- United States

- /

- Software

- /

- NasdaqGS:OTEX

Open Text (NasdaqGS:OTEX) Surges 11% Over The Past Week

Reviewed by Simply Wall St

Open Text (NasdaqGS:OTEX) recently made headlines with a 10.98% rise in its share price over the past week, a move that coincided with tech stocks leading a market rally. While broader market dynamics saw tech driving gains amid easing tariff tensions, Open Text's performance aligned with these trends, potentially buoyed by positive sentiment in the tech sector. The S&P 500 and Nasdaq Composite each rose modestly during this period. Despite global uncertainties, tech stocks, including Nvidia and Broadcom, performed well, indicating robust investor interest in tech companies, which may have supported Open Text's price movement.

The recent leap in Open Text's share price amidst a tech rally offers an interesting backdrop to the company's ongoing initiatives and strategic partnerships. The company's focus on advancing AI and SaaS offerings, particularly with major players like SAP and BASF, is likely to enable high-margin revenue growth. This aligns well with the current market momentum seen in tech stocks. While the short-term price rise may foster optimism, it's essential to recognize Open Text's total shareholder return of 23.67% decline over the past year, indicating challenges in maintaining steady growth compared to its peers in the US Software industry, which posted a return of 1.5% during this period.

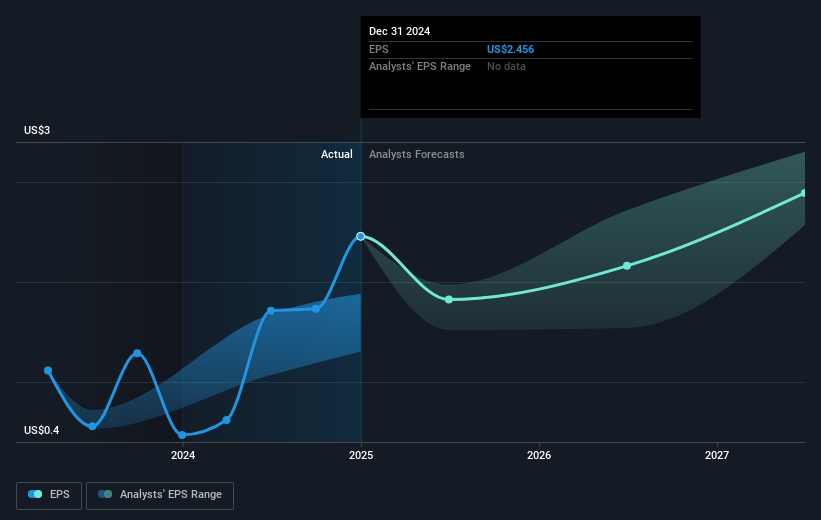

Amidst these developments, revenue and earnings forecasts reflect mixed expectations. Analysts project stable revenue at $5.41 billion annually, with earnings expected to increase to $695.3 million by 2028. However, currency fluctuations and alliance transitions pose risks that could impact revenue and profitability margins. The recent price movement, while positive, must be viewed in relation to the analyst price target of $35.09. At a current price of $23.20, the gap signifies potential upside but relies on achieving forecasted earnings and a projected PE ratio of 15.7x by 2028. Analysts maintain confidence in the stock rising, considering it is estimated to trade below its fair value by a substantial margin.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OTEX

Open Text

Engages in the provision of information management products and services.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives