- United States

- /

- Software

- /

- NasdaqGS:OPRA

Opera (NasdaqGS:OPRA) Announces Robust First-Quarter Earnings With Sales Reaching US$143 Million

Reviewed by Simply Wall St

Opera (NasdaqGS:OPRA) announced robust first-quarter earnings, with sales reaching USD 143 million, marking a significant year-over-year increase. Alongside strong figures, the launch of Aria, an innovative AI feature, further highlighted Opera's strategic advancements. Market conditions saw broad major indexes sliding with concerns surrounding a weak GDP report, yet Opera shares climbed 18% over the past week, aligning against the broader tech sector's downturn. With positive corporate guidance and promising product developments, Opera's upward movement might have counterbalanced the general negative sentiment driven by other tech stocks and economic indicators.

Be aware that Opera is showing 2 risks in our investment analysis.

Find companies with promising cash flow potential yet trading below their fair value.

The recent introduction of Aria, Opera's AI feature, alongside strong first-quarter earnings, has sparked optimism about its future. Revenue growth and enhanced user engagement through its AI initiatives are positive indicators, supporting the narrative of potential increases in revenue and average revenue per user (ARPU). Looking forward, Opera's strategic focus on Western markets and product innovation sets the stage for sustained momentum, though risks from advertising overdependence and economic shifts remain considerations.

Over the past five years, Opera achieved a total return of 300.19%, demonstrating substantial long-term share performance. This contrasts with the past year's comparative performance against the broader US Software industry, where Opera outperformed the industry return of 12%. This consistent upward trend reflects both the company’s growth initiatives and market confidence despite last year's earnings decline.

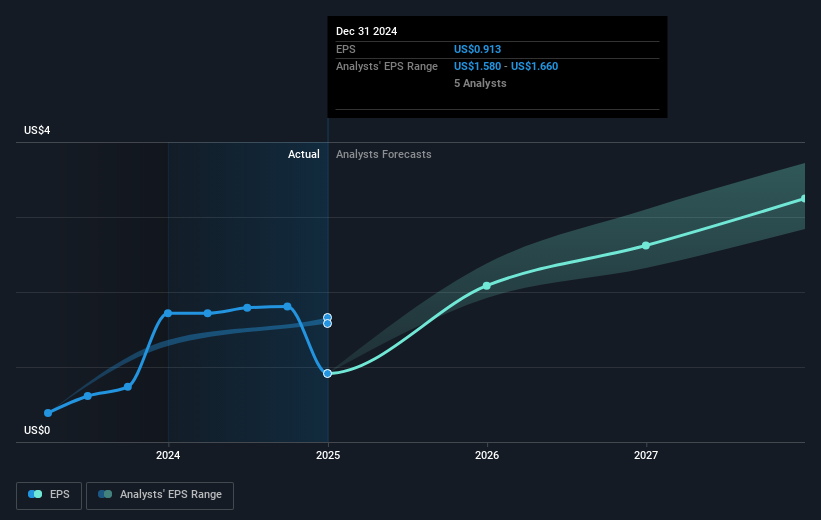

In the context of Opera's recent price targets, the current share price of $14.32 presents a significant discount of 44.2% compared to the analyst consensus price target of $25.64. This gap underscores the potential for further appreciation based on forecasted earnings growth and increased profit margins, which are expected to elevate from 16.8% to 18.8% over the next three years. As Opera continues to strengthen its advertising capabilities and expand its market presence, these developments could enhance revenue forecasts, aligning with the bullish sentiment expressed by analysts.

Evaluate Opera's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPRA

Opera

Provides mobile and PC web browsers and related products and services in Norway and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives