- United States

- /

- IT

- /

- NasdaqGS:OKTA

Okta (OKTA): Evaluating Valuation as Growth Slows and Competitive Pressures Rise

Reviewed by Kshitija Bhandaru

Okta (OKTA) has seen its billings growth slow, with analysts pointing to heightened competition and growing challenges in retaining customers. Investors are closely watching the impact on future revenue and cash flow margins.

See our latest analysis for Okta.

Despite introducing new products aimed at AI security, Okta’s recent news has not yet reignited strong momentum in the share price. After a solid start to the year, the company’s 1-year total shareholder return stands at 13.26%, but longer-term performance remains challenging, with the 5-year total shareholder return still deeply negative. The market’s latest moves reflect ongoing uncertainty about Okta’s growth prospects amid stiffening competition and muted billings growth.

If you’re weighing your next investment move, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

With a recent track record of modest returns and slowing growth, is Okta’s current valuation offering investors a true bargain, or is the market already factoring in all future challenges and upside?

Most Popular Narrative: 26% Undervalued

With Okta’s fair value pegged at $120.37, the most widely followed narrative sees a compelling gap compared to the last close at $89.08. This sets the backdrop for a dramatic difference in outlook between the market and the valuation narrative, especially with so much riding on Okta’s future growth path.

Okta is positioned to capture expanding demand as enterprises globally accelerate cloud migration and digital transformation, with increasing complexity and fragmentation in identity systems driving large organizations to consolidate onto a unified, cloud-native platform, supporting multi-year revenue growth and larger average contract values (ACV).

Want to uncover why this valuation stands apart from current market sentiment? The narrative’s core rests on an aggressive mix of sustained revenue expansion and margin shifts few expect. A handful of pivotal earnings and growth projections drive this optimistic scenario. Curious which assumptions tip the scales? Dive in to discover what really moves the needle in Okta’s fair value math.

Result: Fair Value of $120.37 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if Okta loses ground to integrated security platforms or struggles with scaling new technologies, the optimistic growth story could quickly unravel.

Find out about the key risks to this Okta narrative.

Another View: Multiples Suggest a Steeper Price

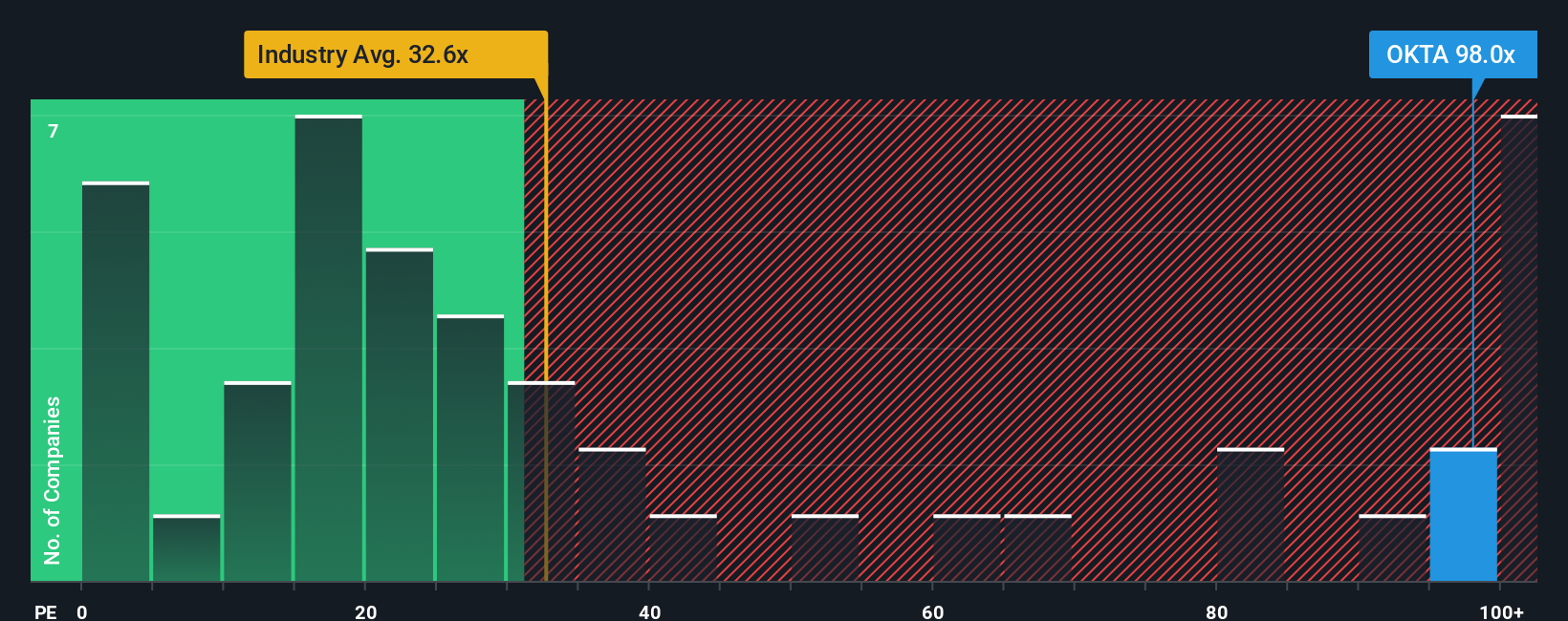

While fair value estimates point to Okta being undervalued, looking at its price-to-earnings ratio tells a different story. The company trades at 93.5x earnings compared to the US IT industry’s average of just 32.2x, and even further above its fair ratio of 40.6x. This wide gap means investors could be taking on valuation risk if market sentiment shifts. Should you trust the promise of future growth, or does this premium signal caution?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Okta Narrative

If this analysis doesn't align with your perspective or you want to reach your own conclusions, you can easily craft your own narrative in just a few minutes. So why not Do it your way?

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Okta.

Looking for more investment ideas?

Why limit your strategy to just one company when there is a world of standout opportunities? Smart investors constantly refresh their watchlist to uncover tomorrow’s winners and avoid missing out on the leaders of the next big trend.

- Catch explosive upswings in the market by checking out these 3559 penny stocks with strong financials, where potential breakout stocks with solid financials may fit your bold investment style.

- Unlock long-term wealth strategies through these 18 dividend stocks with yields > 3% that spotlight resilient businesses delivering steady income and outperforming yields above 3%.

- Capitalize on the future of medicine by exploring these 33 healthcare AI stocks, filled with innovative companies harnessing artificial intelligence to transform healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives