- United States

- /

- Software

- /

- NasdaqCM:ABTC

3 Undervalued Small Caps With Insider Action Across Global Markets

Reviewed by Simply Wall St

As the U.S. market experiences a resurgence with major stock indexes closing sharply higher for the second consecutive day, small-cap stocks are gaining attention amid this renewed risk appetite. In this dynamic environment, identifying promising small-cap opportunities involves looking at companies with solid fundamentals and potential growth catalysts that align well with current market trends.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Wolverine World Wide | 17.2x | 0.8x | 37.49% | ★★★★★☆ |

| Peoples Bancorp | 10.8x | 2.0x | 43.04% | ★★★★★☆ |

| First United | 10.5x | 3.1x | 42.01% | ★★★★★☆ |

| Merchants Bancorp | 8.1x | 2.7x | 47.79% | ★★★★★☆ |

| S&T Bancorp | 11.9x | 4.0x | 34.80% | ★★★★☆☆ |

| Angel Oak Mortgage REIT | 12.4x | 6.3x | 43.68% | ★★★★☆☆ |

| Citizens & Northern | 13.9x | 3.4x | 29.60% | ★★★☆☆☆ |

| Omega Flex | 17.7x | 2.8x | 4.95% | ★★★☆☆☆ |

| Farmland Partners | 6.6x | 8.1x | -93.20% | ★★★☆☆☆ |

| Infinity Natural Resources | NA | 0.7x | -7.31% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

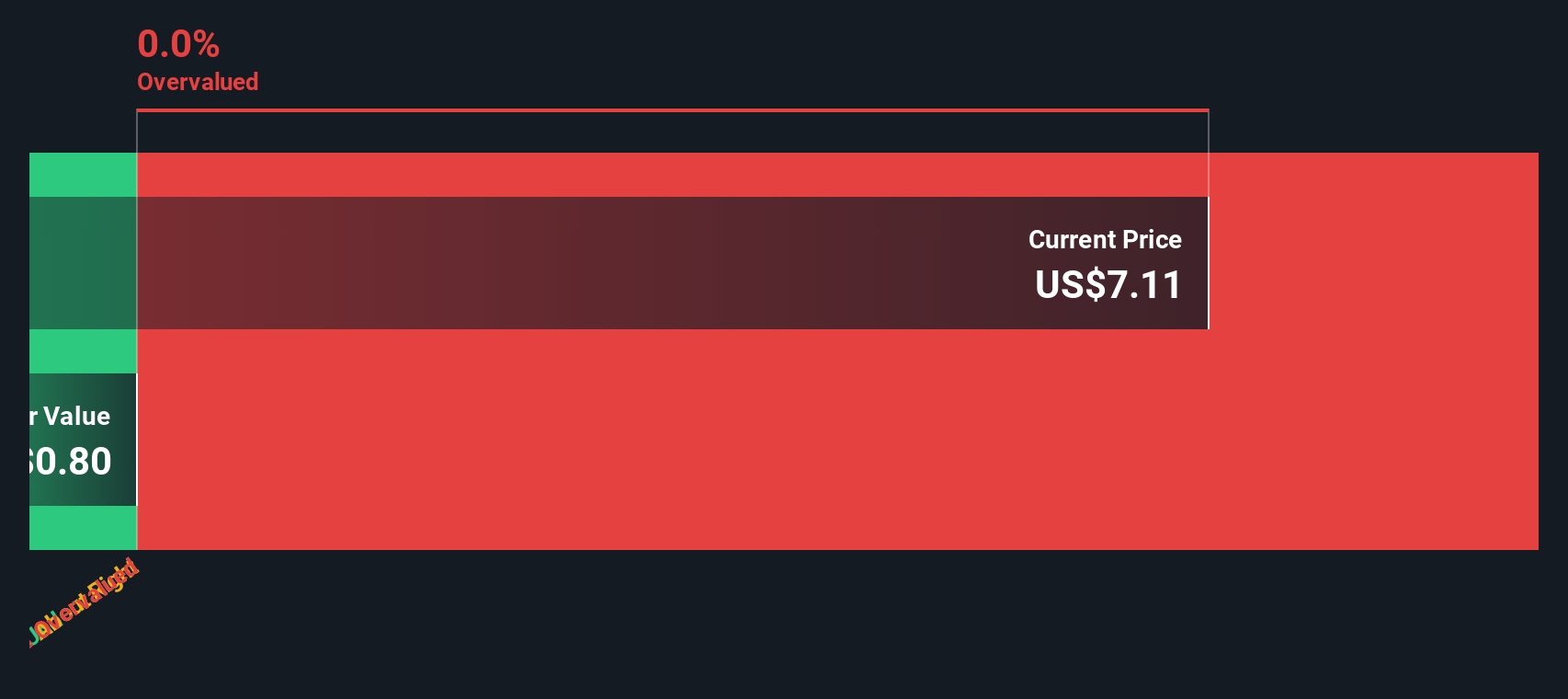

American Bitcoin (ABTC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: American Bitcoin operates within the Internet Software & Services sector, focusing on digital currency solutions, with a market capitalization of $1.75 billion.

Operations: The company primarily generates revenue from its Internet Software & Services segment, with recent figures reaching $122.5 million. The gross profit margin has shown variability, peaking at 54.94% in the latest period. Operating expenses have fluctuated significantly, impacting net income margins which have varied from -158.61% to 6.06%.

PE: 9.9x

American Bitcoin, a company recently added to the S&P Software & Services Select Industry Index, has seen its sales jump to US$64.22 million in Q3 2025 from US$11.61 million a year ago. Despite this growth, it faces challenges with earnings projected to decline by an average of 45.8% annually over the next three years and reliance on high-risk external borrowing for funding. Insider confidence is evident through share purchases made throughout 2025, suggesting faith in potential long-term value despite near-term hurdles.

- Unlock comprehensive insights into our analysis of American Bitcoin stock in this valuation report.

Examine American Bitcoin's past performance report to understand how it has performed in the past.

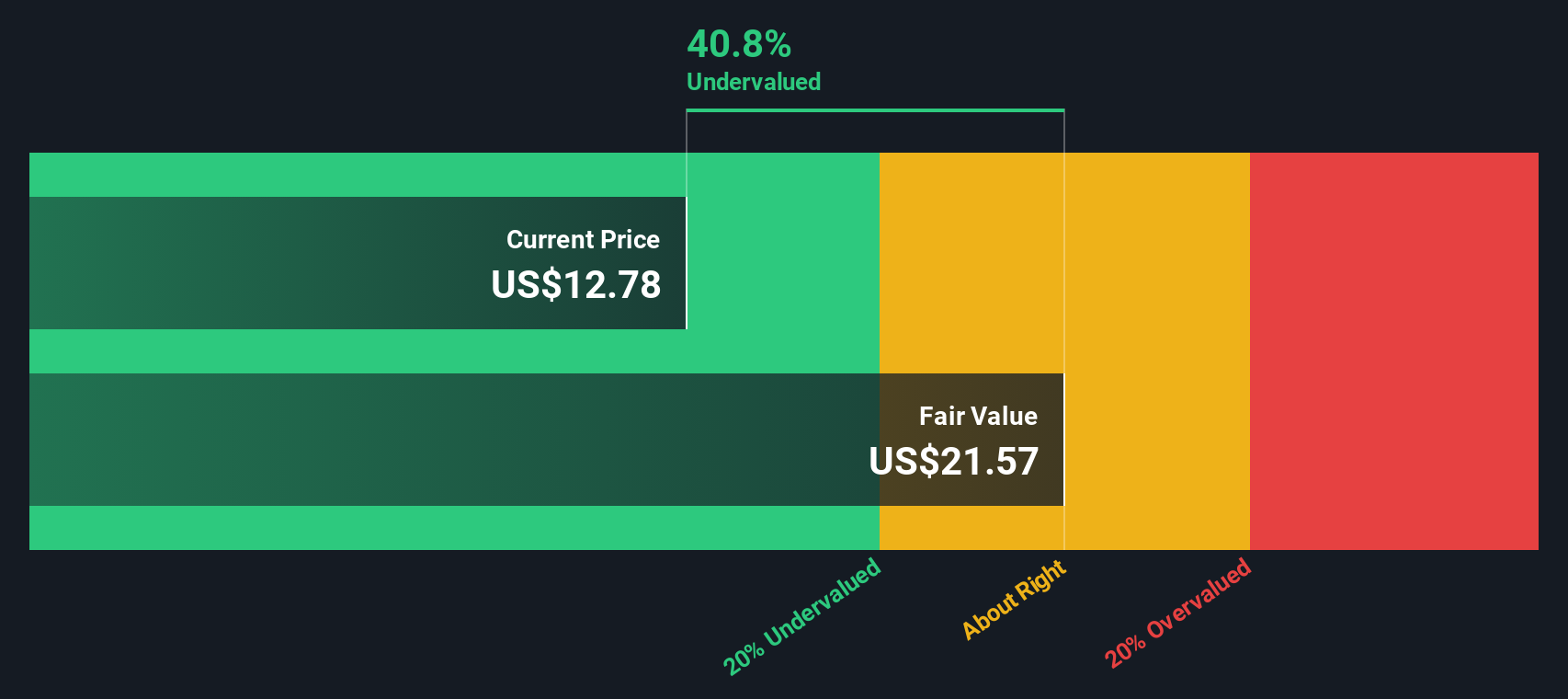

OneSpan (OSPN)

Simply Wall St Value Rating: ★★★★★☆

Overview: OneSpan is a company that specializes in providing digital agreements and security solutions, with a market cap of approximately $0.75 billion.

Operations: OneSpan generates revenue primarily from its Security Solutions and Digital Agreements segments, with Security Solutions contributing a larger portion. The company's gross profit margin has shown an upward trend, reaching 74.26% by mid-2025. Operating expenses are significant, with Sales & Marketing and R&D being notable components.

PE: 8.4x

OneSpan, a cybersecurity-focused company, is gaining attention as an undervalued player in its sector. Recent insider confidence was demonstrated through share purchases between July and September 2025. Despite lowering revenue guidance for 2025 to US$239 million-US$241 million, the firm continues strategic expansions, notably partnering with ThreatFabric to bolster fraud prevention capabilities. The appointment of Shaun Bierweiler as CRO aims to enhance global revenue streams. With a focus on cloud-based security solutions like FIDO authentication in Japan, OneSpan is positioning itself for growth amidst evolving digital threats and regulatory demands.

- Click to explore a detailed breakdown of our findings in OneSpan's valuation report.

Understand OneSpan's track record by examining our Past report.

Infinity Natural Resources (INR)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Infinity Natural Resources is engaged in the acquisition, exploration, development, and production of crude oil and natural gas, with a market cap of $1.25 billion.

Operations: The company's primary revenue stream is from the acquisition, exploration, development, and production of crude oil and natural gas. Over recent periods, its gross profit margin has shown a notable range from 68.02% to 83.28%, reflecting variations in cost management and pricing strategies.

PE: -92.8x

Infinity Natural Resources, a company with a focus on growth, anticipates earnings to rise by 68% annually. Despite relying solely on external borrowing for funding, recent financial maneuvers include an $875 million credit facility expansion. The company has also initiated a $75 million share repurchase program, signaling insider confidence. While revenue increased to US$79.73 million in Q3 2025 from US$69.24 million the previous year, net income fell significantly due to higher expenses and strategic investments aimed at future expansion opportunities.

- Get an in-depth perspective on Infinity Natural Resources' performance by reading our valuation report here.

Gain insights into Infinity Natural Resources' past trends and performance with our Past report.

Make It Happen

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 80 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ABTC

American Bitcoin

A Bitcoin accumulation platform company, focuses on building Bitcoin infrastructure platform.

Good value with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion