- United States

- /

- Software

- /

- NasdaqCM:BTDR

High Growth Tech Stocks To Watch In February 2025

Reviewed by Simply Wall St

In the last week, the United States market has been flat, yet it has risen by 22% over the past year with earnings forecasted to grow annually by 15%. In this environment, identifying high growth tech stocks involves looking for companies that are well-positioned to capitalize on technological advancements and have strong potential for revenue expansion.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 29.07% | 27.57% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 29.48% | 53.36% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.33% | 61.73% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.80% | 58.78% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

| Alvotech | 31.17% | 100.18% | ★★★★★★ |

Click here to see the full list of 229 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Bitdeer Technologies Group (NasdaqCM:BTDR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bitdeer Technologies Group operates as a technology company focused on blockchain and computing, with a market cap of $3.18 billion.

Operations: The company generates revenue primarily through data processing, amounting to $395.61 million.

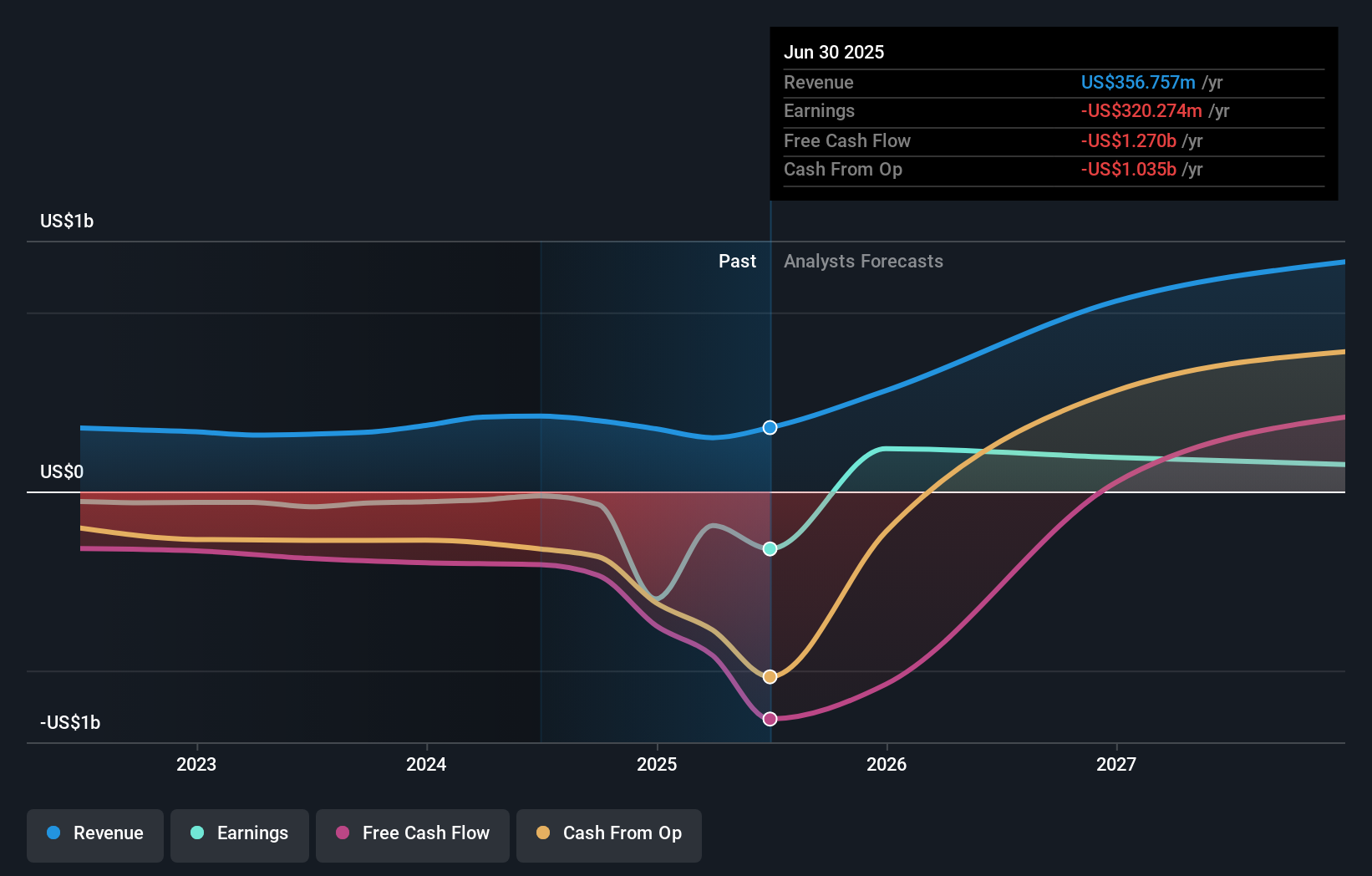

Bitdeer Technologies Group, in its recent stride within the high-growth tech sector, has been marked by notable developments and a strong focus on innovation. With the appointment of Ms. Yuling Ma as CTO, the company is poised to enhance its technological strategies and product offerings, particularly through initiatives like ReMine which facilitates a transparent market for mining machine transactions. Despite facing challenges such as a significant drop in Bitcoin mined monthly year-over-year from 434 to 145 Bitcoins and reporting substantial losses with a net loss of $50.1 million in Q3 2024 alone, Bitdeer's revenue growth projections remain robust at an annual rate of 51.8%. This figure outpaces general US market expectations significantly and underscores potential for recovery and profitability, supported by strategic leadership changes and product innovations that could catalyze future financial performance.

Agilysys (NasdaqGS:AGYS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Agilysys, Inc. is a company that develops and markets software-enabled solutions and services for the hospitality industry across North America, Europe, the Asia-Pacific region, and India with a market capitalization of approximately $2.42 billion.

Operations: Agilysys focuses on providing software-enabled solutions and services specifically tailored for the hospitality industry, generating revenue primarily from its Computer Services segment, which amounts to $263.57 million.

Agilysys, a key player in the hospitality software sector, recently announced significant client acquisitions, including Hamilton Island Enterprises and Kiva Dunes, which have adopted its comprehensive suite of solutions to enhance operational efficiencies and guest experiences. This strategic expansion is underscored by a robust annual revenue growth of 17.9% and an impressive forecasted earnings increase of 22.5% per year. Despite a challenging past with earnings dropping by 74% last year, Agilysys's commitment to innovation is evident in its R&D spending trends that align closely with its revenue growth, ensuring the company remains at the forefront of technological advancements in its industry. These developments suggest promising prospects for Agilysys as it continues to evolve and cater to the dynamic needs of global hospitality providers.

- Take a closer look at Agilysys' potential here in our health report.

Gain insights into Agilysys' past trends and performance with our Past report.

Okta (NasdaqGS:OKTA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Okta, Inc. operates as an identity partner in the United States and internationally, with a market cap of $16.50 billion.

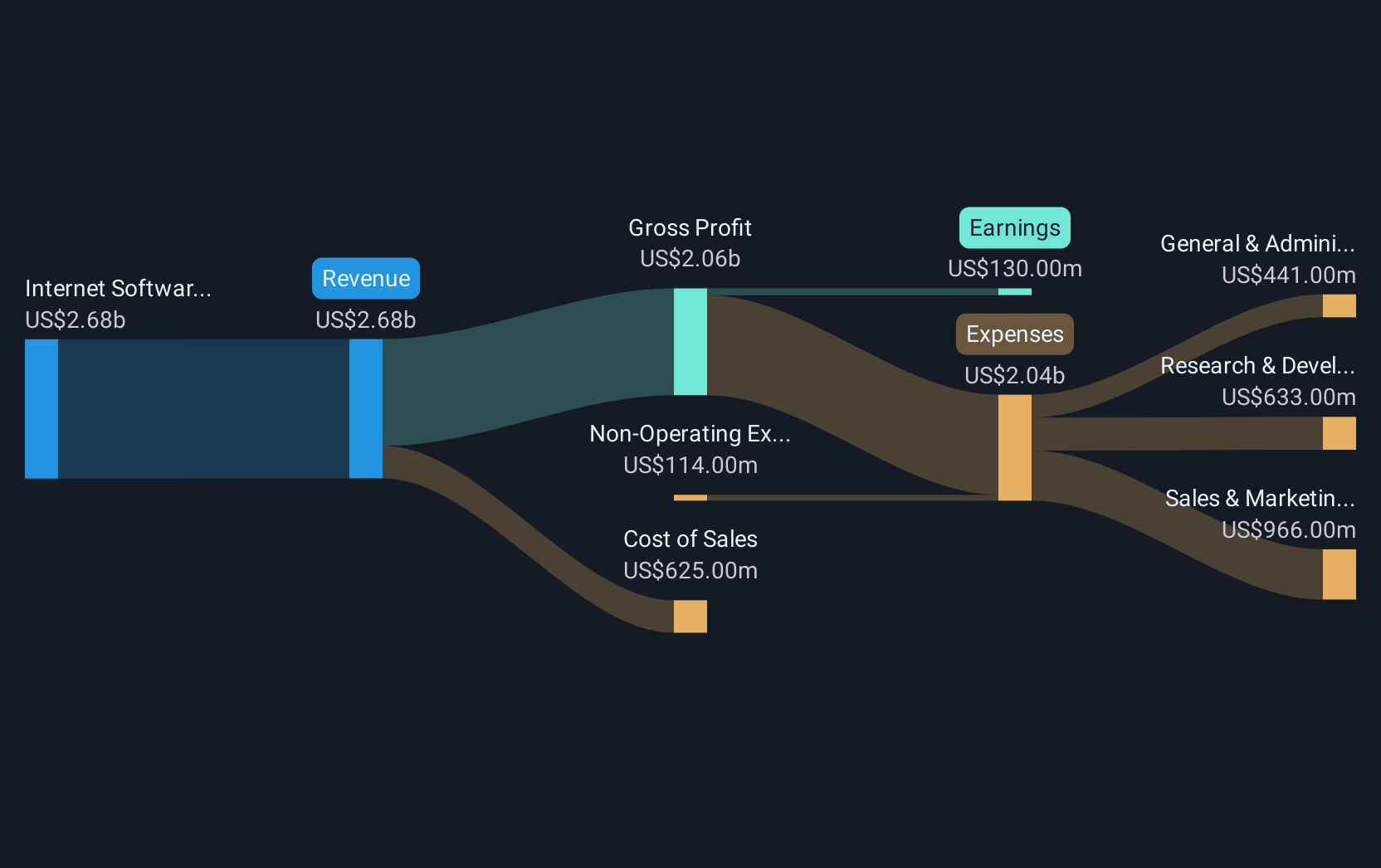

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $2.53 billion. It operates as an identity partner across the United States and internationally, focusing on providing secure identity management solutions.

Okta's strategic partnership with Incode Technologies, announced on February 13, 2025, marks a significant advancement in workforce identity management by integrating cutting-edge biometric authentication with Okta's cloud services. This collaboration is set to enhance security across distributed networks, crucial in an era where traditional multi-factor authentication systems are increasingly bypassed by sophisticated AI-driven threats. Additionally, the recent executive reshuffle with Eric Kelleher stepping up as COO underscores Okta's focus on reigniting growth and leveraging identity solutions to solidify its market position. With these developments and a robust projected revenue growth of 9.6% per year alongside an expected earnings surge of 38.2%, Okta is well-positioned to capitalize on the expanding demand for secure and efficient digital identity solutions.

- Click here to discover the nuances of Okta with our detailed analytical health report.

Evaluate Okta's historical performance by accessing our past performance report.

Key Takeaways

- Get an in-depth perspective on all 229 US High Growth Tech and AI Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and computing.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives