- United States

- /

- Software

- /

- NasdaqGS:NTSK

Is Netskope’s Recent 22.7% Jump Justified by Its Valuation and Growth Outlook?

Reviewed by Bailey Pemberton

- Many investors are asking whether Netskope is quietly becoming a bargain or just another hyped software name, as the market starts to pay closer attention to its underlying value story.

- The stock has jumped 22.7% over the last week while remaining flat over the past month and year to date. This pattern often signals a shift in sentiment rather than a long established trend.

- Recent headlines have focused on Netskope's position in cloud security and secure access service edge technology, highlighting new customer wins and growing interest from large enterprises looking to modernize their network security stack. At the same time, sector wide coverage has framed Netskope alongside other cybersecurity players as potential beneficiaries of rising cyber spending and the ongoing shift to zero trust architectures.

- Despite that buzz, Netskope currently carries a valuation score of 0/6, suggesting it does not screen as undervalued on any of the standard checks. Next, we will unpack those valuation methods in detail and then finish with a more holistic way to think about what the stock may be worth.

Netskope scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Netskope Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting its future cash flows and then discounting them back to today, using a required rate of return. For Netskope, the DCF is based on a 2 Stage Free Cash Flow to Equity approach, using cash flow projections in $ as the foundation.

Netskope currently generates last twelve month Free Cash Flow of about $3.95 Million. Analyst and model projections see this rising sharply, with estimated Free Cash Flow reaching around $345 Million in 2035 as the business scales and margins improve. The early years are anchored to analyst expectations, while Simply Wall St extrapolates additional years to complete the 10 year forecast path.

When all of these projected cash flows are discounted back to today, the model produces an intrinsic value of roughly $10.00 per share. Compared with the current share price, the DCF implies the stock is about 125.0% overvalued. This suggests investors are paying well ahead of the modeled cash flow story.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Netskope may be overvalued by 125.0%. Discover 907 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Netskope Price vs Sales

For growing software companies that are still working toward consistent profitability, the Price to Sales ratio is often the most practical valuation yardstick because it relates the share price directly to current revenue, which is usually more stable than earnings.

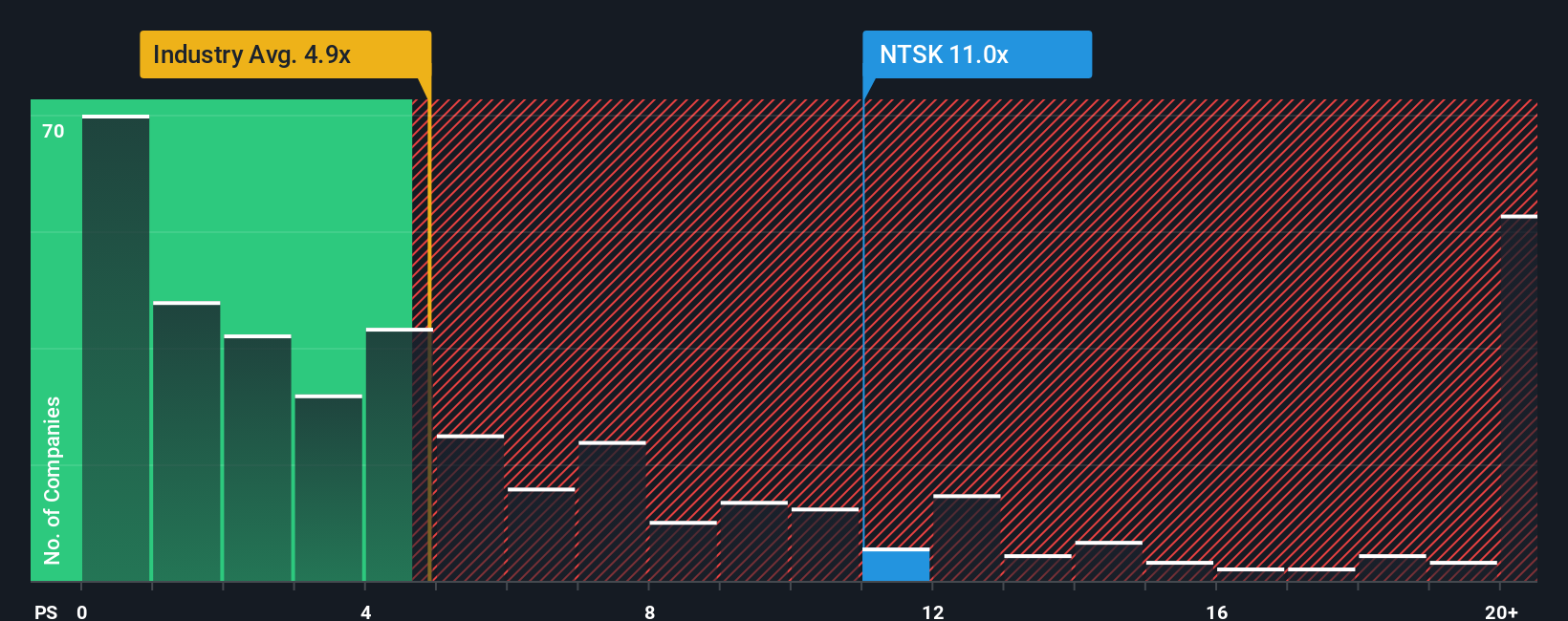

In general, faster revenue growth and lower business risk can justify a higher P/S multiple, while slower growth, thinner margins, or higher uncertainty should pull that “normal” or “fair” multiple lower. Netskope currently trades at about 13.97x sales, which is well above both the Software industry average of roughly 5.06x and the peer group average of about 8.90x. This indicates that the market is already pricing in strong growth and execution.

Simply Wall St’s Fair Ratio is a proprietary estimate of what Netskope’s P/S should be once we factor in its growth outlook, profitability profile, competitive position, market cap and risk. This makes it a more tailored benchmark than a simple comparison with peers or the broader industry, which can miss important differences in quality or risk. As Netskope does not have a Fair Ratio calculated here, we cannot formally declare it over or undervalued on this metric alone. However, the sizable premium to both peers and the sector suggests expectations are demanding.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1446 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Netskope Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story to your numbers, including what you think Netskope is worth and how its revenue, earnings and margins might evolve over time. A Narrative connects three parts of your investment view: the business story you believe in, the financial forecast that flows from that story, and the fair value estimate that those forecasts imply. On Simply Wall St, millions of investors build and share these Narratives on the Community page, making it easy to explore different perspectives without needing a spreadsheet or complex models. Narratives then help you decide when to buy or sell by comparing your Fair Value directly with today’s share price, and they automatically update as new information such as earnings results or major news is released. For example, some Netskope investors may build Narratives that point to a fair value that is much higher than today’s price. Others, using more conservative assumptions, may arrive at a significantly lower figure.

Do you think there's more to the story for Netskope? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Netskope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTSK

Netskope

A cybersecurity company, provides security, networking, and analytics solutions to largest enterprises to mid-sized companies worldwide.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)