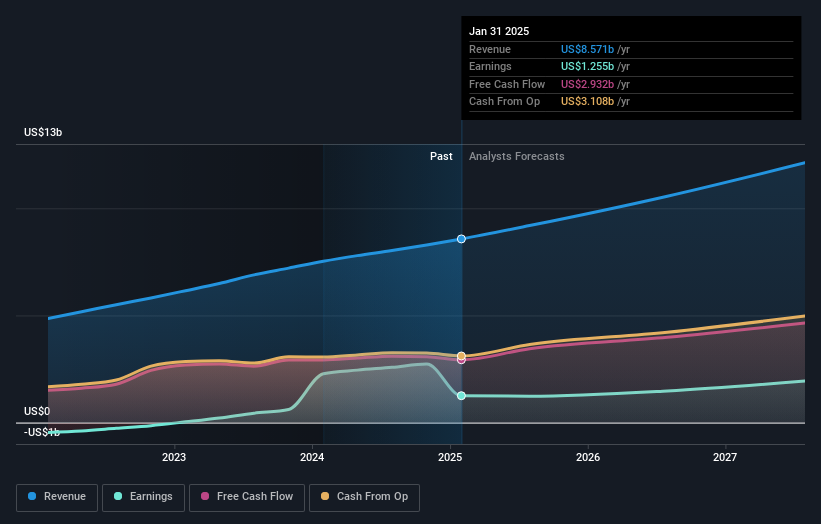

Operations: Palo Alto Networks generates revenue primarily from its Security Software & Services segment, which accounts for $8.57 billion. The company focuses on delivering comprehensive cybersecurity solutions globally.

Palo Alto Networks has demonstrated adaptability and foresight in the cybersecurity sector, notably through its recent strategic moves. The company's annual revenue growth is projected at 12.9%, outpacing the US market average of 8.3%, with earnings expected to increase by 17.7% annually, signaling robust financial health compared to a broader market growth of 13.5%. At the GITEX Africa conference and in its partnership with the NHL, Palo Alto emphasized its commitment to advanced security solutions like AI-powered operations and next-generation firewalls, which are critical as digital threats evolve rapidly. These initiatives not only enhance client security frameworks but also position Palo Alto as a leader in integrating cutting-edge technology for comprehensive digital protection.

- Click here and access our complete health analysis report to understand the dynamics of Palo Alto Networks.

Evaluate Palo Alto Networks' historical performance by accessing our past performance report.

Palantir Technologies (NasdaqGS:PLTR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Palantir Technologies Inc. develops software platforms for intelligence and counterterrorism operations globally, with a market cap of $217.23 billion.

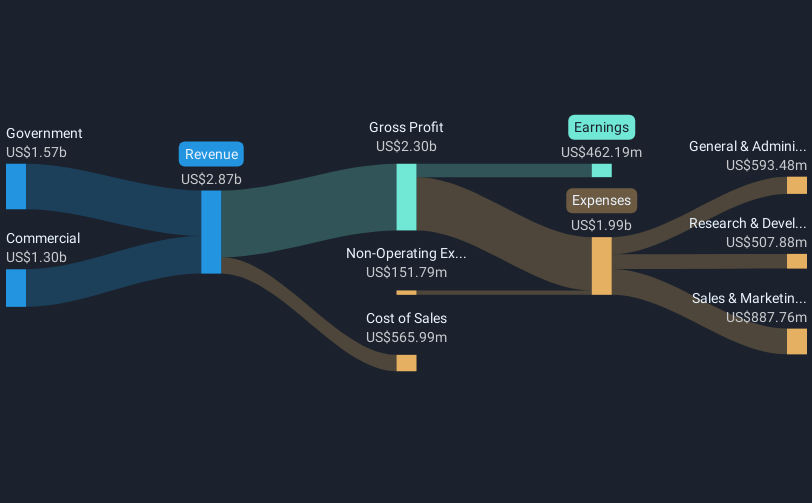

Operations: Palantir Technologies generates revenue primarily from two segments: Government, contributing $1.57 billion, and Commercial, accounting for $1.30 billion. The company's focus is on providing software solutions to support intelligence and counterterrorism efforts across various regions, including the United States and the United Kingdom.

Palantir Technologies has been making significant strides in the high-growth tech sector, especially noted for its recent earnings growth of 120.3% over the past year, far surpassing the software industry's average of 25.4%. This growth is underpinned by a robust increase in annual revenue and earnings, forecasted at 21.3% and 27.1% respectively, indicating a strong upward trajectory compared to the US market averages of 8.3% and 13.5%. Contributing to this performance is Palantir's strategic focus on innovative AI applications across diverse sectors including defense and healthcare, as evidenced by their partnerships with Everfox for classified network operations and R1 for healthcare financial performance optimization. These collaborations not only enhance Palantir's service offerings but also solidify its position as a pivotal player in integrating cutting-edge technology solutions into complex operational environments.

- Get an in-depth perspective on Palantir Technologies' performance by reading our health report here.

Understand Palantir Technologies' track record by examining our Past report.

Sea (NYSE:SE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sea Limited operates in digital entertainment, e-commerce, and digital financial services across Southeast Asia, Latin America, and other international markets with a market capitalization of approximately $68.19 billion.

Operations: Sea Limited generates revenue primarily from e-commerce, contributing $12.42 billion, followed by digital entertainment and digital financial services at $1.91 billion and $2.37 billion respectively.

Sea Limited has demonstrated remarkable growth, with a 194.8% increase in earnings over the past year, significantly outpacing its industry's average. This surge is supported by a robust revenue hike to $16.82 billion from $13.06 billion previously, reflecting a 14.5% annual growth rate that exceeds the U.S market average of 8.3%. The company's strategic investments in R&D have fostered innovation and efficiency, positioning it well for sustained growth amidst competitive tech landscapes. With earnings expected to grow by 32% annually over the next three years, Sea's trajectory suggests continued upward momentum in aligning with evolving market demands and consumer preferences.

- Unlock comprehensive insights into our analysis of Sea stock in this health report.

Review our historical performance report to gain insights into Sea's's past performance.

Turning Ideas Into Actions

- Get an in-depth perspective on all 234 US High Growth Tech and AI Stocks by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives