- United States

- /

- Software

- /

- NasdaqGS:NTSK

Does Netskope’s Recent 1.9% Price Uptick Signal Growth Potential in 2025?

Reviewed by Bailey Pemberton

If you are considering what to do with Netskope stock, you are certainly not alone. The market has been watching closely as Netskope’s price edged up by 1.9% over the past week, reflecting renewed interest after a fairly quiet start to the year. At last close, shares were priced at $22.45, which puts things in an interesting spot for both long-term backers and newcomers deciding whether this is a moment to buy, sell, or simply watch from the sidelines.

Despite the modest positive return week over week, year to date the stock is slightly in the red, down 0.2%, which might say as much about shifting risk perceptions as it does about company-specific news. At first glance, those movements could hint at underlying growth potential, but some investors may see them as noise in an evolving market landscape.

When it comes to valuation, Netskope’s score currently stands at 0 out of 6 based on the standard undervaluation checks. That means the company isn’t rated as undervalued under any of the typical measures, so if you were hoping for a quick green light from the numbers alone, you might want to look more closely.

Let’s break down exactly how those valuation checks work and what they reveal about Netskope’s current status. In addition, I’ll share an even better approach to understanding value that goes beyond the basics, so you get a complete picture before making your next move.

Netskope scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

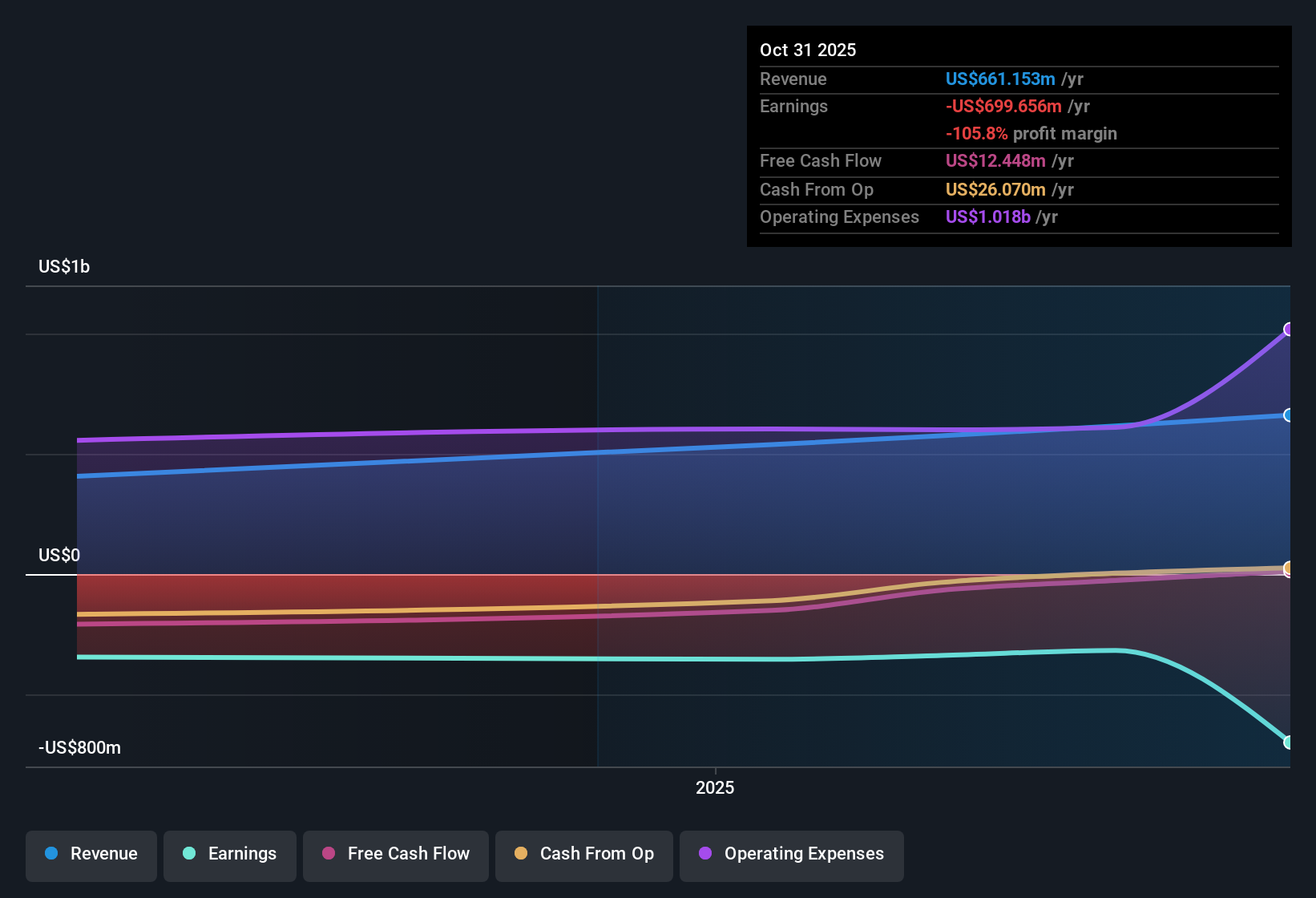

Approach 1: Netskope Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's value. This approach helps investors understand whether a stock’s current price is justified by its future earnings, or if it is trading at a bargain or a premium.

For Netskope, the model uses a two-stage projection of Free Cash Flow (FCF). Currently, Netskope’s FCF stands at $3.95 Million. Analysts project FCF to increase steadily, reaching $76.18 Million by 2028. Looking even further, extrapolated data suggests FCF could rise to $341.55 Million by 2035. These projections reflect accelerating growth. However, the estimates beyond five years are algorithmic rather than analyst-driven.

After running all the numbers, the DCF model calculates Netskope’s intrinsic fair value at $9.75 per share. Compared to its latest price of $22.45, this indicates the stock is trading at a 130.3% premium to its intrinsic value. This suggests significant overvaluation on a cash flow basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Netskope may be overvalued by 130.3%. Find undervalued stocks or create your own screener to find better value opportunities.

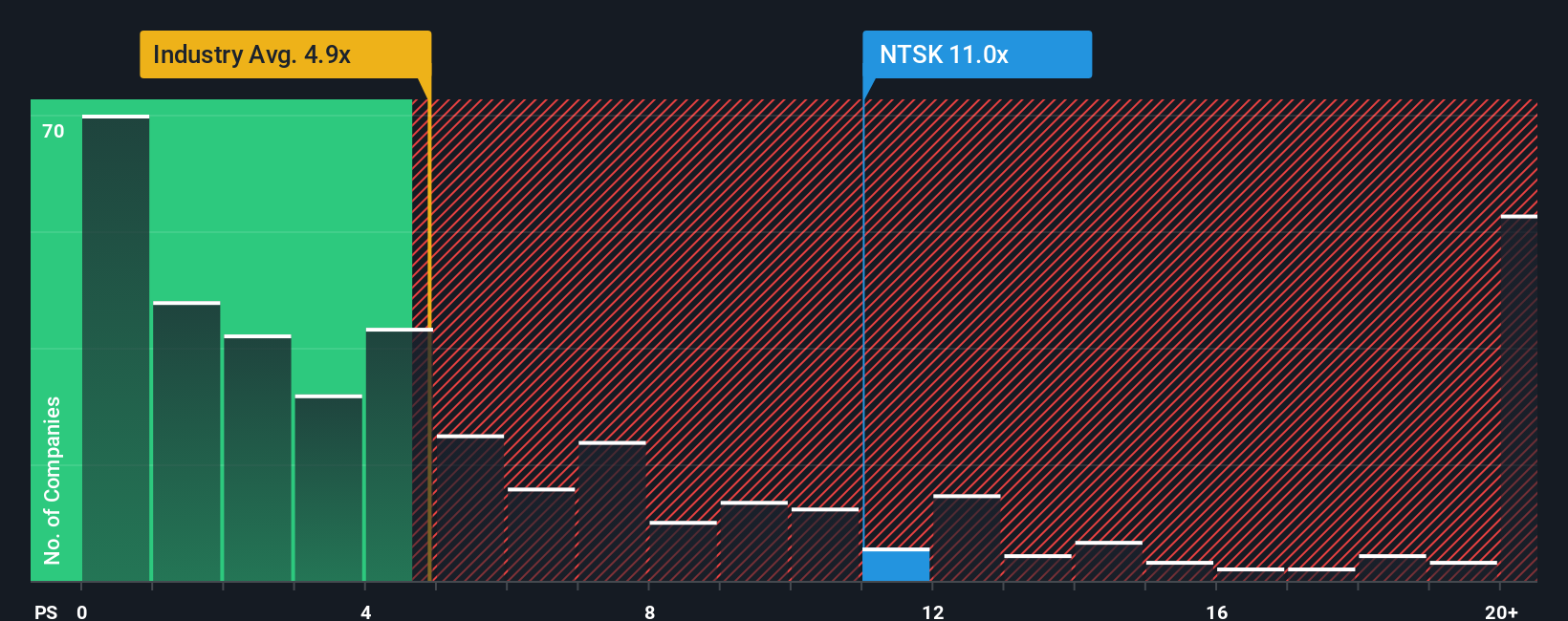

Approach 2: Netskope Price vs Sales

The Price-to-Sales (P/S) ratio is a valuable valuation metric, especially for technology and software companies like Netskope that may still be scaling toward profitability. It allows investors to gauge how much they are paying for each dollar of a company's sales, providing insight when earnings are negative or inconsistent. This is often the case for high-growth, reinvestment-heavy firms.

Generally, a company with higher growth prospects or lower risk may command a premium P/S ratio, while slower growth or higher risk should result in a lower ratio. Comparing Netskope’s P/S can help clarify whether the current price justifies its revenue potential and risk profile.

Currently, Netskope trades at a P/S ratio of 13.94x. When compared to the broader Software industry average of 5.19x and its peer group average of 7.68x, Netskope stands out as notably more expensive. This substantial premium typically reflects exceptional growth expectations or a strong competitive position, but also raises the stakes if growth falters.

Simply Wall St’s “Fair Ratio” takes this a step further by estimating the P/S ratio that would be considered reasonable given Netskope’s projected growth, profit margins, market cap, and unique risks. Unlike a broad peer or industry comparison, the Fair Ratio offers a more tailored and rigorous perspective that adapts as company fundamentals evolve.

In this case, comparing Netskope’s P/S of 13.94x to its Fair Ratio shows that the stock is significantly above what would be considered fair, indicating it is currently overvalued based on sales multiples.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Netskope Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story, or perspective, about a company and its future. It allows you to shape assumptions like fair value, future revenues, earnings, and profit margins to reflect how you see things unfolding.

With Narratives, you link Netskope’s business story directly to a financial forecast and ultimately to what you believe is a fair value for the stock. Narratives are a simple and accessible tool, available for every company on Simply Wall St’s Community page, where millions of investors share and refine their own views.

By building your own Narrative, you can easily see how your interpretation of Netskope’s potential stacks up against the current share price, helping you decide whether to buy, sell, or wait. Best of all, these Narratives stay up to date and automatically adjust as new earnings data or breaking news arrives so your view remains relevant.

For example, some investors in the Community see Netskope’s fair value as high as $35 per share, while others estimate it as low as $7. This showcases just how much perspectives can differ depending on the story you believe.

Do you think there's more to the story for Netskope? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netskope might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTSK

Netskope

A cybersecurity company, provides security, networking, and analytics solutions to largest enterprises to mid-sized companies worldwide.

Low risk with concerning outlook.

Similar Companies

Market Insights

Community Narratives