- United States

- /

- Software

- /

- NasdaqGS:OS

A Fresh Look at OneStream (OS) Valuation After Growth, Guidance Update, and Strategic Expansions

Reviewed by Kshitija Bhandaru

If you’re tracking OneStream (OS) right now, you’ve probably noticed several headlines landing all at once. The company just posted healthy subscription and revenue growth, nudged its annual guidance a bit higher, and unveiled a suite of new tools, while also warning about possible speedbumps ahead due to unpredictable U.S. public-sector spending. For investors, this mix of steady momentum and fresh caution feels like a classic “should I stay or go?” moment.

Over the past year, OneStream’s share price has slid over 41%, retreating steadily despite management’s upbeat updates and efforts to broaden its reach with solutions like CPM Express. Momentum has clearly faded since the beginning of the year, as the market weighs healthy growth numbers against a more uncertain macro backdrop and leadership’s conservative signals. Even so, this new push into verticals such as embedded AI and ESG solutions shows the company is not standing still.

So, does the market have it right on OneStream, or is there a window here for value-focused investors if future growth is not fully reflected in today’s price?

Most Popular Narrative: 31.6% Undervalued

The most widely followed narrative sees OneStream as significantly undervalued. A fair value estimate is meaningfully above its current share price. This view is grounded in robust assumptions about future growth and profitability.

Ongoing large-scale digital transformation across industries, with CFOs increasingly seeking unified platforms to replace legacy financial systems, strongly positions OneStream to capture expanding market share. This supports sustained subscription revenue and new customer growth.

Want to know why analysts believe this valuation is no fluke? At the heart of this story are bullish growth expectations, margin expansion, and a future profit multiple usually reserved for industry titans. Curious about the bold projections and the numbers behind this fair value call? Unlock the calculations that drive the current price target.

Result: Fair Value of $29.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing uncertainty around public sector contracts and slower transitions to SaaS models could quickly dampen near-term revenue momentum for OneStream investors.

Find out about the key risks to this OneStream narrative.Another View: Multiples Tell a Different Story

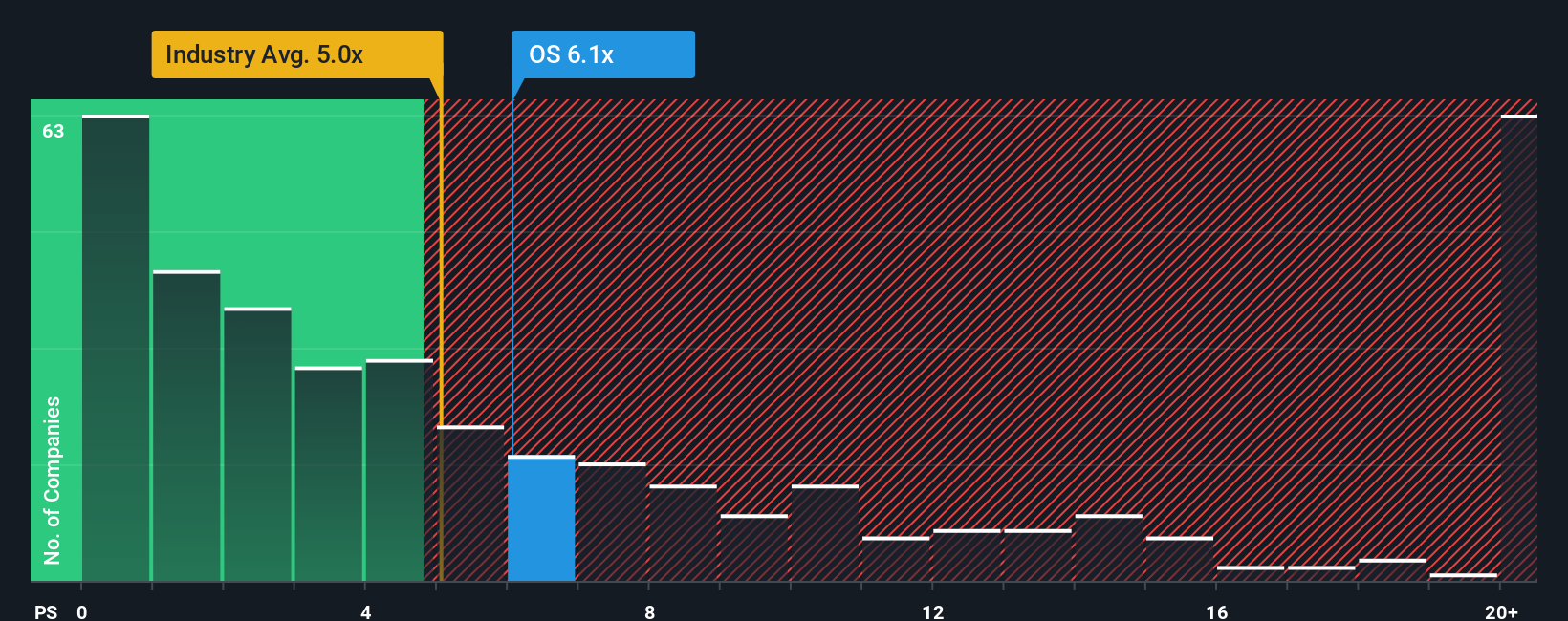

Our comparison using sales-based ratios against the US Software industry paints a less optimistic picture. Based on this method, OneStream’s shares look a bit expensive compared to sector averages. Is the market factoring in too much future growth?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding OneStream to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own OneStream Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly craft your own perspective in just a few minutes. Do it your way.

A great starting point for your OneStream research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your competitive edge with handpicked strategies that could shape your next big move. Don’t miss these powerful ways to spot unique investment opportunities before others catch on.

- Fuel your portfolio growth by tapping into hidden value and long-term gains with our undervalued stocks based on cash flows.

- Access tomorrow’s tech leaders by following fast-rising companies at the crossroads of artificial intelligence with our curated AI penny stocks.

- Step up your passive income game with high-yielding opportunities using our screen for dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OS

OneStream

OneStream, Inc. delivers a unified, AI-enabled, and extensible software platform in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives