- United States

- /

- IT

- /

- NasdaqGS:OKTA

Okta (OKTA): Reassessing Valuation After Strong Q3 Beat and Raised Revenue Guidance

Reviewed by Simply Wall St

Okta (OKTA) just delivered an earnings double punch, topping expectations for its third quarter and then raising revenue guidance for both the coming quarter and fiscal 2026, giving investors fresh numbers to reassess the stock.

See our latest analysis for Okta.

The upbeat guidance has helped extend Okta’s positive run, with a roughly mid teens year to date share price return and a solid multi year total shareholder return. This signals gradually improving sentiment rather than a speculative spike.

If this kind of steady, fundamentals driven move appeals to you, it might be worth exploring high growth tech and AI stocks as a way to spot the next wave of potential winners in similar spaces.

With shares still trading at a double digit discount to Wall Street targets despite accelerating profits, investors now face a crucial question: Is Okta quietly undervalued, or is the market already baking in the next leg of growth?

Most Popular Narrative: 18.8% Undervalued

With Okta last closing at $90.59 against a narrative fair value of $111.62, the story leans toward upside and hinges on how identity demand evolves.

The proliferation of AI agents and nonhuman identities is creating new, urgent security use cases that require sophisticated identity governance, privileged access management, and policy controls. These are areas where Okta is innovating (Cross App Access, Auth0 for AI Agents, Axiom acquisition), opening incremental growth avenues and potential margin expansion through higher value and differentiated products.

Curious how steady double digit growth, expanding margins, and a premium future earnings multiple can still point to upside? The narrative’s math may surprise you.

Result: Fair Value of $111.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from full stack security platforms and slower new customer growth could put pressure on Okta’s pricing power and challenge the upside narrative.

Find out about the key risks to this Okta narrative.

Another View: Pricing Sends a Different Signal

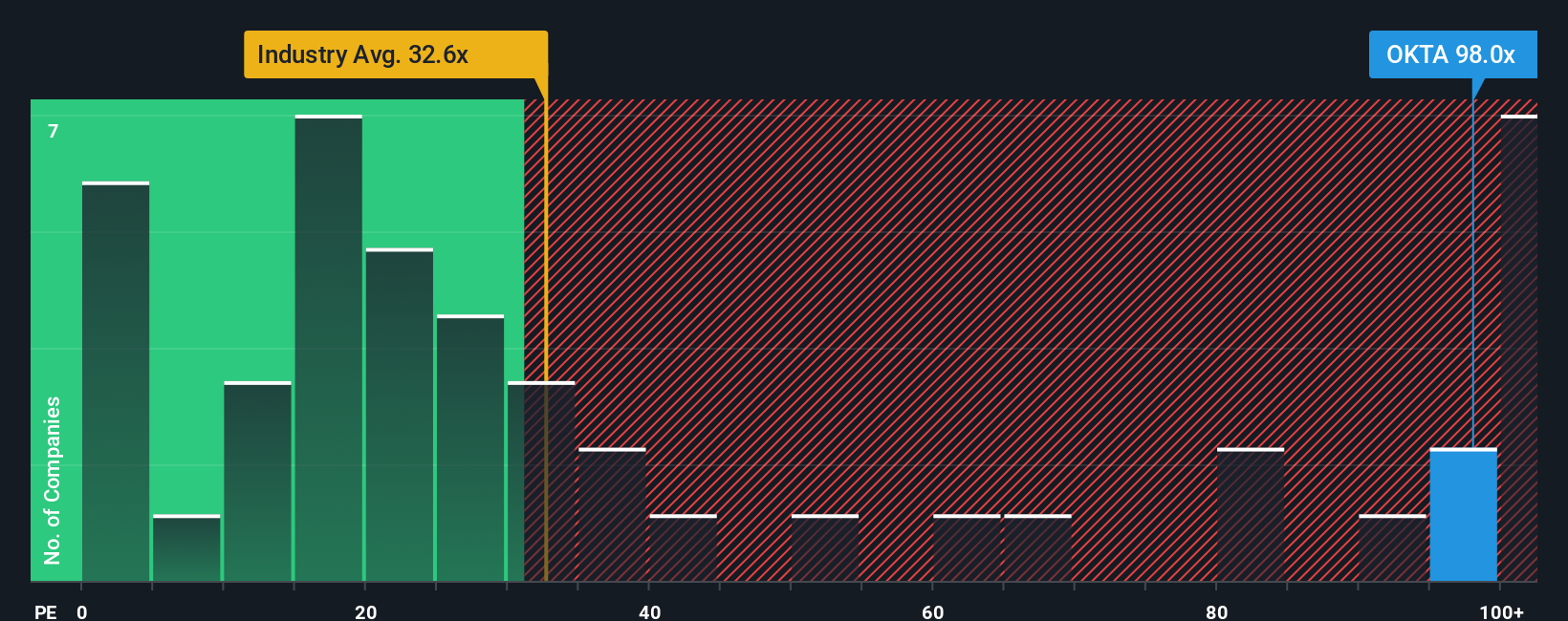

Okta may look undervalued against narrative fair value, but its 82.3x price to earnings stands far above the US IT sector at 30x, peers at 29.1x, and even a 36.2x fair ratio. That premium narrows the margin of safety, so what exactly is the market already pricing in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Okta Narrative

If you would rather follow your own research path or challenge these assumptions, you can build a personalized view of Okta in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Okta.

Looking for your next investing edge?

Do not stop with just one opportunity, use the Simply Wall Street Screener to uncover fresh stocks that match your goals before the crowd catches on.

- Capture potential mispricing by targeting quality companies trading below intrinsic value through these 904 undervalued stocks based on cash flows tailored to cash flow strength.

- Capitalize on the AI tailwind by zeroing in on innovators shaping automation, data intelligence, and smart platforms with these 25 AI penny stocks.

- Lock in recurring income potential by focusing on reliable payers and sustainable yields using these 12 dividend stocks with yields > 3% as your starting filter.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026