- United States

- /

- Software

- /

- NasdaqGS:OPRA

Opera (OPRA) Margin Decline Tests Bullish Narratives Despite Strong Growth and Value Signals

Reviewed by Simply Wall St

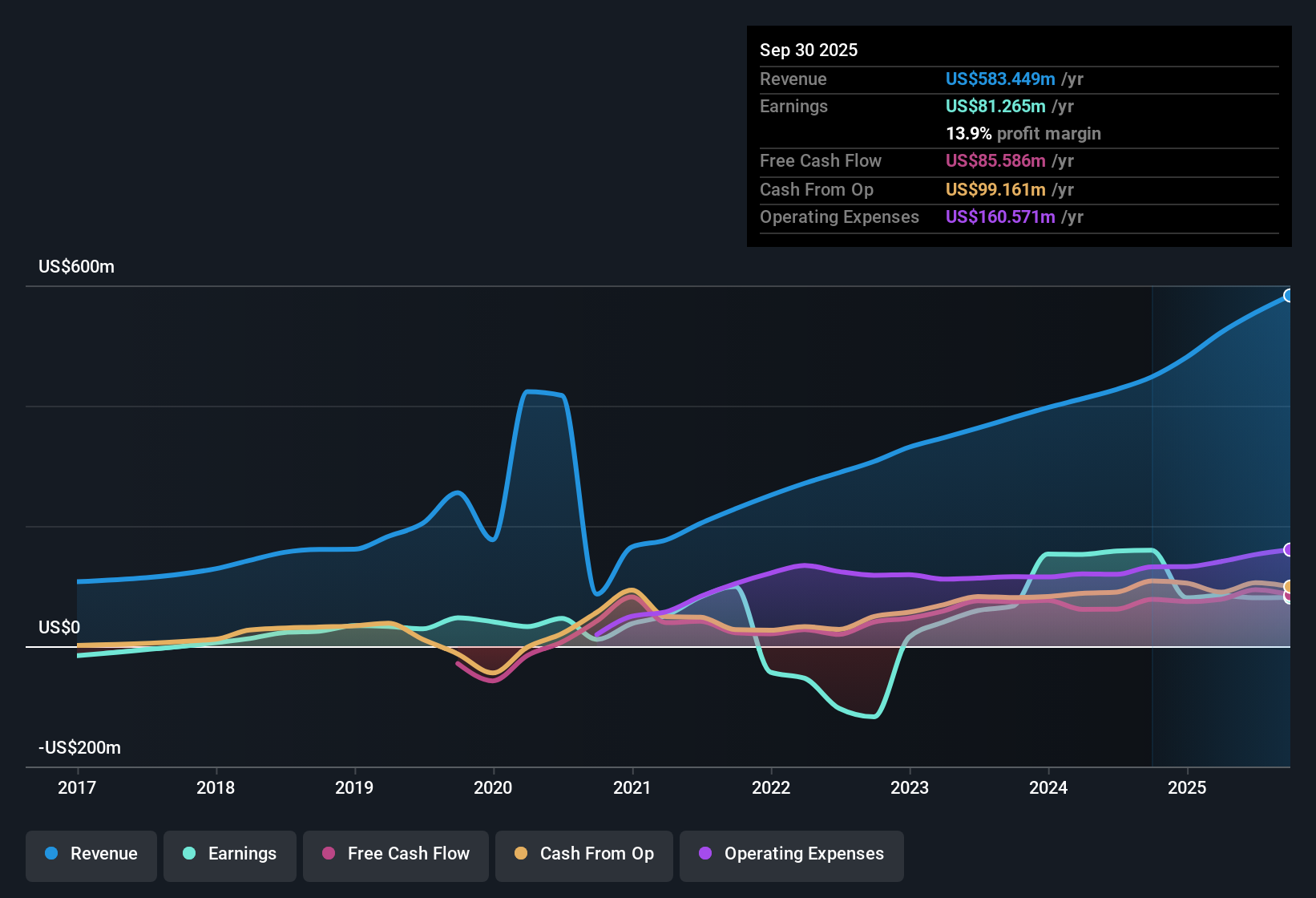

Opera (OPRA) posted robust forecasts in its recent results, with earnings expected to grow 23.8% annually, well above the US market’s 15.7% rate. Revenue is projected to climb 11.6% per year, while the current net profit margin sits at 14%, down from last year’s 35.6%. Over the past five years, earnings have averaged 29.8% annual growth, but the most recent period marked a decline. Against this backdrop, shares trade at $14.53, significantly below the estimated fair value of $48.31, and the price-to-earnings ratio stands at 16x, which is lower than both industry and peer averages. With strong forecasts and an attractive relative valuation, attention now turns to what the margin contraction could mean for investors going forward.

See our full analysis for Opera.Now, let’s see how these results hold up against the narratives built around Opera. This is where the numbers get put to the real test.

See what the community is saying about Opera

Margin Recovery in Analyst Forecasts

- Analysts expect Opera’s profit margin to rise from 14.5% today to 16.7% over the next three years, partially offsetting the recent drop from last year’s 35.6%.

- According to the analysts' consensus view, product and market expansion, such as AI-powered browser launches and entry into fintech, are set to help steady margins.

- Consensus narrative notes that growing average revenue per user (ARPU), from Western markets and premium offerings, could improve margins further.

- However, the company's dependence on integrating third-party AI and heavy regulatory exposure in fintech may dampen long-term margin expansion, tempering the optimism of the margin outlook.

- Momentum Behind New Revenue Streams

- Revenue tied to advertising and digital commerce saw 44% year-over-year growth within e-commerce-related verticals, adding to Opera’s diversification efforts beyond core browser income.

- As analysts’ consensus view highlights, the shift into fintech, AI, and targeted advertising is lowering reliance on browser ad revenue and helping Opera tap into broad digitalization trends.

- Expansion of MiniPay, Opera’s stablecoin wallet, supports this by bringing in 9 million activated wallets and 250 million transactions, a real sign of traction among new user cohorts.

- Bulls see these diversification wins as key to unlocking stronger future earnings, while skeptics caution that further regulatory or partnership risks could limit near-term monetization.

Valuation Points to Reward Skew

- Opera trades at $14.53 per share, well below both its DCF fair value of $48.31 and the consensus analyst price target of $25.50, a 23.2% upside from the stock price.

- Consensus narrative asserts this discount is supported by Opera’s PE ratio of 16x, marking a significant gap with the software sector’s 34.8x and its peer group’s 28.9x.

- This valuation gap, together with solid long-term earnings growth assumptions of 23.8% annually, heavily supports the view that rewards outweigh risks for new investors.

- At the same time, the analyst expectations are predicated on Opera maintaining its higher growth pace and not seeing further deterioration in margins or competitive position in the browser and fintech markets.

Consensus estimates suggest Opera’s story is just getting started, especially if execution matches ambitious growth targets. See how the full market narrative weighs the risks and upside in our consensus summary. 📊 Read the full Opera Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Opera on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the numbers that stands out? Share your viewpoint in just a few moments and shape your own story. Do it your way

A great starting point for your Opera research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Opera’s earnings outlook is upbeat, sustained margin volatility and questions about the durability of long-term profit growth introduce notable uncertainty for investors.

If steady performance matters to you, use our stable growth stocks screener (2113 results) to discover companies that consistently deliver reliable growth and maintain stronger margins across changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPRA

Opera

Provides mobile and PC web browsers and related products and services in Norway and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion