- United States

- /

- Software

- /

- NasdaqGS:OPRA

How Opera’s AI Browser Upgrades and Query Growth Could Shape the OPRA Investment Case

Reviewed by Sasha Jovanovic

- Opera has recently rolled out a new generation of AI-powered features across its Opera One, Opera GX, and Opera Neon browsers, reaching over 80 million users and leveraging Google's Gemini AI models for faster, more interactive experiences.

- A noteworthy element is Opera's rebuilt agentic architecture, which not only delivers 20% faster response times but also enables new voice and multi-file analysis capabilities, supporting a reported 17% annual growth in AI-driven query revenue.

- We’ll examine how Opera’s latest AI integration and rising AI-driven query revenue impact its longer-term investment narrative and competitive position.

Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

Opera Investment Narrative Recap

For investors considering Opera, the central question is whether the company’s innovations in AI-powered browsers can materially boost user engagement and revenue in a market dominated by much larger competitors. The recent launch of AI-integrated features across Opera’s browsers may support near-term engagement and incremental query revenue, which is a key short-term catalyst, but the reliance on third-party AI models remains the biggest immediate risk, as it could raise costs and limit Opera’s ability to truly differentiate.

The recent launch of Opera Neon, an AI-native browser designed as a productivity tool for knowledge workers, is closely aligned with Opera’s push into premium segments and higher ARPU markets. This move reinforces Opera’s effort to monetize advanced features, but also brings into focus potential margin pressures tied to ongoing dependence on major AI providers and licensing arrangements.

By contrast, investors should be aware of emerging risks tied to Opera’s deep reliance on outside technology partners, especially as competition in browser AI continues to intensify...

Read the full narrative on Opera (it's free!)

Opera's outlook anticipates $813.6 million in revenue and $135.8 million in earnings by 2028. This is based on analysts forecasting a 13.6% annual revenue growth rate and a $55.2 million increase in earnings from the current $80.6 million.

Uncover how Opera's forecasts yield a $25.50 fair value, a 87% upside to its current price.

Exploring Other Perspectives

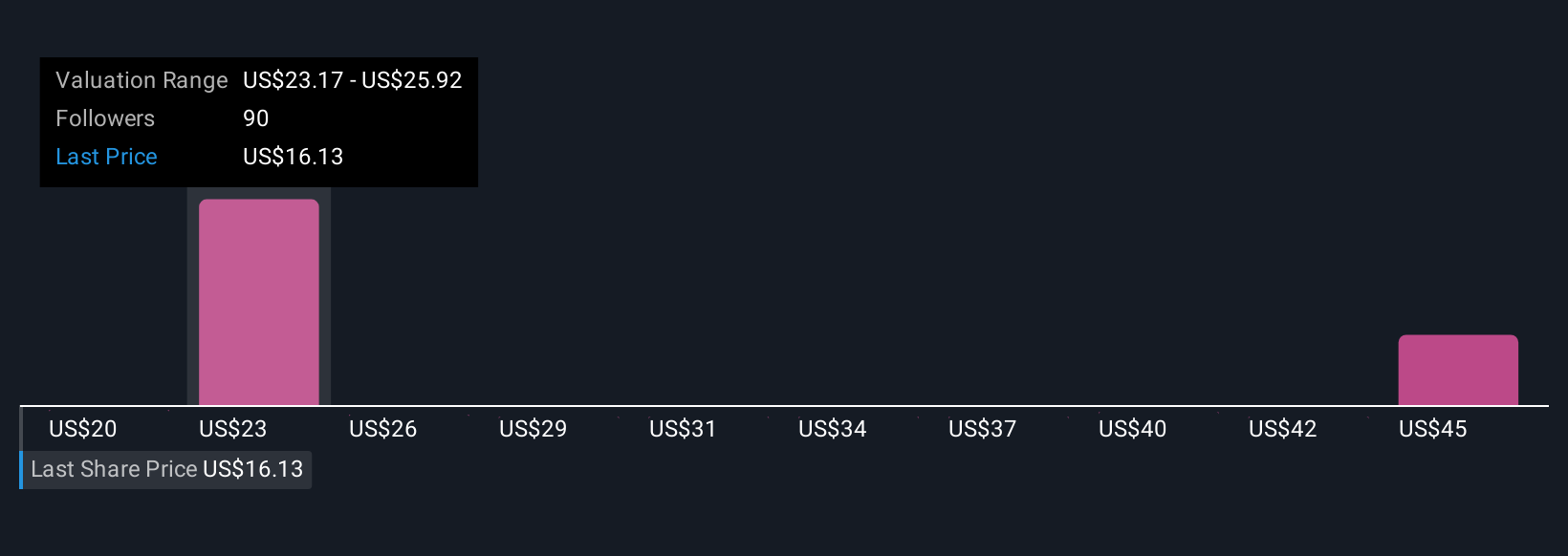

Eight members of the Simply Wall St Community currently value Opera shares between US$23 and US$49.92, capturing a wide spectrum of opinions about its future prospects. As you weigh these perspectives, keep in mind that rising licensing costs tied to external AI model integration could influence Opera’s long-term earnings growth; explore the range of viewpoints to inform your own assessment.

Explore 8 other fair value estimates on Opera - why the stock might be worth just $23.00!

Build Your Own Opera Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Opera research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Opera research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Opera's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OPRA

Opera

Provides mobile and PC web browsers and related products and services in Norway and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Endeavour Group's Future PE Expected to Climb to 15.51%

A Quality Compounder Marked Down on Overblown Fears

Etsy Stock: Defending Differentiation in a World of Infinite Marketplaces

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion