- United States

- /

- Software

- /

- NasdaqGS:OPRA

Opera's (NASDAQ:OPRA) Dividend Will Be $0.39

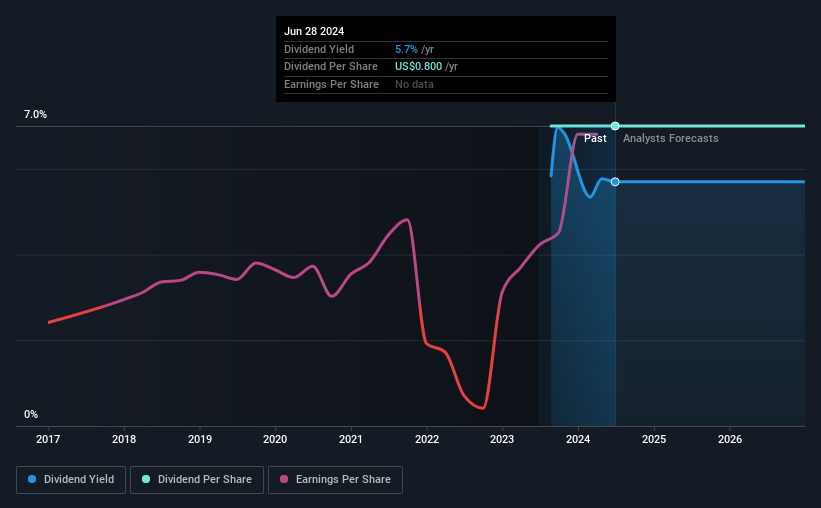

The board of Opera Limited (NASDAQ:OPRA) has announced that it will pay a dividend on the 15th of July, with investors receiving $0.39 per share. This makes the dividend yield 5.7%, which will augment investor returns quite nicely.

View our latest analysis for Opera

Opera's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Prior to this announcement, Opera's dividend was only 47% of earnings, however it was paying out 115% of free cash flows. This signals that the company is more focused on returning cash flow to shareholders, but it could mean that the dividend is exposed to cuts in the future.

Over the next year, EPS is forecast to fall by 23.9%. If the dividend continues along recent trends, we estimate the payout ratio could be 59%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Opera Is Still Building Its Track Record

It is tough to make a judgement on how stable a dividend is when the company hasn't been paying one for very long. This doesn't mean that the company can't pay a good dividend, but just that we want to wait until it can prove itself.

The Dividend Looks Likely To Grow

The company's investors will be pleased to have been receiving dividend income for some time. We are encouraged to see that Opera has grown earnings per share at 41% per year over the past five years. Opera is clearly able to grow rapidly while still returning cash to shareholders, positioning it to become a strong dividend payer in the future.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. With cash flows lacking, it is difficult to see how the company can sustain a dividend payment. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for Opera that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPRA

Opera

Provides mobile and PC web browsers and related products and services in Norway and internationally.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Promigas E.S.P looks to a promising future with 35% revenue growth

Kratos Defense & Security Solutions (KTOS): Scaling "Attritable" Dominance in a New Era of Aerial Conflict.

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks