- United States

- /

- Software

- /

- NasdaqGS:PANW

3 Stocks Estimated To Be Trading Below Their Intrinsic Value In July 2025

Reviewed by Simply Wall St

Over the last seven days, the United States market has remained flat, yet it is up 13% over the past year with earnings anticipated to grow by 15% annually in the coming years. In this context of steady growth and positive earnings outlook, identifying stocks that are trading below their intrinsic value can present potential opportunities for investors seeking to capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SharkNinja (SN) | $105.55 | $210.92 | 50% |

| Roku (ROKU) | $88.14 | $173.21 | 49.1% |

| Robert Half (RHI) | $42.53 | $83.11 | 48.8% |

| Hess Midstream (HESM) | $37.96 | $73.34 | 48.2% |

| e.l.f. Beauty (ELF) | $116.99 | $230.48 | 49.2% |

| ConnectOne Bancorp (CNOB) | $24.66 | $47.49 | 48.1% |

| Carter Bankshares (CARE) | $17.95 | $35.50 | 49.4% |

| Camden National (CAC) | $43.34 | $83.12 | 47.9% |

| Atlantic Union Bankshares (AUB) | $33.32 | $65.54 | 49.2% |

| ACNB (ACNB) | $43.97 | $84.28 | 47.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

ON Semiconductor (ON)

Overview: ON Semiconductor Corporation offers intelligent sensing and power solutions across various global markets, with a market cap of approximately $22.82 billion.

Operations: The company's revenue is primarily derived from three segments: Power Solutions Group ($3.12 billion), Intelligent Sensing Group ($1.07 billion), and Analog & Mixed-Signal Group ($2.48 billion).

Estimated Discount To Fair Value: 11.6%

ON Semiconductor is trading at US$57.62, below its fair value estimate of US$65.18, making it potentially undervalued based on cash flows. Despite a challenging first quarter with a net loss of US$486.1 million and reduced sales, earnings are forecast to grow significantly at 33.5% annually over the next three years, outpacing the broader U.S. market's growth rate of 14.7%. Recent index exclusions may impact investor sentiment temporarily but do not alter long-term projections.

- The analysis detailed in our ON Semiconductor growth report hints at robust future financial performance.

- Dive into the specifics of ON Semiconductor here with our thorough financial health report.

Palo Alto Networks (PANW)

Overview: Palo Alto Networks, Inc. is a global provider of cybersecurity solutions with a market cap of approximately $134.31 billion.

Operations: The company's revenue primarily comes from its Security Software & Services segment, which generated approximately $8.87 billion.

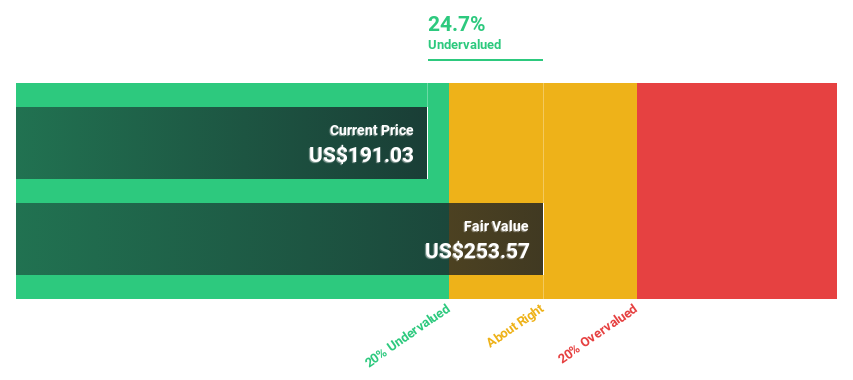

Estimated Discount To Fair Value: 18.8%

Palo Alto Networks, with a current stock price of US$203.99, trades below its estimated fair value of US$251.07, suggesting potential undervaluation based on cash flows. The company's revenue is projected to grow at 12.5% annually, surpassing the broader U.S. market's growth rate of 8.7%. Despite a decline in net income for the third quarter compared to last year, strategic partnerships are enhancing its AI and security offerings, supporting future profitability and operational resilience.

- The growth report we've compiled suggests that Palo Alto Networks' future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Palo Alto Networks stock in this financial health report.

Pure Storage (PSTG)

Overview: Pure Storage, Inc. provides data storage and management technologies, products, and services globally, with a market cap of approximately $18.35 billion.

Operations: The company's revenue primarily comes from its computer storage devices segment, which generated $3.25 billion.

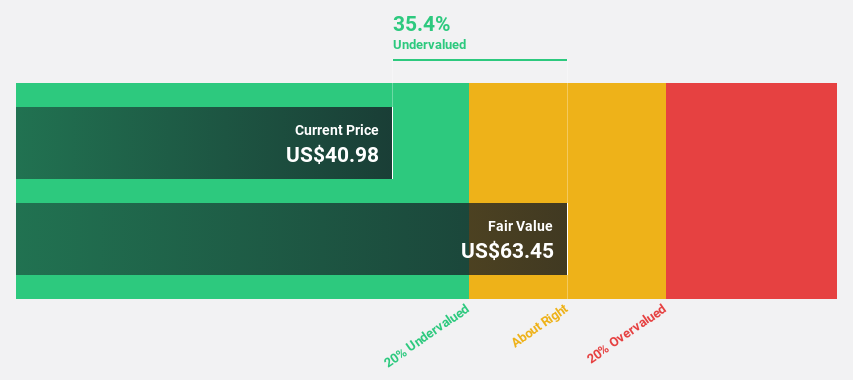

Estimated Discount To Fair Value: 42.8%

Pure Storage, trading at US$57.08, is undervalued with a fair value estimate of US$99.72. Its earnings are projected to grow significantly by 34% annually, outpacing the U.S. market's 14.7%. Recent executive changes include Tarek Robbiati as CFO, bringing extensive financial expertise which could enhance cash flow management and strategic growth initiatives. Product innovations like Imaging Storage-as-a-Service and Enterprise Data Cloud bolster its competitive edge in data-intensive sectors, potentially driving long-term cash flow improvements.

- In light of our recent growth report, it seems possible that Pure Storage's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Pure Storage.

Seize The Opportunity

- Delve into our full catalog of 176 Undervalued US Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PANW

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives