- United States

- /

- Software

- /

- NasdaqGS:NTNX

Nutanix (NTNX) Valuation After Earnings Reset and Guidance Cut: Short-Term Setback or Longer-Term Opportunity?

Reviewed by Simply Wall St

Nutanix (NTNX) has been under pressure after its latest earnings report, where revenue came in light and management trimmed forward guidance, blaming delayed deal closures rather than weakening demand or cash generation.

See our latest analysis for Nutanix.

The earnings reset has clearly knocked sentiment, with a roughly 26.8% 1 month share price decline and a 21.2% year to date share price return pulling back from earlier highs, even though the 3 year total shareholder return of about 58.9% still points to a solid longer term story.

If Nutanix’s volatility has you thinking about what else is out there in cloud and infrastructure, it might be a good time to explore high growth tech and AI stocks.

With Nutanix now trading well below both recent highs and average analyst targets, investors are left with a familiar puzzle: is this a reset that creates upside, or a signal that markets have already priced in future growth?

Most Popular Narrative Narrative: 31.7% Undervalued

With Nutanix last closing at $48.27 against a most popular narrative fair value of $70.70, the valuation gap reflects ambitious growth and margin expectations.

Innovation in AI driven and software defined offerings including enhanced AI capabilities (GPT in a Box 2.0, Nutanix Enterprise AI), support for external storage, and integrated container management differentiates the platform in an increasingly data

Curious how this story justifies a richer future earnings multiple and stronger margins than today, even after slower growth assumptions and a higher discount rate? The narrative leans on accelerating revenue, expanding profitability and a premium valuation usually reserved for category leaders. Want to see exactly which forecasts and time horizon have to play out for that upside to materialise?

Result: Fair Value of $70.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on Nutanix sustaining execution as competition intensifies and on large enterprise deals or renewals not slipping, delaying, or repricing materially.

Find out about the key risks to this Nutanix narrative.

Another View: Rich on Earnings Metrics

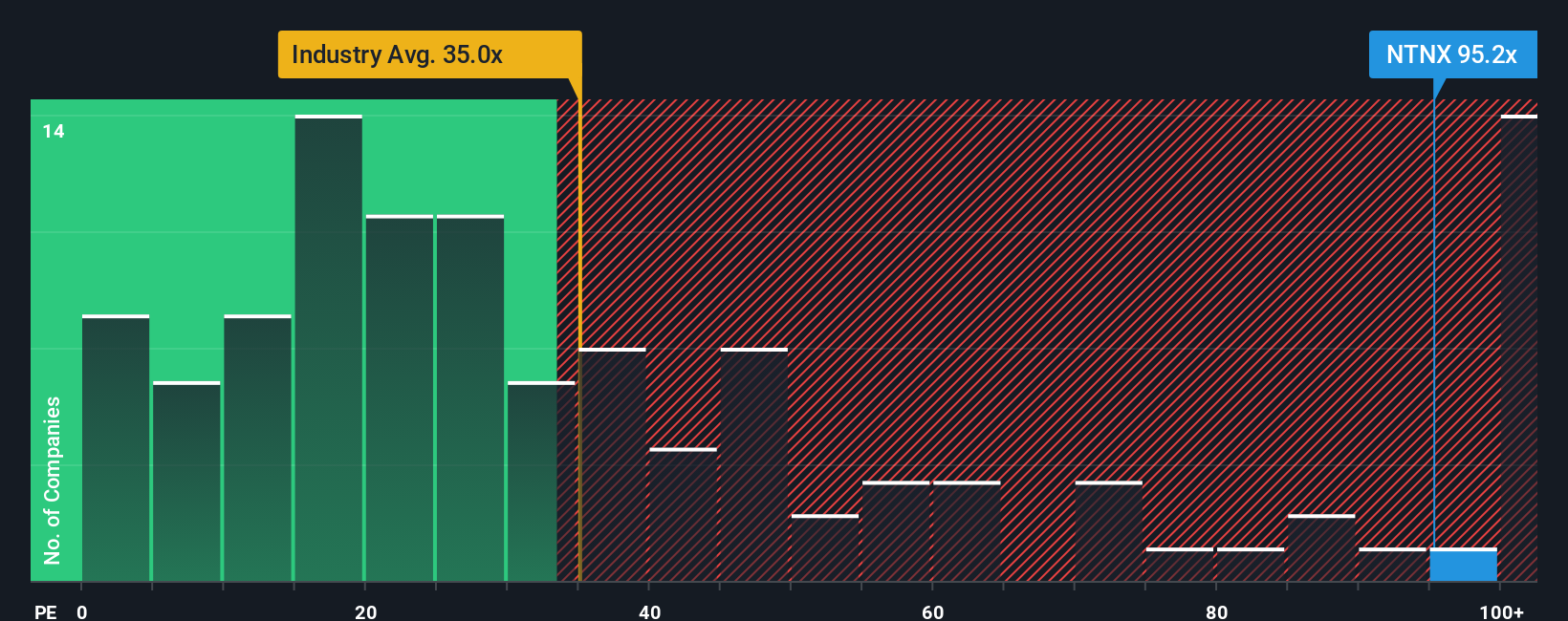

While the narrative points to upside versus fair value, Nutanix screens as expensive on earnings, trading at about 59.2 times earnings versus a fair ratio of 43.6 times, the US Software industry at 32.4 times, and peers around 41.8 times. Is the premium a cushion or a cliff if growth stumbles?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nutanix Narrative

If you see Nutanix differently or want to dive into the numbers yourself, you can build a custom view in just minutes, Do it your way.

A great starting point for your Nutanix research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

While Nutanix might be on your radar, you may miss powerful opportunities if you stop here. Let Simply Wall St’s screener guide your next smart move.

- Capture early stage momentum by targeting growth potential within these 3625 penny stocks with strong financials before the wider market catches on.

- Position yourself at the heart of the automation wave by screening for next generation innovators using these 25 AI penny stocks.

- Lock in income and resilience by hunting for reliable payers through these 13 dividend stocks with yields > 3% that can support long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)