- United States

- /

- IT

- /

- NasdaqGS:OKTA

Okta (NasdaqGS:OKTA) Projects US$712 Million Q2 Revenue With 10% Year-Over-Year Growth

Reviewed by Simply Wall St

Okta (NasdaqGS:OKTA) has announced confirmed earnings guidance, anticipating a 10% year-over-year growth for Q2 fiscal 2026. This factors into its notable 40% share price increase over the last quarter, contrasting with a flat broader market. During this period, significant events included Okta's addition to multiple S&P indexes and introducing innovative product features, which complemented the upward price movement. While the market held steady amidst global economic uncertainties, Okta's solid financial performance and favorable market positioning likely bolstered investor confidence despite the broader economic challenges widely discussed.

Be aware that Okta is showing 1 warning sign in our investment analysis.

Okta's recent announcement of a 10% year-over-year earnings growth guidance and its integration into multiple S&P indexes contributed to a 40% surge in its share price over the past quarter. These developments are critical, as they align with the narrative of robust demand for secure identity management solutions amid rising cybersecurity threats and the proliferation of AI. While the short-term market reaction has been positive, it's important to analyze the broader context. Over the last three years, Okta's total shareholder return, including dividends, was 51.11%, reflecting a solid longer-term performance.

Over the past year, Okta underperformed compared to the US IT industry, which saw a 32.3% increase. However, the company's inclusion in S&P indexes and recent product innovations may bolster its competitive differentiation. In terms of future revenue and earnings, analysts project steady growth, indicating that the recent upward momentum could potentially continue to support Okta's forecasts. Currently trading at US$123.72, the share price is slightly above the consensus price target of US$123.56, suggesting a minimal premium and indicating that market sentiment is largely in line with analyst expectations. As Okta capitalizes on its market positioning, it remains vital to stay informed and critically assess these projections against personal assumptions and expectations.

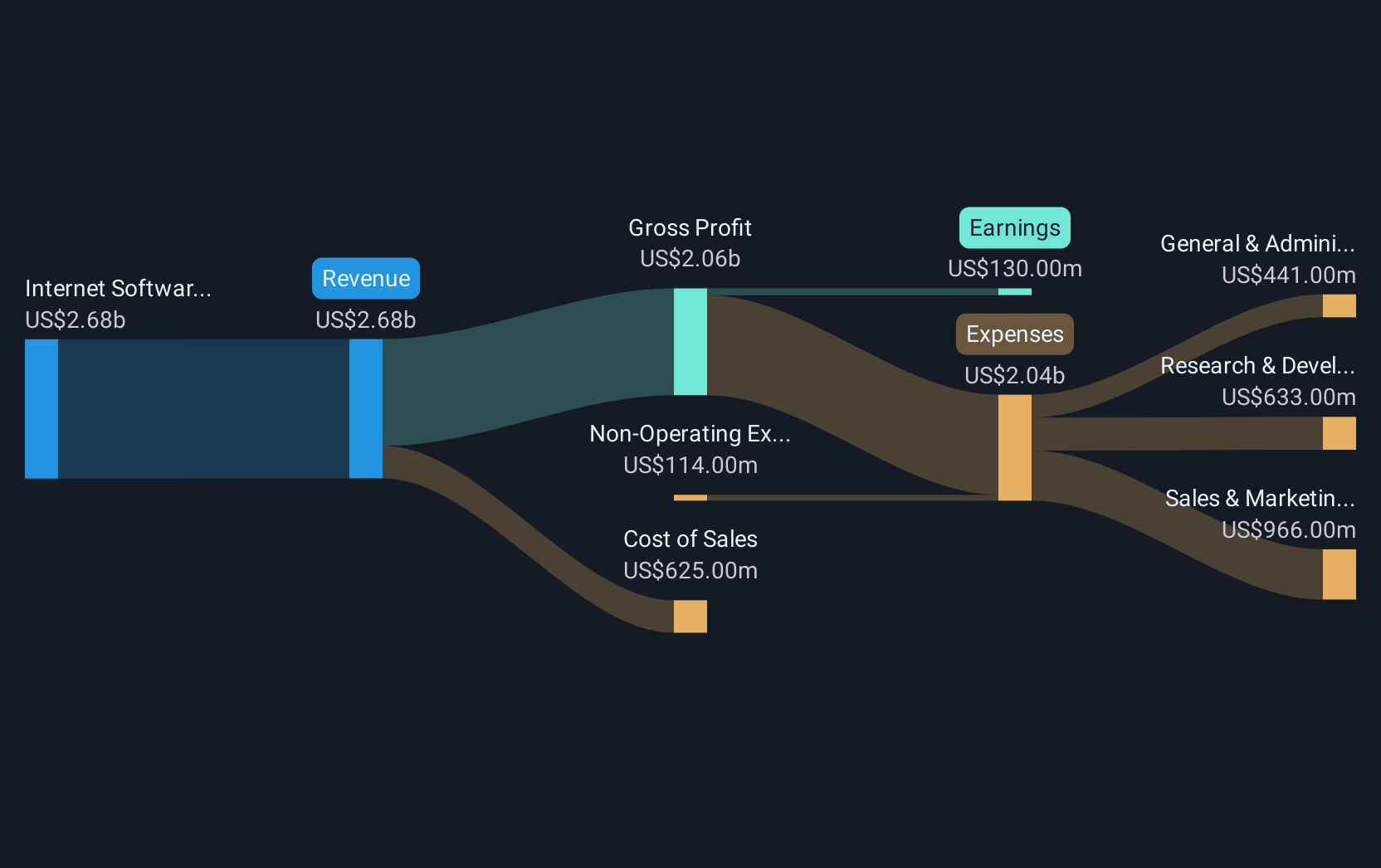

Click to explore a detailed breakdown of our findings in Okta's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:OKTA

Okta

Operates as an identity partner in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives