- United States

- /

- Software

- /

- NasdaqGS:NTNX

Nutanix (NTNX) Net Profit Margin Turns Positive, Challenging Cautious Narratives on Profit Sustainability

Reviewed by Simply Wall St

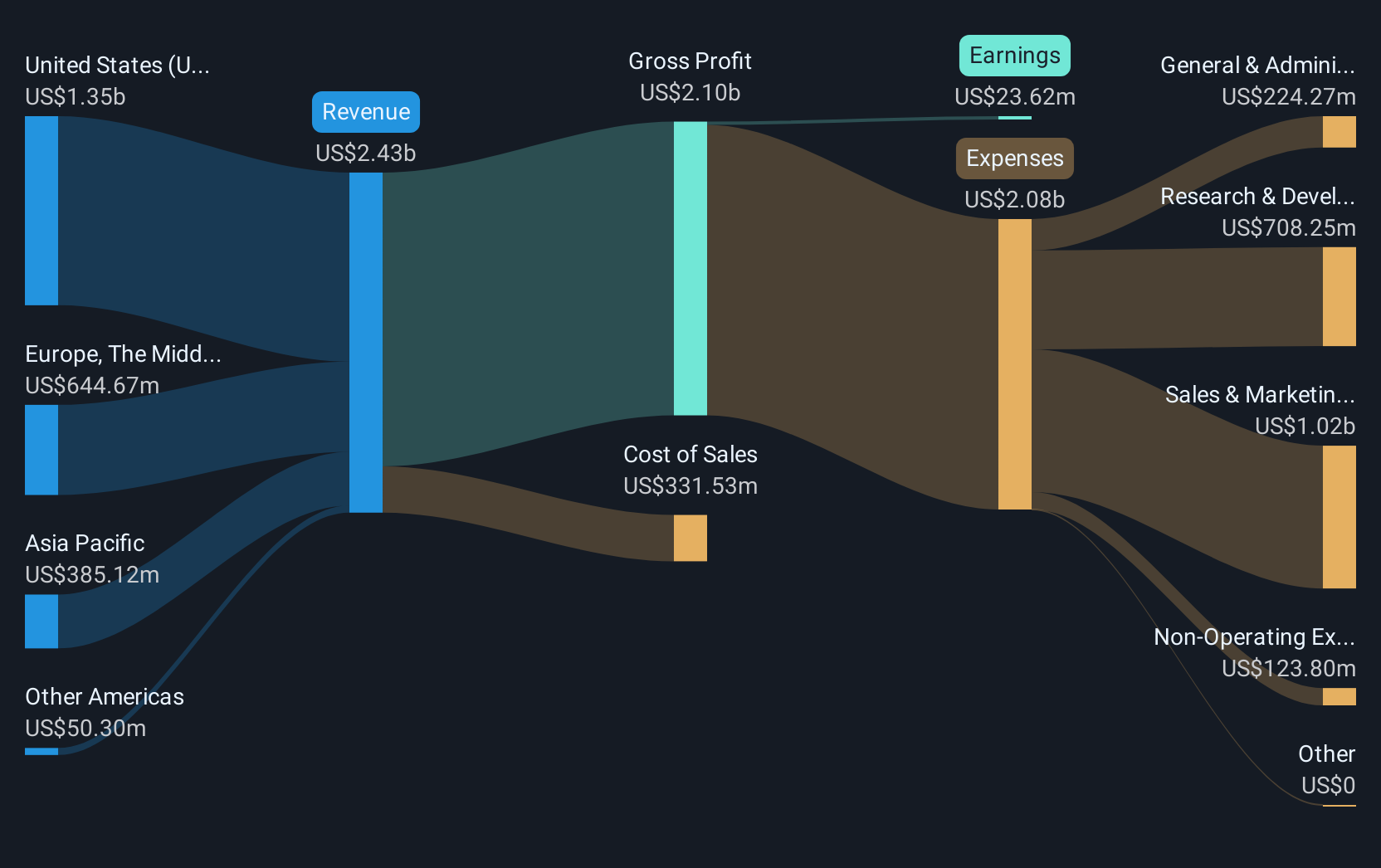

Nutanix (NTNX) just reported its Q1 2026 results, posting revenue of $670.6 million and basic EPS of $0.23, with net income hitting $62.1 million. Looking at recent quarters, the company has seen revenue climb from $547.9 million in Q4 2024 to $670.6 million in the latest period. Basic EPS turned positive after a previous loss of -$0.51 in Q4 2024. Margins have shown notable resilience, setting a solid foundation for this latest release.

See our full analysis for Nutanix.Next, we will see how these headline results compare to the evolving company narrative and where some commonly held views on Nutanix might be put to the test.

See what the community is saying about Nutanix

Net Profit Margin Flips Positive

- Nutanix delivered trailing 12-month net income of $220.5 million, a sharp reversal from a $124.8 million loss the year before, with net profit margin turning positive.

- The consensus narrative highlights that improved net margins and high-quality earnings have become central to Nutanix’s investment thesis.

- Trailing 12-month Basic EPS jumped to $0.82, compared with negative values a year ago. This challenges cautious views around the sustainability of profit growth.

- The analysts' consensus view is that longer-term profitability trends now support valuation upside, especially given Nutanix's forecast annual earnings growth of 32.68% outpacing the broader US market.

Trading 36% Below DCF Fair Value

- The current share price of $48.34 is 36.4% below Nutanix’s DCF fair value of $76.06, as estimated in the analysis.

- Consensus opinion anchors on the stock’s discount to DCF fair value.

- Consensus price targets (using $71.70) are still well above today’s price, so the gap between valuation models and current market levels remains significant.

- Analysts agree that continued profit expansion could help close this discount, with anticipated earnings reaching $513 million by 2028. They note this relies on margins growing from 7.4% to 13.2% over that span.

Balance Sheet Risks Temper Excitement

- Nutanix continues to face a high debt burden and negative shareholders’ equity, two factors flagged by consensus as core risks for investors.

- Despite the profitability shift, consensus narrative cautions investors that elevated leverage and negative equity could limit downside protection if growth expectations are missed.

- Even with profitability improving, these risks set Nutanix apart from industry peers with stronger balance sheets and may explain why the market’s valuation is cautious despite rapid forecasted growth.

- Consensus narrative points out that debt and equity challenges should not be overlooked, especially if enterprise IT budgets tighten or cost inflation continues to rise.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Nutanix on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from a different angle? Put your perspective into action and build your own interpretation in just a few minutes with Do it your way.

A great starting point for your Nutanix research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Nutanix’s profitability turnaround is impressive, but its high debt and negative equity pose ongoing risks if expectations are not met or growth falters.

For peace of mind, seek out companies with stronger financial foundations and let solid balance sheet and fundamentals stocks screener (1924 results) guide you to stocks built to weather market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nutanix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NTNX

Nutanix

Provides an enterprise cloud platform in North America, Europe, the Asia Pacific, the Middle East, Latin America, and Africa.

High growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)