- United States

- /

- Software

- /

- NasdaqGS:OTEX

Will Analyst Optimism on Cloud Strategy Shift the Long-Term Outlook for Open Text (OTEX)?

Reviewed by Simply Wall St

- Open Text Corporation recently presented at Fal.Con 2025 in Las Vegas, with Product Marketing Manager Nik Earnest discussing advancements at the company.

- Following this, Open Text received a broker upgrade highlighting improved operational execution, successful acquisition synergies, and rising relevance from digital transformation trends.

- We’ll examine how this positive analyst commentary boosts the company’s investment narrative around cloud and AI-driven growth initiatives.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Open Text Investment Narrative Recap

To be an Open Text shareholder right now, it comes down to believing the company can successfully reignite growth via cloud and AI-driven solutions, even as legacy maintenance revenue faces pressure. This latest broker upgrade, reflecting improved operational execution and successful acquisition synergies, adds weight to the cloud narrative, but it does not fundamentally alter the short-term catalyst, the pace of cloud adoption, or address the biggest immediate risk: continued underperformance in key business units like cybersecurity. Among recent announcements, the launch of new AI-powered features in Open Text's Cloud Editions (CE) 25.3 stands out by directly aligning with current catalysts around digital transformation. These advancements position Open Text to potentially accelerate customer migration to its cloud platforms, a vital step if the company is to offset the drag from declining legacy revenues and unlock higher-margin recurring revenue streams. In contrast, investors should be aware that ongoing weakness in cloud revenue growth in core cybersecurity units could still...

Read the full narrative on Open Text (it's free!)

Open Text's outlook anticipates $5.4 billion in revenue and $862.6 million in earnings by 2028. This forecast is based on a 1.4% annual revenue growth rate and an increase in earnings of $426.7 million from the current level of $435.9 million.

Uncover how Open Text's forecasts yield a $34.80 fair value, a 5% downside to its current price.

Exploring Other Perspectives

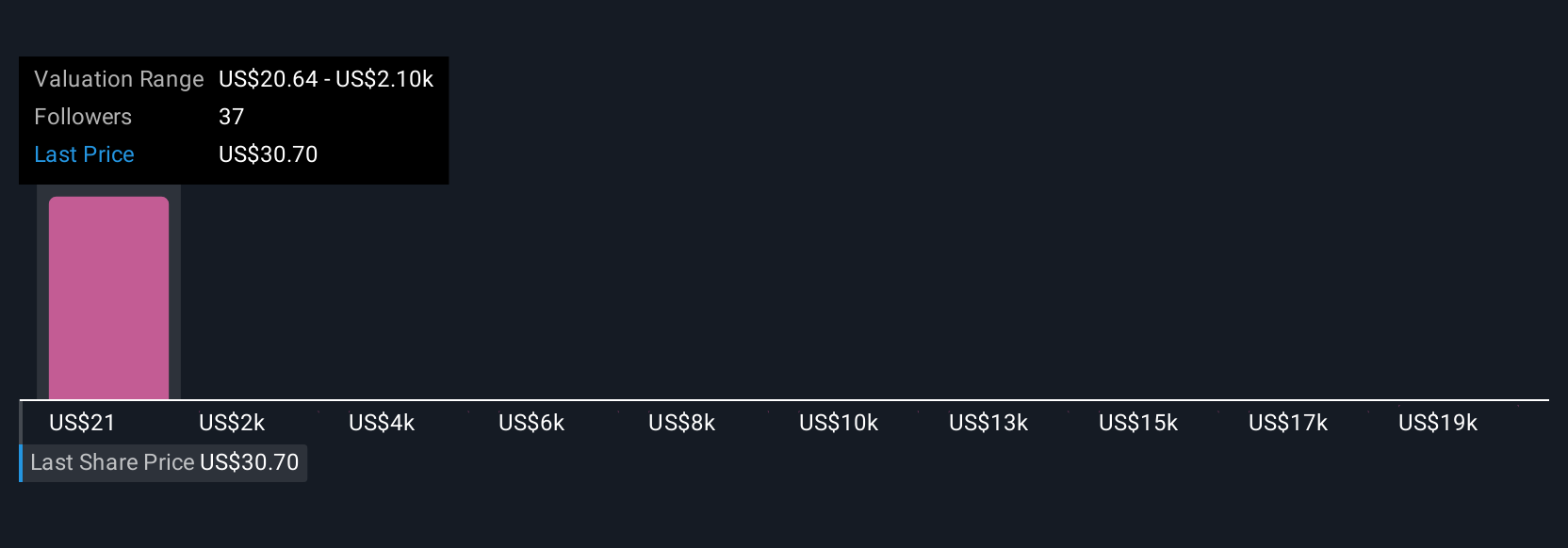

Six members of the Simply Wall St Community have published fair value estimates for Open Text, ranging from US$20.64 to US$66.67 per share. While many see significant upside, remember that expected cost savings from restructuring are still not a given, reviewing all viewpoints can help you decide if the optimism is justified.

Explore 6 other fair value estimates on Open Text - why the stock might be worth as much as 82% more than the current price!

Build Your Own Open Text Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Open Text research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Open Text research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Open Text's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OTEX

Open Text

Designs, develops, markets, and sells information management software and solutions in North, Central, and South America, Europe, the Middle East, Africa, Australia, Japan, Singapore, India, and China.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives